November 9, 2023

SNG, Valo Networks, and COS Systems Publish Joint White Paper on Options to Bridge Broadband Gaps for Unserved and Underserved Areas

Strategic Networks Group (SNG), Valo Networks, and COS Systems, today announced that they have published a white paper, exploring the challenges that bridging broadband gaps in unserved and underserved areas entails, as well as presenting possible approaches to address them.

- This white paper explores the challenges faced by localities (communities, regions, etc.) and presents four potential options to address their broadband gaps: do nothing, subsidize an ISP, become an ISP, or develop a digital infrastructure public-private partnership.

- After thorough evaluation, the digital infrastructure public-private partnership (DI-PPP) approach emerges as the most recommended solution because it leverages the strengths of both public and private sectors to ensure affordable broadband access is available to all.

The release of the white paper “Leaving No One Behind in an Increasingly Digital World–Options to Bridge Broadband Gaps in Unserved and Underserved Areas” is the outcome of a long partnership between SNG, COS, and Valo to enable stewardship of localities’ digital future that is sustainable, inclusive, and cost-effective.

Ensuring that no one in your locality is left behind in an increasingly digital world means that everybody can access reliable and affordable high-speed internet. This broadband connectivity has become essential infrastructure for localities. However, there are still areas where broadband services are non-existent (unserved) or inadequate (underserved).

This joint white paper compares the various options available to localities seeking to bridge their broadband gaps and ensure equitable access to digital opportunities. Recognizing that a one-size-fits-all solution does not exist, the paper analyzes the advantages and drawbacks of each proposed option to help decision-makers make better-informed choices about their locality’s digital future.

“We are delighted to jointly announce this white paper highlighting different options to solve broadband gaps” said Michael Curri, founder and President of SNG. “We will continue to work with localities and private sector to build a sustainable broadband and digital inclusion ecosystem.”

White Paper – Options to Bridge Broadband Gaps in Unserved and Underserved Areas

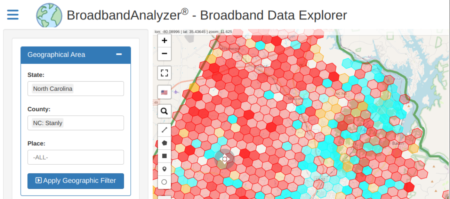

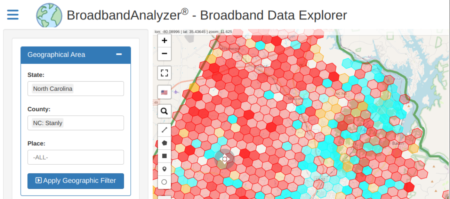

For localities and counties in the United States, there is a free Broadband Overview Report available at www.broadbandanalyzer.com that provides:

- a high-level broadband availability report and map for your area

- the total number of households that are unserved and underserved by broadband in your area

|

|

If you want to learn more about digital infrastructure, public-private partnerships, digital inclusion, and how to get started, reach out to us at Strategic Networks Group.

For more information on what it takes to setup, operate, or commercialize digital infrastructure, don’t hesitate to reach out to us at Valo Networks.

For more information on what it takes to operate digital infrastructure, or an Open Access network, or to tap into our pool of service provider partners willing to participate, don’t hesitate to reach out to us at COS Systems.

For more information about developing a Digital Infrastructure Strategy for your locality, see: https://sngroup.com/digital-infrastructure-strategy-for-communities/

With more and more funding for broadband – for example, the US’s $100 billion through the American Jobs Plan, or Canada’s Universal Broadband Fund – unserved and underserved localities should be encouraged by these positive and significant steps. However, there are a number of uncertainties:

With more and more funding for broadband – for example, the US’s $100 billion through the American Jobs Plan, or Canada’s Universal Broadband Fund – unserved and underserved localities should be encouraged by these positive and significant steps. However, there are a number of uncertainties:

- Will the broadband funding legislation actually pass? – intact? – and when?

- Government investment in broadband will not cover all the unserved and underserved areas – so who will get the funding?

- How long will the application process take to define? – what will be the terms and conditions? – and when will funds actually be available to localities?

- Will localities be able to over-build existing incumbent networks – even if they are not future-proof? – if no, to what extent will digital infrastructure fully cover the locality? Will all have access to online health, education, workforce development, smart community services, etc.?

- Do local leaders understand why some individuals and businesses do not take advantage of what broadband is already available? Does the locality have strategies and eligible funding to bridge digital divides, to bring everyone online, and to maximize community benefits from broadband investments?

SNG recommends that localities proceed with their own and/or private investment to build digital infrastructure and to not lose any additional time in bridging broadband gaps. No locality can wait to catch the next wave of broadband funding. COVID-19 has accelerated the urgency that digital infrastructure be available to all – now.

In parallel to developing their own broadband investment solutions, localities should apply for broadband funding once the application process is available. If their application is funded, great – then use public funds to support and expand a healthy competitive broadband marketplace that connects all local premises with digital infrastructure that can provide needed redundancy by being available to multiple providers.

In parallel to developing their own broadband investment solutions, localities should apply for broadband funding once the application process is available. If their application is funded, great – then use public funds to support and expand a healthy competitive broadband marketplace that connects all local premises with digital infrastructure that can provide needed redundancy by being available to multiple providers.

For those localities that know they have broadband problems, but struggle to find a path forward – especially when potentially large investments are needed … there is an alternative strategy. Localities need to answer key questions on how to solve their broadband needs:

- Where are the broadband gaps and where are the greatest needs in our locality?

- How is the lack of broadband affecting our businesses and residents?

- What technologies make sense to address our broadband gaps? Are we committed to solutions that meet current and long term needs? What investments are needed?

- Will our broadband problem be solved by the private sector service providers? Are there areas of interest and opportunity for private sector providers for accelerating network build-out to our unserved and underserved areas?

- Based on identified broadband gaps and needs, potential for accelerating private sector build-out – what is the roadmap for potential broadband projects?

SNG can help in this process with our Broadband Technical Opportunities Roadmap to answer these questions and empower localities to develop their own strategies so they can effectively engage with service providers and other partners to take action. Broadband is too important to your community’s prospects not to own your digital future.

Investing in community digital infrastructure is a low-risk impact investment with steady returns – and a solid alternative to traditional investments where there is increasing volatility (stock markets), uncertainty (e.g. oil and gas industry), or marginal yields (investment grade bonds). Private investors and patient capital are part of the solution for communities.

Investing in community digital infrastructure is a low-risk impact investment with steady returns – and a solid alternative to traditional investments where there is increasing volatility (stock markets), uncertainty (e.g. oil and gas industry), or marginal yields (investment grade bonds). Private investors and patient capital are part of the solution for communities.

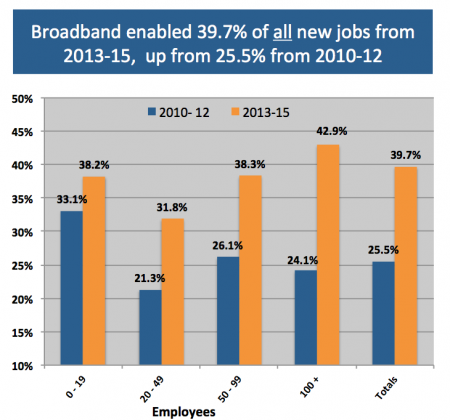

Patient capital enables pivoting to an economic case for investing in community digital infrastructure, capturing new revenues from local economic growth by growing the local economy through broadband and digital transformation. Revenue from increased local economic activity is captured through additional subscriptions (higher take-rates), higher value-subscriptions, and value-added services.

