With more and more funding for broadband – for example, the US’s $100 billion through the American Jobs Plan, or Canada’s Universal Broadband Fund – unserved and underserved localities should be encouraged by these positive and significant steps. However, there are a number of uncertainties:

With more and more funding for broadband – for example, the US’s $100 billion through the American Jobs Plan, or Canada’s Universal Broadband Fund – unserved and underserved localities should be encouraged by these positive and significant steps. However, there are a number of uncertainties:

- Will the broadband funding legislation actually pass? – intact? – and when?

- Government investment in broadband will not cover all the unserved and underserved areas – so who will get the funding?

- How long will the application process take to define? – what will be the terms and conditions? – and when will funds actually be available to localities?

- Will localities be able to over-build existing incumbent networks – even if they are not future-proof? – if no, to what extent will digital infrastructure fully cover the locality? Will all have access to online health, education, workforce development, smart community services, etc.?

- Do local leaders understand why some individuals and businesses do not take advantage of what broadband is already available? Does the locality have strategies and eligible funding to bridge digital divides, to bring everyone online, and to maximize community benefits from broadband investments?

SNG recommends that localities proceed with their own and/or private investment to build digital infrastructure and to not lose any additional time in bridging broadband gaps. No locality can wait to catch the next wave of broadband funding. COVID-19 has accelerated the urgency that digital infrastructure be available to all – now.

In parallel to developing their own broadband investment solutions, localities should apply for broadband funding once the application process is available. If their application is funded, great – then use public funds to support and expand a healthy competitive broadband marketplace that connects all local premises with digital infrastructure that can provide needed redundancy by being available to multiple providers.

In parallel to developing their own broadband investment solutions, localities should apply for broadband funding once the application process is available. If their application is funded, great – then use public funds to support and expand a healthy competitive broadband marketplace that connects all local premises with digital infrastructure that can provide needed redundancy by being available to multiple providers.

For those localities that know they have broadband problems, but struggle to find a path forward – especially when potentially large investments are needed … there is an alternative strategy. Localities need to answer key questions on how to solve their broadband needs:

- Where are the broadband gaps and where are the greatest needs in our locality?

- How is the lack of broadband affecting our businesses and residents?

- What technologies make sense to address our broadband gaps? Are we committed to solutions that meet current and long term needs? What investments are needed?

- Will our broadband problem be solved by the private sector service providers? Are there areas of interest and opportunity for private sector providers for accelerating network build-out to our unserved and underserved areas?

- Based on identified broadband gaps and needs, potential for accelerating private sector build-out – what is the roadmap for potential broadband projects?

SNG can help in this process with our Broadband Technical Opportunities Roadmap to answer these questions and empower localities to develop their own strategies so they can effectively engage with service providers and other partners to take action. Broadband is too important to your community’s prospects not to own your digital future.

As a local leader or elected official, you may need to decide whether or not you need a survey, or a study for your broadband initiative. If the value isn’t clear, or if it doesn’t get you closer to your goal, why spend time and money on a ‘survey’ or another ‘study’? Don’t do it just because another community has.

As a local leader or elected official, you may need to decide whether or not you need a survey, or a study for your broadband initiative. If the value isn’t clear, or if it doesn’t get you closer to your goal, why spend time and money on a ‘survey’ or another ‘study’? Don’t do it just because another community has.

Understand which communities have achieved their broadband goals and how they got there.

If you have areas that are unserved or underserved with broadband, private sector providers have not seen enough of a business case for them to invest. Low density, tough terrain, insufficient take rates to make a business case, etc. are realities that must be overcome and will require more than re-packaging of your market, or expounding on ‘we have a great community’. If service providers have a better return on their investment elsewhere, that is where they will invest.

To get broadband deployed to your unserved or underserved areas there are generally three options going forward – 1) entice a provider to deploy in your area by subsidizing their business case; 2) build your own network to compete directly with other incumbent providers; or, 3) build your own digital infrastructure which multiple providers can then use to provide services (like municipal roads which are built, owned and maintained by the municipality, but anyone can use them).

Regardless of which option communities choose, elected officials would want to be in the best position to negotiate and to decide the best path forward for their community by understanding the broadband investment options, the market potential, and the community returns on investment (ROI).

Regardless of which option communities choose, elected officials would want to be in the best position to negotiate and to decide the best path forward for their community by understanding the broadband investment options, the market potential, and the community returns on investment (ROI).

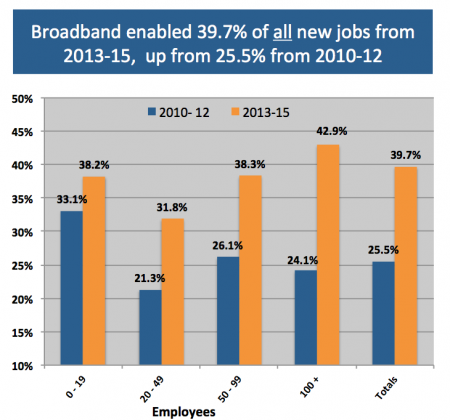

As a builder of broadband networks explained, ‘take rates’ and ‘revenue generation’ are really the opposite of what a community wants to achieve. A community needs to focus on the development of a sustainable model that does not restrict, but enables sustainable future growth. What communities nor providers don’t know is what broadband can do to sustain and grow what the community already has, as well as how that growth has been suppressed by lack of or slow broadband investment

For these reasons assessing broadband demand is not a survey, but necessary due diligence on the market potential and choosing your broadband strategy (bringing providers to serve your areas, or building your own) while ensuring the best return for your community.

We know that providers already have their expected take rates and will use their spreadsheets in developing their own business case. However from SNG’s extensive research, the majority of the community benefits from broadband are off-balance sheet to providers – which means providers under-value their return on investment as compared to community returns on investment (i.e. community benefits). We call this an economic case for investing in broadband – some people call it a government business case. It’s the same reason we have public investment in roads.

We know that providers already have their expected take rates and will use their spreadsheets in developing their own business case. However from SNG’s extensive research, the majority of the community benefits from broadband are off-balance sheet to providers – which means providers under-value their return on investment as compared to community returns on investment (i.e. community benefits). We call this an economic case for investing in broadband – some people call it a government business case. It’s the same reason we have public investment in roads.

For those considering a public-private partnership, if you know that you have a strong market potential (current and future demand) for broadband and value-added services, this will strengthen your position on negotiating how much your community needs invest to make a successful business case. On the other side, if your unserved and underserved areas do not show a strong demand then you may want to limit your risk, or take actions to build up demand. It is also possible that some areas have higher demand than others, which can allow you to be more tactical with the timing and prioritization of broadband deployments.

Data points on market potential inform your investment case for whether you choose to negotiate with an ISP by developing an RFQ or RFI for a public-private partnership, or if you decide to build your own digital infrastructure. We’ve written about this issue in our recent post: Where do we put our efforts to get connected with broadband?

SNG has recently launched the Digital Economy Demand Checkup offering with a regional ISP (who were the ones that requested we do this) and we think it will be of interest to communities everywhere because it:

Gives local residents and businesses a vehicle to express their need and willingness to sign-up for better connectivity – contact lists for those who want to sign-up can be shared with the provider, finance last mile deployment, inform broadband deployment priorities, etc.

Gives local residents and businesses a vehicle to express their need and willingness to sign-up for better connectivity – contact lists for those who want to sign-up can be shared with the provider, finance last mile deployment, inform broadband deployment priorities, etc.- Provides elected officials with proven tools to collect needed data points to answer the following questions:

- What is the current broadband demand as compared to expected demand from provider’s spreadsheets?

- What is the potential demand that can drive additional revenues for providers, as well as community benefits?

- What are the issues or barriers that need to be overcome to drive demand and meaningful use so that local businesses and residents fully leverage technology?

We are able to address these fundamental investment case issues in a cost effective way with our Digital Economy Demand Checkup. Not only do we identify current demand, but also potential demand and market potential. We don’t know of anyone else that can benchmark demand to increase service provider revenues and maximize local economic impacts. For example, with a municipal service provider we identified a 64% increase in revenues for no additional capital investment. This represents an increase of 47% in Average Revenue Per User (ARPU).

SNG was recently asked by residents from a neighborhood just outside Nashville, Tennessee, where to best put their efforts to get connected with broadband. They have lived in a location for 10 years and it is not serviced with high-speed internet even though they are near where it stops on either end of their community. Asking the incumbent providers in their words “has proven futile” to getting better service. However they have many neighbors who would be interested in better internet service because many have businesses and work from home and they don’t want to move.

At SNG, we understand this challenge, which too many residents and businesses face across North America because of their perceived addressable market, expected revenues vs. cost to service their market, low density, etc. Approaching private sector providers can be ‘futile’ if those providers do not see enough of a business case to invest in your area and when providers have better returns elsewhere.