An economic case for investing in digital infrastructure is what communities and the broadband industry have been waiting for – now it is time to execute. The COVID-19 pandemic has sharpened the argument that the case for broadband is not just economic – but existential. Elected officials, local decision-makers, and community leaders have to understand that:

Investing in broadband cannot be put off. Leaders can no longer wait for their replacement to take on a broadband initiative. Even if they do not have the experience, know-how, or time left in their term – their community needs reliable broadband now.

Investing in broadband cannot be put off. Leaders can no longer wait for their replacement to take on a broadband initiative. Even if they do not have the experience, know-how, or time left in their term – their community needs reliable broadband now.- The need is real and growing —the escalating transition of work, healthcare and education to a digital platform means that broadband can no longer be considered a luxury, it is essential to competitiveness and sustainability. Heavily increasing network traffic and burdening networks that were not built for such loads.

- A new norm has emerged — COVID-19 is driving home the reality that gaps in broadband access, quality, and affordability are endangering the very survival of citizens and businesses in communities that do not have digital infrastructure.

Communities seeking better broadband need solutions now. Investors are looking for steady returns. SNG has established an economic case to engage investors and bring private capital to deliver community digital infrastructure, digital transformation, and workforce development.

We start with digital infrastructure for the new economy, which is more than simply fast internet access. Community digital infrastructure is a network platform that connects all residents and businesses (like roads) so that every community member can access and effectively participate in the increasingly online economy. Digital transformation and workforce development increase local innovation and digital inclusion, which grow the local economy and workforce – whose growth further expands the local market for broadband and value-added service revenues for the digital infrastructure network. This virtuous cycle yields indirect community benefits, such as local business retention and growth, new good-paying local jobs, increased local GDP and tax base, increased autonomy and quality of life, among many others.

You have a new way to bring private capital and community digital infrastructure together and get this done.

How do you reliably and accurately identify areas that are unserved, underserved, or future ready with broadband?

As Form 477 data is often inaccurate or overstated, the State of Oregon has hired SNG to conduct a Statewide Broadband Assessment to collect data from end-users on what services are available to them and combine that with data on broadband infrastructure to develop a more accurate broadband map and a more granular understanding of broadband gaps. This will be submitted to the Oregon State Legislature in February 2020 to help legislators make better, evidence-based decisions on legislation, programs and funding so that all Oregon households and businesses are able to effectively participate in an increasingly digital economy.

As Form 477 data is often inaccurate or overstated, the State of Oregon has hired SNG to conduct a Statewide Broadband Assessment to collect data from end-users on what services are available to them and combine that with data on broadband infrastructure to develop a more accurate broadband map and a more granular understanding of broadband gaps. This will be submitted to the Oregon State Legislature in February 2020 to help legislators make better, evidence-based decisions on legislation, programs and funding so that all Oregon households and businesses are able to effectively participate in an increasingly digital economy.

We need data and insights on broadband market potential and the returns from investing in broadband. At SNG we call this the economic case for broadband – that broadband investment solutions need to be self-sustaining and not subsidized to be effective long term. Both private and public investors need data and insights to assess a broadband market and its potential to net a positive return on investment. For this, the right information is needed and SNG has developed a holistic approach to gathering the data and developing the intelligence needed to make sustainable broadband investment decisions.

In presenting at the 2019 ISE EXPO in Fort Worth, Texas, we had a good discussion about the billions it will take to address unserved and underserved areas in the next five years. There were localities, cooperatives, and providers in attendance and we discussed how pivoting to a digital infrastructure approach pays for broadband investments.

In presenting at the 2019 ISE EXPO in Fort Worth, Texas, we had a good discussion about the billions it will take to address unserved and underserved areas in the next five years. There were localities, cooperatives, and providers in attendance and we discussed how pivoting to a digital infrastructure approach pays for broadband investments.

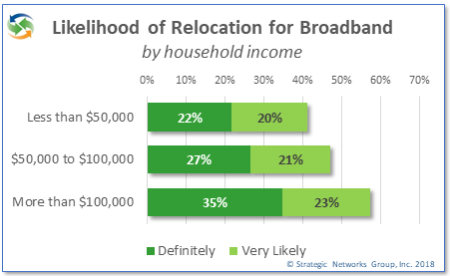

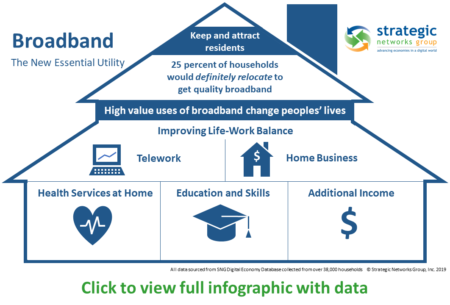

Broadband is more than fast internet service – it is about having the digital infrastructure in place to enable your residents and businesses to stay and thrive – otherwise they will leave, or suffer decline. This is a decision that cannot be put-off, or pushed to the next group of elected officials – the longer it takes, the greater the losses to the local economy and quality of life.

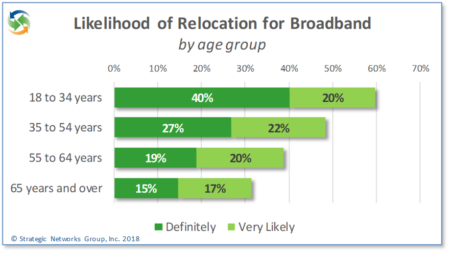

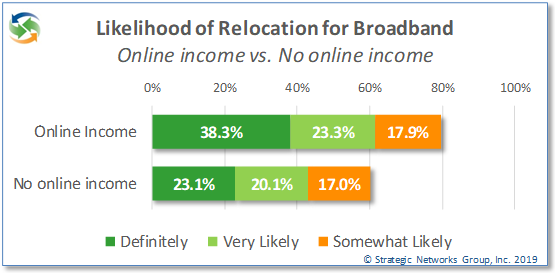

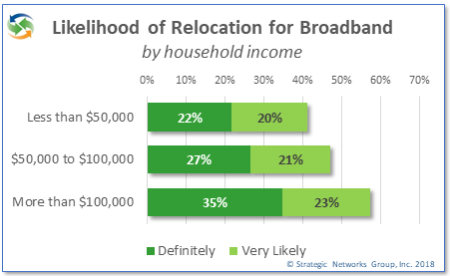

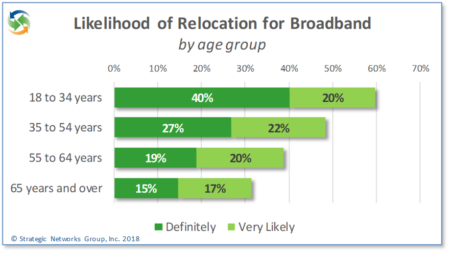

An example of these types of economic losses and negative community impacts can be found in the Broadband Impact and Market Demand Assessment SNG conducted for Custer County, Colorado where without broadband 45% of households would relocate (20.7% Definitely and 24.7% Very Likely) and 18% of businesses would close down.

Choice for Localities

Localities, co-ops, and utilities have a choice to make:

– Wait until service providers see enough returns to justify investing

– Or, invest in digital infrastructure and transformation to connect people, economies, communities

Consequences of that choice are:

– Loss of jobs, businesses, population, GDP from lack of broadband

– Or, growth in digital assets and local capacity … retaining base and sovereignty

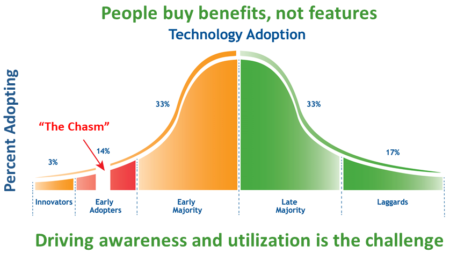

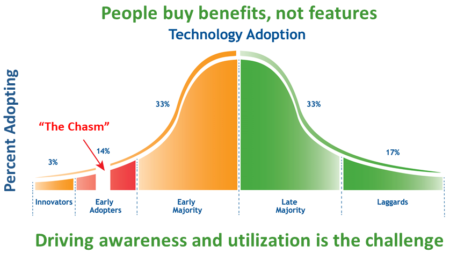

Localities need the expertise, resources, and commitment to see how they can get started with broadband and invest in their digital future. They need to start with answering the ‘why’ of broadband and digital infrastructure. The value from broadband and digital infrastructure comes from how it is used – driving utilization drives perceived value of technology. Plus, investments in digital infrastructure can pay for themselves

Additionally, States investing in broadband need to rethink 10 year broadband investment plans. Although they may be financially easier to budget, what localities can wait 5-10 years until they get the broadband they need? – businesses, youth, and those can leave will have left – they will have to leave to survive.

As a local leader or elected official, you may need to decide whether or not you need a survey, or a study for your broadband initiative. If the value isn’t clear, or if it doesn’t get you closer to your goal, why spend time and money on a ‘survey’ or another ‘study’? Don’t do it just because another community has.

As a local leader or elected official, you may need to decide whether or not you need a survey, or a study for your broadband initiative. If the value isn’t clear, or if it doesn’t get you closer to your goal, why spend time and money on a ‘survey’ or another ‘study’? Don’t do it just because another community has.

Understand which communities have achieved their broadband goals and how they got there.

If you have areas that are unserved or underserved with broadband, private sector providers have not seen enough of a business case for them to invest. Low density, tough terrain, insufficient take rates to make a business case, etc. are realities that must be overcome and will require more than re-packaging of your market, or expounding on ‘we have a great community’. If service providers have a better return on their investment elsewhere, that is where they will invest.

To get broadband deployed to your unserved or underserved areas there are generally three options going forward – 1) entice a provider to deploy in your area by subsidizing their business case; 2) build your own network to compete directly with other incumbent providers; or, 3) build your own digital infrastructure which multiple providers can then use to provide services (like municipal roads which are built, owned and maintained by the municipality, but anyone can use them).

Regardless of which option communities choose, elected officials would want to be in the best position to negotiate and to decide the best path forward for their community by understanding the broadband investment options, the market potential, and the community returns on investment (ROI).

Regardless of which option communities choose, elected officials would want to be in the best position to negotiate and to decide the best path forward for their community by understanding the broadband investment options, the market potential, and the community returns on investment (ROI).

As a builder of broadband networks explained, ‘take rates’ and ‘revenue generation’ are really the opposite of what a community wants to achieve. A community needs to focus on the development of a sustainable model that does not restrict, but enables sustainable future growth. What communities nor providers don’t know is what broadband can do to sustain and grow what the community already has, as well as how that growth has been suppressed by lack of or slow broadband investment

For these reasons assessing broadband demand is not a survey, but necessary due diligence on the market potential and choosing your broadband strategy (bringing providers to serve your areas, or building your own) while ensuring the best return for your community.

We know that providers already have their expected take rates and will use their spreadsheets in developing their own business case. However from SNG’s extensive research, the majority of the community benefits from broadband are off-balance sheet to providers – which means providers under-value their return on investment as compared to community returns on investment (i.e. community benefits). We call this an economic case for investing in broadband – some people call it a government business case. It’s the same reason we have public investment in roads.

We know that providers already have their expected take rates and will use their spreadsheets in developing their own business case. However from SNG’s extensive research, the majority of the community benefits from broadband are off-balance sheet to providers – which means providers under-value their return on investment as compared to community returns on investment (i.e. community benefits). We call this an economic case for investing in broadband – some people call it a government business case. It’s the same reason we have public investment in roads.

For those considering a public-private partnership, if you know that you have a strong market potential (current and future demand) for broadband and value-added services, this will strengthen your position on negotiating how much your community needs invest to make a successful business case. On the other side, if your unserved and underserved areas do not show a strong demand then you may want to limit your risk, or take actions to build up demand. It is also possible that some areas have higher demand than others, which can allow you to be more tactical with the timing and prioritization of broadband deployments.

Data points on market potential inform your investment case for whether you choose to negotiate with an ISP by developing an RFQ or RFI for a public-private partnership, or if you decide to build your own digital infrastructure. We’ve written about this issue in our recent post: Where do we put our efforts to get connected with broadband?

SNG has recently launched the Digital Economy Demand Checkup offering with a regional ISP (who were the ones that requested we do this) and we think it will be of interest to communities everywhere because it:

Gives local residents and businesses a vehicle to express their need and willingness to sign-up for better connectivity – contact lists for those who want to sign-up can be shared with the provider, finance last mile deployment, inform broadband deployment priorities, etc.

Gives local residents and businesses a vehicle to express their need and willingness to sign-up for better connectivity – contact lists for those who want to sign-up can be shared with the provider, finance last mile deployment, inform broadband deployment priorities, etc.- Provides elected officials with proven tools to collect needed data points to answer the following questions:

- What is the current broadband demand as compared to expected demand from provider’s spreadsheets?

- What is the potential demand that can drive additional revenues for providers, as well as community benefits?

- What are the issues or barriers that need to be overcome to drive demand and meaningful use so that local businesses and residents fully leverage technology?

We are able to address these fundamental investment case issues in a cost effective way with our Digital Economy Demand Checkup. Not only do we identify current demand, but also potential demand and market potential. We don’t know of anyone else that can benchmark demand to increase service provider revenues and maximize local economic impacts. For example, with a municipal service provider we identified a 64% increase in revenues for no additional capital investment. This represents an increase of 47% in Average Revenue Per User (ARPU).

SNG was recently asked by residents from a neighborhood just outside Nashville, Tennessee, where to best put their efforts to get connected with broadband. They have lived in a location for 10 years and it is not serviced with high-speed internet even though they are near where it stops on either end of their community. Asking the incumbent providers in their words “has proven futile” to getting better service. However they have many neighbors who would be interested in better internet service because many have businesses and work from home and they don’t want to move.

At SNG, we understand this challenge, which too many residents and businesses face across North America because of their perceived addressable market, expected revenues vs. cost to service their market, low density, etc. Approaching private sector providers can be ‘futile’ if those providers do not see enough of a business case to invest in your area and when providers have better returns elsewhere.

The challenge to get broadband deployed in unserved or underserved areas is to enable a positive case for investment. Driving awareness and utilization of broadband with local residents and businesses drives local economic growth and community benefits – which makes a case for public investment to bridge broadband gaps.

Two Options Going Forward

There are generally two options going forward – either 1) a public-private-partnership to entice a broadband provider to deploy in your area by subsidizing their business case; or, 2) build your own digital infrastructure which multiple providers can then use to provide services (like municipal roads which are built, owned and maintained by the municipality, but anyone can use them).

Subsidizing a Service Provider’s Business Case

If you choose to subsidize a provider’s business case to bridge their gap between their costs and their expected returns on capital, then local dollars should be used to build infrastructure that the locality owns (like a tower, backhaul fiber, etc.). This retains local ownership and negotiation capability which may be needed if there is poor broadband service because the provider is exercising a market dominant position. Retain ownership and control of your digital future.

In working with providers, there is also the option of conducting a broadband demand assessment to identify people ready to sign-up to new service, as well as assess potential demand for online services. This is local market demand research. Private sector providers are often reluctant to spend their retained earnings on such research, especially if they are unsure there is a business case for them. By quantifying current and potential broadband demand up-front and sharing that with private sector providers, they can apply that data to their business models to see if there is a business case for them that previously ‘flew under their radar’. Having a contact list of people who are ready and committed to sign-up makes that business case for the provider even stronger.

In both these broadband public-private-partnership instances, local funds subsidize one service provider. This may be a tactical, less complicated, and a less involved way for a locality to move forward – who in their right mind would want to take on more work, especially a broadband initiative! However, performance agreements should be negotiated and periodically reviewed to ensure local residents and businesses are getting the broadband they need – and want.

Investing in Digital Infrastructure

The other approach is the locality investing in their own digital infrastructure which is more involved, more complicated, and longer term. But this approach addresses the issue of local ownership and control of essential infrastructure – as with other infrastructure like roads, or electrical where community benefits are significantly greater than a private sector business case. At SNG we call this the economic case for investing in broadband. The example of Ammon, Idaho, proves that it is possible for a locality to own their digital future while also allowing multiple providers to provide competitive, robust internet services that meet the needs of local residents, businesses, and organizations.

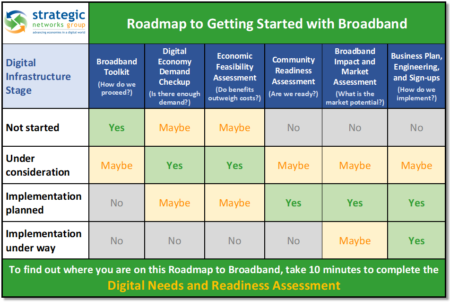

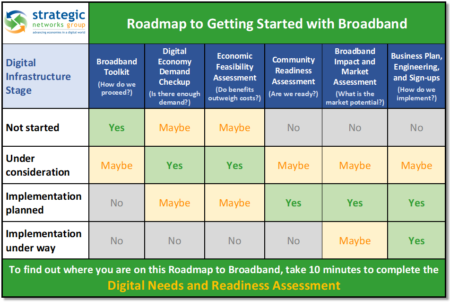

Deciding where and how to get started depends on the addressable market of the locality (i.e. broadband market potential), the local champions available to drive the process, the local organizational capacity to support a broadband initiative, and whether local residents, businesses, and organizations (government, education, health) have an understanding and vision of how they can benefit from using online practices. The table below outlines a roadmap to get started with broadband and SNG’s suite of services that have been designed to help you make the right decisions based on your needs and circumstances, no matter what stage you are at in the process.

Where and How to Get Started with a Broadband Initiative

If you are interested in assessing at what stage your locality is in the process of getting broadband – because it is a process – we have the Digital Needs and Readiness Assessment that your local broadband champion can take online. When they completed the 10 minute online survey, a report will be generated and automatically be emailed to them. We developed this tool specifically to help local leaders understand at what stage their locality is and to help them prioritize their community goals and priorities. SNG’s goal with this is to help local leaders make better informed decision on how they can and need to move forward in a way that is pragmatic, clear, and cost-effective.

SNG Research Brief – Broadband Impact on Household Income

SNG Research Brief – Broadband Impact on Household Income

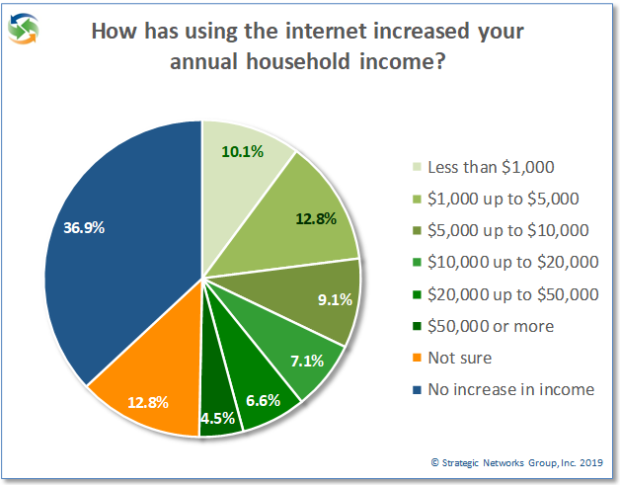

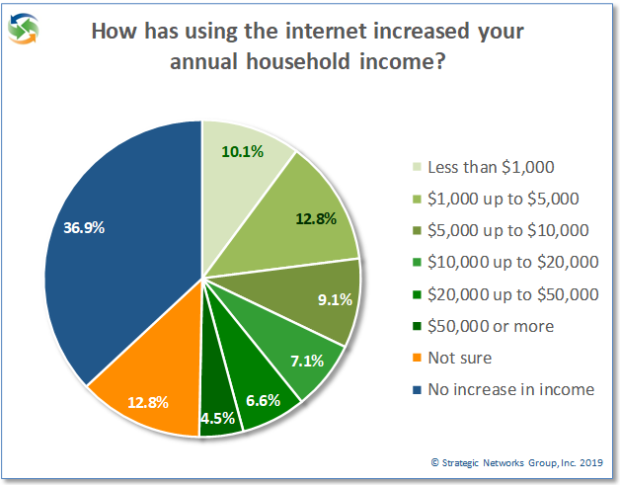

Household uses of the internet are often seen as lifestyle enhancements or conveniences, such as online entertainment, social networking, paying bills, or simply browsing for information on topics of inetrest. However, a significant number of households also use the internet to generate income, ranging from small amounts of supplementary income to full time home business income.

More than entertainment and social apps

SNG’s research of more than 18,000 households shows that 89% have a personal web presence and, while the majority use this for personal or professional networking, more than 30% of these households use their web presence to generate income. Overall, more than 50% of households report that the use of broadband has enabled them to increase their household income in one way or another. 29% earn substantial supplementary income of between $1,000 and $20,000 annually, while another 12% earn more than $20,000 annually. At whatever level of additional income, it can make a huge difference to the lifestyle of most people, and households are finding ways to use the internet and their broadband connections to make it happen.

SNG’s research of more than 18,000 households shows that 89% have a personal web presence and, while the majority use this for personal or professional networking, more than 30% of these households use their web presence to generate income. Overall, more than 50% of households report that the use of broadband has enabled them to increase their household income in one way or another. 29% earn substantial supplementary income of between $1,000 and $20,000 annually, while another 12% earn more than $20,000 annually. At whatever level of additional income, it can make a huge difference to the lifestyle of most people, and households are finding ways to use the internet and their broadband connections to make it happen.

The two most obvious ways that the internet and broadband connections can be used to generate household income are teleworking and home-based businesses. These create income directly from employment and from business activities respectively. However, even excluding these households more than 41% of the remainder still generate additional household income online in amounts large and small.

It is no surprise, then, that more than 50% of households see the ability to work from home as a significant benefit of broadband, and 37% say that the opportunity to earn additional income is a very significant benefit. While there are many other lifestyle benefits from broadband that rate higher across all households, one should not underestimate the significance and impact of how many households use broadband to create household income.

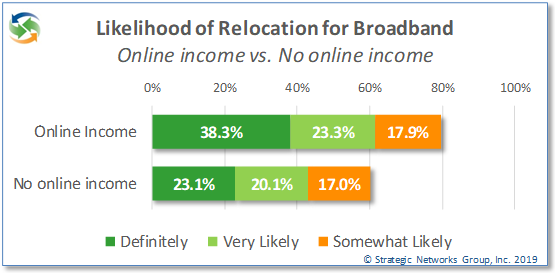

When you have income generation, access to the internet with quality broadband becomes much more than a “nice to have”. Households see the value in this and community leaders need to recognize this as well. In fact, the likelihood of relocating for quality broadband is significantly higher for those generating income online compared to households that do not. These are innovative households that communities can ill-afford to lose.

When you have income generation, access to the internet with quality broadband becomes much more than a “nice to have”. Households see the value in this and community leaders need to recognize this as well. In fact, the likelihood of relocating for quality broadband is significantly higher for those generating income online compared to households that do not. These are innovative households that communities can ill-afford to lose.

Broadband enhances the workforce

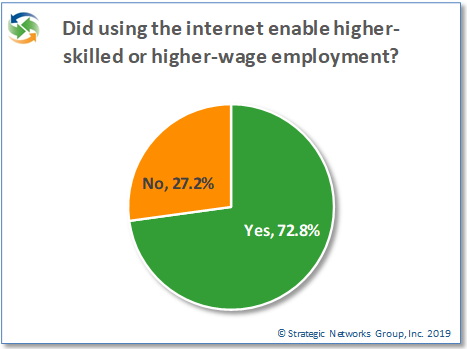

While earning additional household income is significant, the majority of working households still have one or more members employed at jobs, either at an employer establishment or by teleworking. Having access to quality broadband helps households improve their employment in two important ways. First, broadband provides access to online training and education for enhancing skills and learning new ones. Second, with access to a world of opportunities the internet helps people find better jobs, including the ability to telework rather than relocate.

More than 45% of households use the internet for education or training courses. Of these, 45% strongly agree that online education provides access to more learning opportunities and more than 30% say that online training enabled the completion of a degree or certification. It is significant that broadband can make such a potential difference to the livelihood of one in seven households.

More than 45% of households use the internet for education or training courses. Of these, 45% strongly agree that online education provides access to more learning opportunities and more than 30% say that online training enabled the completion of a degree or certification. It is significant that broadband can make such a potential difference to the livelihood of one in seven households.

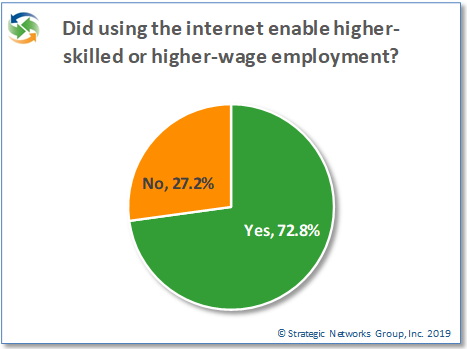

Of those households that had a member finding new employment, 73% said that using the internet helped them to gain better employment in higher-skill or higher-wage jobs, with 20% of those households using telework.

Broadband enables people to enhance their skills wherever they live and to find better employment while remaining in their community. These benefits of broadband do not impact every household since not everyone is equally motivated to follow these paths, but broadband makes it possible for those who do.

See what broadband means for a rural county and how they got the support and funding to build the digital infrastructure they need to thrive – Custer County Broadband Impact and Market Assessment.

Find out more about SNG Solutions for Local Economic Development.

SNG Research Brief – Teleworking

SNG Research Brief – Teleworking

Teleworking is not for everyone, nor is it available to everyone in their job. However, a growing number of people telework part or all of their work week. We define telework as working at your job from home in a formal arrangement with the employer during normal working hours, as opposed to simply accessing the workplace remotely on an occasional basis or while traveling.

Teleworking offers tremendous potential for people to be employed in the type of job they want and to live in the community they prefer, but to telework effectively people need robust and reliable broadband connections. So, what is the current state of teleworking and what is its impact on teleworking households and the community? SNG has compiled important teleworking insights from research of over 18,000 households.

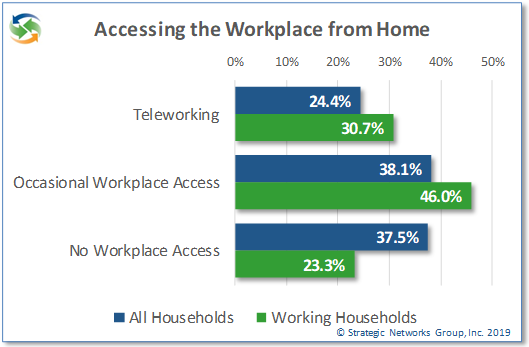

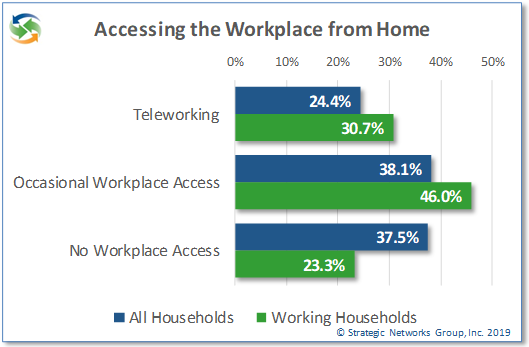

Nearly one in four households (24.4%) include one or more teleworking members. An additional 38% of households access the workplace from home on an occasional basis. These numbers increase to 31% and 46% for employed, working-age households. The vast majority of those employed use home internet for work reasons to some degree.

Nearly one in four households (24.4%) include one or more teleworking members. An additional 38% of households access the workplace from home on an occasional basis. These numbers increase to 31% and 46% for employed, working-age households. The vast majority of those employed use home internet for work reasons to some degree.

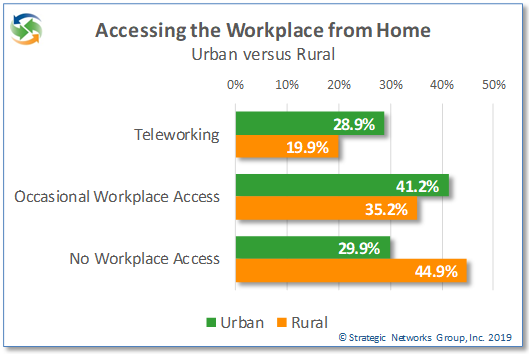

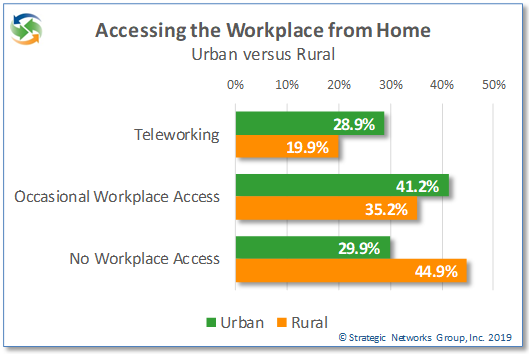

There is a significant difference between urban and rural households in accessing the workplace from home. Occasional workplace access is 6 percentage points lower for rural households, and teleworking is 9 percentage points lower. There can be a number of reasons for this difference, but one factor is the availability and quality of broadband in urban versus rural communities, as discussed in our research brief on household broadband. While teleworking offers the same benefits whether in an urban or rural community, it can be of particular value to rural residents who have a more limited range of local employment opportunities than their urban counterparts.

44% of teleworkers spend at least 4 days per week working from home, with an average of 3.2 days per week teleworking. The average one-way commute avoided is 60 miles (100 km) with almost one-third of teleworker living more than 60 miles from their employer workplace. Those with more distant commutes tend to telework more days per week. Nearly 75% of teleworkers say that reducing their time commuting is a very important benefit. This not only reduces commuting time, but reduces costs for fuel and car maintenance while reducing traffic, road wear, and fuel emissions.

44% of teleworkers spend at least 4 days per week working from home, with an average of 3.2 days per week teleworking. The average one-way commute avoided is 60 miles (100 km) with almost one-third of teleworker living more than 60 miles from their employer workplace. Those with more distant commutes tend to telework more days per week. Nearly 75% of teleworkers say that reducing their time commuting is a very important benefit. This not only reduces commuting time, but reduces costs for fuel and car maintenance while reducing traffic, road wear, and fuel emissions.

Not just a convenience

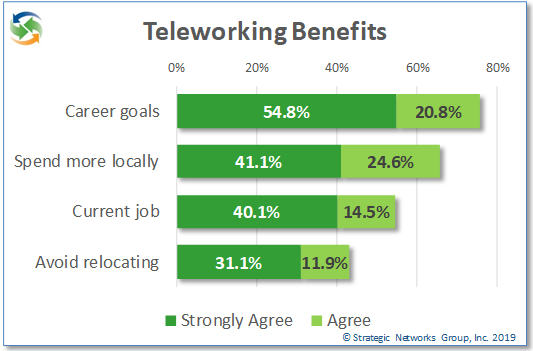

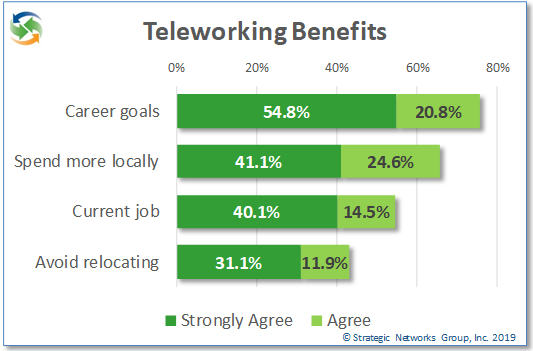

Teleworking is not merely a convenience and cost saving for households, although these are important benefits. More than half of teleworkers strongly agree that their ability to telework in their job helps in achieving their career goals. 40% strongly agree that they would not have their current job were it not for teleworking and 31% strongly agree that they would need to relocate for their job if they could not telework.

Teleworking is not merely a convenience and cost saving for households, although these are important benefits. More than half of teleworkers strongly agree that their ability to telework in their job helps in achieving their career goals. 40% strongly agree that they would not have their current job were it not for teleworking and 31% strongly agree that they would need to relocate for their job if they could not telework.

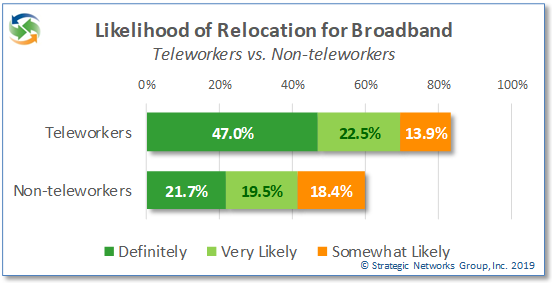

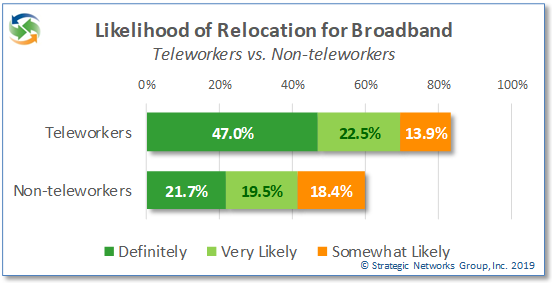

For those currently teleworking, their ability to do so is an important factor in being able to remain in their community while employed in a job that meets their goals. Having access to quality broadband is essential for people to effectively work from their home office. In fact, the likelihood of household relocation to get quality broadband service is more that twice as high for teleworking households than for non-teleworking households, with 47% saying they would definitely relocate for broadband versus 22% of non-teleworkers. (For more on this, please read our research brief on Broadband Importance to Household Location.)

For those currently teleworking, their ability to do so is an important factor in being able to remain in their community while employed in a job that meets their goals. Having access to quality broadband is essential for people to effectively work from their home office. In fact, the likelihood of household relocation to get quality broadband service is more that twice as high for teleworking households than for non-teleworking households, with 47% saying they would definitely relocate for broadband versus 22% of non-teleworkers. (For more on this, please read our research brief on Broadband Importance to Household Location.)

An unsung community asset

The significance of this for communities is that those households who may want to telework and have the opportunity to do so may need to either forgo those employment opportunities or relocate out of the community if they do not have the quality of broadband they need. By the same token, those who may want to locate into the community for its other attractions will be inhibited to do so if the available broadband does not allow them to telework effectively. While teleworking only impacts a portion of the population, it is a significant portion and a lack of quality broadband can have noticeable consequences for attraction and retention of households.

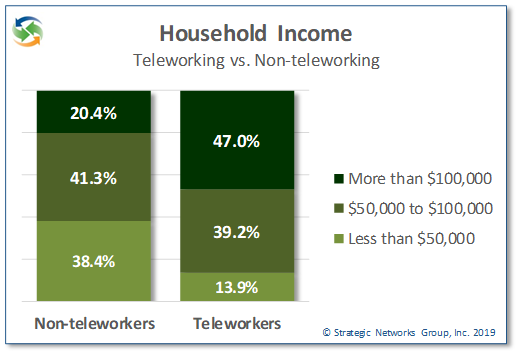

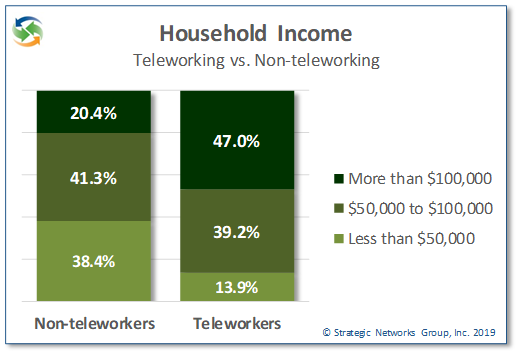

Not only is the teleworking household segment a significant percentage of the community, it is a highly valuable segment. Teleworking households have significantly higher incomes than non-teleworking households, with 47% having a household income of more than $100,000 per year compared to 20% of non-teleworking households. 86% earn more than $50,000 per year.

Not only is the teleworking household segment a significant percentage of the community, it is a highly valuable segment. Teleworking households have significantly higher incomes than non-teleworking households, with 47% having a household income of more than $100,000 per year compared to 20% of non-teleworking households. 86% earn more than $50,000 per year.

Households with higher incomes spend more locally, own more valuable properties, and pay higher taxes locally. While communities cannot create teleworking employment opportunities for residents, ensuring that they have the quality broadband needed sets the stage for having more residents telework and stay in the community, as well as attracting new teleworking residents.

Teleworking delivers benefits not only to those teleworking but also to the community by giving residents the option to find or keep the job they want while remaining in their community of choice. By working from home, teleworkers spend more time in their community, buy more locally, and are more engaged in the community. Communities that ensure they have quality, robust broadband provide a platform for teleworking and open up more opportunities for their residents and for attracting new residents.

See what teleworking means for a rural county and how they got the support and funding to build the digital infrastructure they need to thrive – Custer County Broadband Impact and Market Assessment.

Find out more about SNG Solutions for Local Economic Development.

SNG Research Brief – Household Broadband

SNG Research Brief – Household Broadband

Access to robust and competitive broadband is essential for any community to survive, let alone thrive. Unserved or underserved areas continue to exist in many localities, whether because of limited or no choices for service providers, outdated technology, etc. This research brief provides some insights and data points on the current state of access for households, with focus on rural communities and how they compare to urban areas.

From SNG’s research of over 19,000 households across the North America we are able to reveal some of the important findings that proponents of broadband need to know. These insights are from household data collected directly by SNG rather than statistics provided by service providers or other agencies.

Technologies used

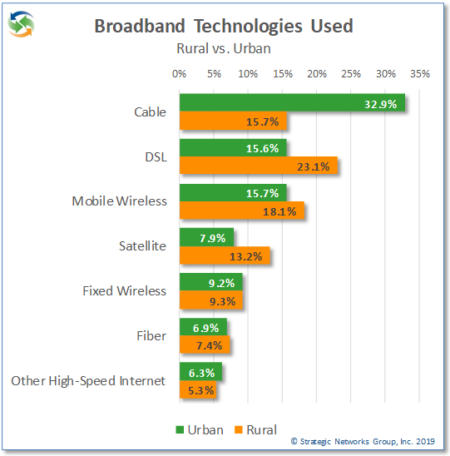

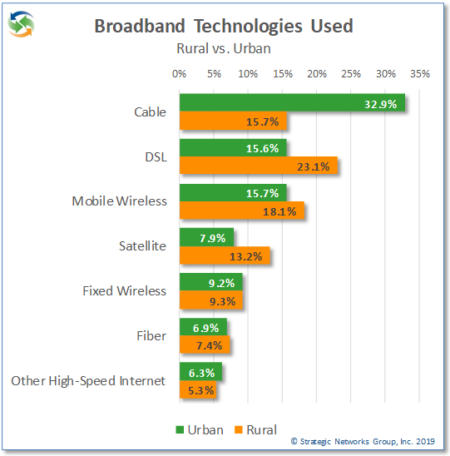

While fiber deployment and use are increasing, cable remains the dominant broadband technology overall with 23.6% of households, followed by DSL at 19.6%. However, the picture changes when you compare urban and rural areas.

While cable dominates urban markets, DSL is still the most used technology in rural areas – which suggests that this is due to the lack of other available options. Fiber use is low for both urban and rural households. For rural areas in particular, the lack of cable and fiber options drives up the use of mobile wireless and satellite as an alternative.

Broadband Service Priorities and Satisfaction

From a user perspective, technology is only relevant for its impact on connection speed, reliability, and price. Understandably, much emphasis is put on speed of connection, since this is how services are sold. However, when it comes to how households prioritize their selection of service, reliability is cited as highest priority with 88% of households compared to 77% who say speed is a high priority and 66% who say affordability is a high priority. These priorities are almost identical between rural and urban households.

So, if that is what households expect, then what is available and how do they feel about the connections they have?

So, if that is what households expect, then what is available and how do they feel about the connections they have?

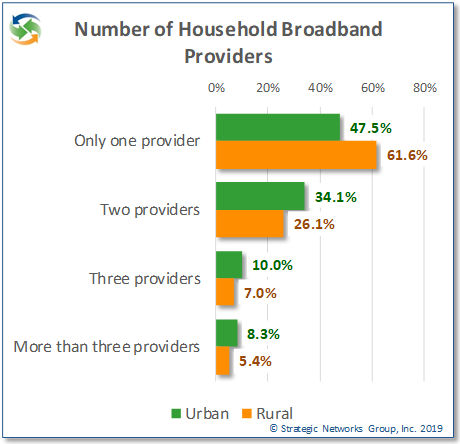

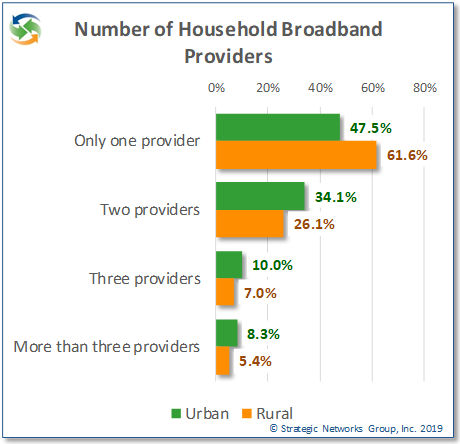

More than half (54%) of households have only one broadband provider available, clearly indicating a lack of choice for most households. For rural areas nearly 62% of households have only one broadband provider to choose from, with implications for competitive service price and quality.

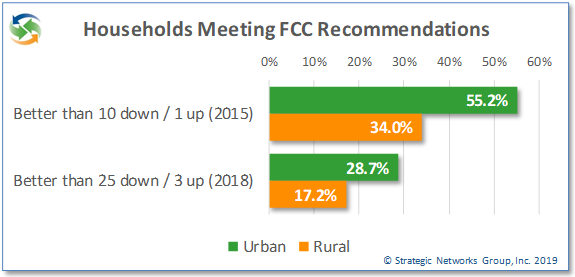

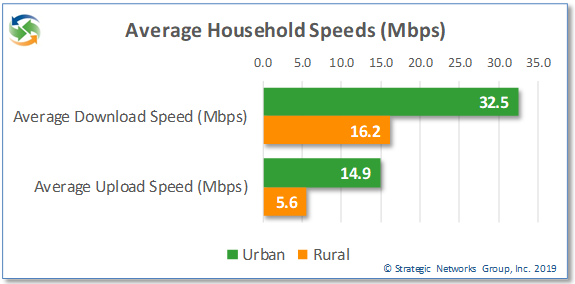

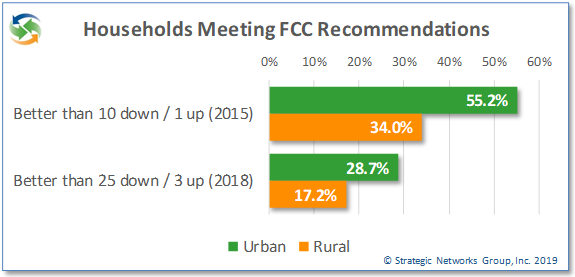

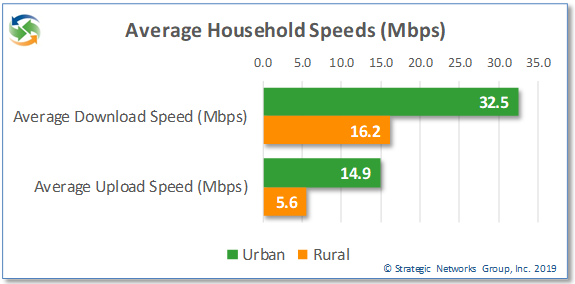

This is reflected in rural service speeds, price, and satisfaction. On average, rural households get approximately half the download speed as urban households and just over one third the upload speed. When it comes to meeting current FCC speed recommendations, 28.7% of urban households meet or exceed the recommended 25 Mbps download and 3 Mbps upload speed, while only 17.2% of rural households do so. Even looking at the old FCC recommendation of 10 Mbps down and 1 Mbps up, just over one third of rural households meet those speeds.

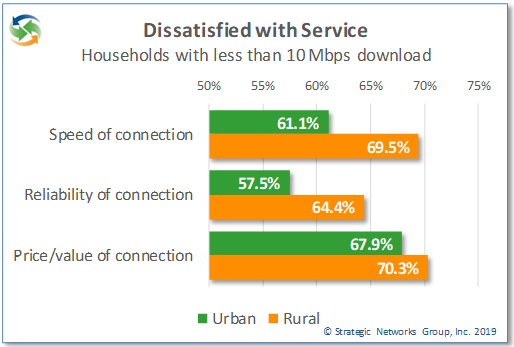

More than 61% of rural households get less than 10 Mbps download speed for an average cost of $70 per month. Overall, rural households pay a monthly cost of $4.38 per MB compared to $2.32 per MB for urban households, almost double the cost. Rural households have less choice and slower speeds and spend more for the same or poorer service.

More than 61% of rural households get less than 10 Mbps download speed for an average cost of $70 per month. Overall, rural households pay a monthly cost of $4.38 per MB compared to $2.32 per MB for urban households, almost double the cost. Rural households have less choice and slower speeds and spend more for the same or poorer service.

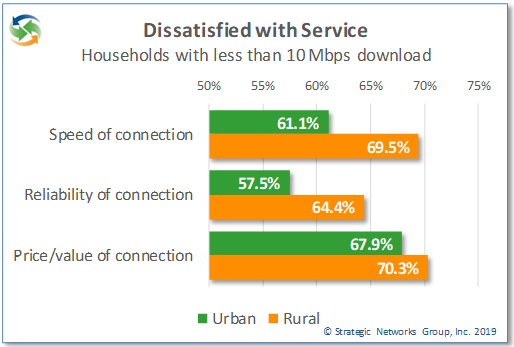

As a result, 70% of rural households subscribing to less than 10 Mbps download speeds are dissatisfied with the value of  their service for the price they pay, and 69% are dissatisfied with the speed of service. In addition, 64% of households are dissatisfied with the reliability of their service. The satisfaction levels are only slightly better for urban households with less than 10 Mbps download, with 68% dissatisfied with value, 58% with speed, and 68% with reliability.

their service for the price they pay, and 69% are dissatisfied with the speed of service. In addition, 64% of households are dissatisfied with the reliability of their service. The satisfaction levels are only slightly better for urban households with less than 10 Mbps download, with 68% dissatisfied with value, 58% with speed, and 68% with reliability.

This is partly explained by the different mix of technologies deployed in rural areas. With a higher proportion of DSL and satellite connections used in rural areas the quality of speed and reliability is reflected in overall satisfaction levels, resulting in lower satisfaction with value for the price of the  service. Fiber connections generate the highest satisfaction levels by far, followed by cable service. Very few households are fully satisfied with DSL or satellite services, and yet for some these are their only options for broadband connectivity.

service. Fiber connections generate the highest satisfaction levels by far, followed by cable service. Very few households are fully satisfied with DSL or satellite services, and yet for some these are their only options for broadband connectivity.

34.7% of households say that their fiber connection is “worth every penny” for value satisfaction, compared to 7.6% for cable, 4.6% for DSL, and 2.0% for satellite. Another 48% say the value of fiber is “acceptable for what I pay”, versus 38% for cable, 27% for DSL, and 15% for satellite. Similar satisfaction levels by technology are shown for connection speed and reliability. More than any other technology, fiber is clearly a solution that meets household priorities and expectations.

The Implications for Households and Communities

Households without good broadband available to them may choose not to take any of the options forgoing the speed and reliability they need. Households in this situation will not use the internet to its fullest capacity, missing opportunities for them to fully benefit from what the internet can offer – such as new income opportunities, remote access to health care and education. This negatively impacts community well-being as inadequate broadband risks losing population and difficulty in attracting new residents and businesses. This is particularly challenging for smaller, rural communities where SNG research has shown that they are more likely to lack quality broadband and have the most to lose in terms of population decline, especially among youth.

See how a rural county got the support and funding to build the digital infrastructure they need to thrive – Custer County Broadband Impact and Market Assessment.

Find out more about SNG Solutions for Local Economic Development.

With more and more funding for broadband – for example, the

With more and more funding for broadband – for example, the  In parallel to developing their own broadband investment solutions, localities should apply for broadband funding once the application process is available. If their application is funded, great – then use public funds to support and expand a healthy competitive broadband marketplace that

In parallel to developing their own broadband investment solutions, localities should apply for broadband funding once the application process is available. If their application is funded, great – then use public funds to support and expand a healthy competitive broadband marketplace that  Investing in community digital infrastructure is a low-risk impact investment with steady returns – and a solid alternative to traditional investments where there is increasing volatility (stock markets), uncertainty (e.g. oil and gas industry), or marginal yields (investment grade bonds). Private investors and patient capital are part of the solution for communities.

Investing in community digital infrastructure is a low-risk impact investment with steady returns – and a solid alternative to traditional investments where there is increasing volatility (stock markets), uncertainty (e.g. oil and gas industry), or marginal yields (investment grade bonds). Private investors and patient capital are part of the solution for communities. Investing in broadband cannot be put off. Leaders can no longer wait for their replacement to take on a broadband initiative. Even if they do not have the experience, know-how, or time left in their term – their community needs reliable broadband now.

Investing in broadband cannot be put off. Leaders can no longer wait for their replacement to take on a broadband initiative. Even if they do not have the experience, know-how, or time left in their term – their community needs reliable broadband now.

As Form 477 data is often inaccurate or overstated, the State of Oregon has hired SNG to conduct a

As Form 477 data is often inaccurate or overstated, the State of Oregon has hired SNG to conduct a

In presenting at the

In presenting at the

As a local leader or elected official, you may need to decide whether or not you need a survey, or a study for your broadband initiative. If the value isn’t clear, or if it doesn’t get you closer to your goal, why spend time and money on a ‘survey’ or another ‘study’? Don’t do it just because another community has.

As a local leader or elected official, you may need to decide whether or not you need a survey, or a study for your broadband initiative. If the value isn’t clear, or if it doesn’t get you closer to your goal, why spend time and money on a ‘survey’ or another ‘study’? Don’t do it just because another community has. Regardless of which option communities choose, elected officials would want to be in the best position to negotiate and to decide the best path forward for their community by understanding the broadband investment options, the

Regardless of which option communities choose, elected officials would want to be in the best position to negotiate and to decide the best path forward for their community by understanding the broadband investment options, the  We know that providers already have their expected take rates and will use their spreadsheets in developing their own business case. However from SNG’s extensive research, the majority of the community benefits from broadband are off-balance sheet to providers – which means providers under-value their return on investment as compared to community returns on investment (i.e. community benefits). We call this

We know that providers already have their expected take rates and will use their spreadsheets in developing their own business case. However from SNG’s extensive research, the majority of the community benefits from broadband are off-balance sheet to providers – which means providers under-value their return on investment as compared to community returns on investment (i.e. community benefits). We call this

SNG Research Brief – Broadband Impact on Household Income

SNG Research Brief – Broadband Impact on Household Income

SNG Research Brief – Teleworking

SNG Research Brief – Teleworking