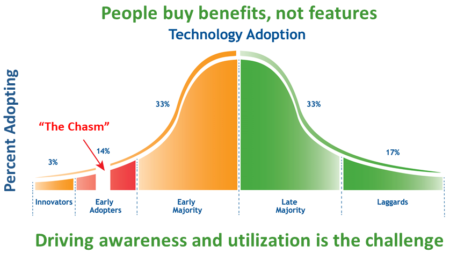

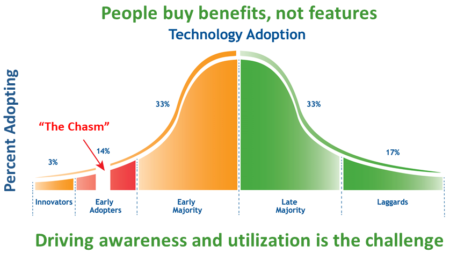

The challenge to get broadband deployed in unserved or underserved areas is to enable a positive case for investment. Driving awareness and utilization of broadband with local residents and businesses drives local economic growth and community benefits – which makes a case for public investment to bridge broadband gaps.

Two Options Going Forward

There are generally two options going forward – either 1) a public-private-partnership to entice a broadband provider to deploy in your area by subsidizing their business case; or, 2) build your own digital infrastructure which multiple providers can then use to provide services (like municipal roads which are built, owned and maintained by the municipality, but anyone can use them).

Subsidizing a Service Provider’s Business Case

If you choose to subsidize a provider’s business case to bridge their gap between their costs and their expected returns on capital, then local dollars should be used to build infrastructure that the locality owns (like a tower, backhaul fiber, etc.). This retains local ownership and negotiation capability which may be needed if there is poor broadband service because the provider is exercising a market dominant position. Retain ownership and control of your digital future.

In working with providers, there is also the option of conducting a broadband demand assessment to identify people ready to sign-up to new service, as well as assess potential demand for online services. This is local market demand research. Private sector providers are often reluctant to spend their retained earnings on such research, especially if they are unsure there is a business case for them. By quantifying current and potential broadband demand up-front and sharing that with private sector providers, they can apply that data to their business models to see if there is a business case for them that previously ‘flew under their radar’. Having a contact list of people who are ready and committed to sign-up makes that business case for the provider even stronger.

In both these broadband public-private-partnership instances, local funds subsidize one service provider. This may be a tactical, less complicated, and a less involved way for a locality to move forward – who in their right mind would want to take on more work, especially a broadband initiative! However, performance agreements should be negotiated and periodically reviewed to ensure local residents and businesses are getting the broadband they need – and want.

Investing in Digital Infrastructure

The other approach is the locality investing in their own digital infrastructure which is more involved, more complicated, and longer term. But this approach addresses the issue of local ownership and control of essential infrastructure – as with other infrastructure like roads, or electrical where community benefits are significantly greater than a private sector business case. At SNG we call this the economic case for investing in broadband. The example of Ammon, Idaho, proves that it is possible for a locality to own their digital future while also allowing multiple providers to provide competitive, robust internet services that meet the needs of local residents, businesses, and organizations.

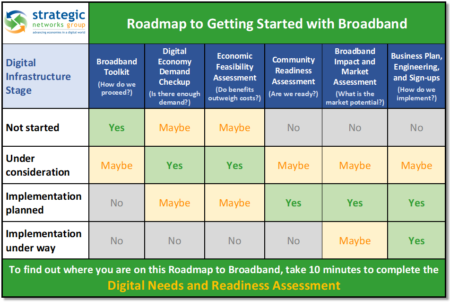

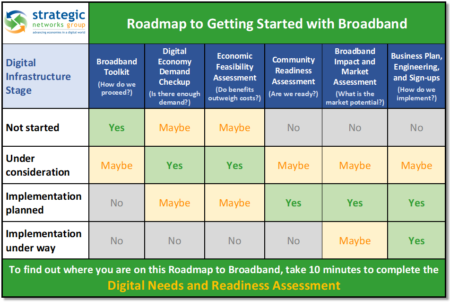

Deciding where and how to get started depends on the addressable market of the locality (i.e. broadband market potential), the local champions available to drive the process, the local organizational capacity to support a broadband initiative, and whether local residents, businesses, and organizations (government, education, health) have an understanding and vision of how they can benefit from using online practices. The table below outlines a roadmap to get started with broadband and SNG’s suite of services that have been designed to help you make the right decisions based on your needs and circumstances, no matter what stage you are at in the process.

Where and How to Get Started with a Broadband Initiative

If you are interested in assessing at what stage your locality is in the process of getting broadband – because it is a process – we have the Digital Needs and Readiness Assessment that your local broadband champion can take online. When they completed the 10 minute online survey, a report will be generated and automatically be emailed to them. We developed this tool specifically to help local leaders understand at what stage their locality is and to help them prioritize their community goals and priorities. SNG’s goal with this is to help local leaders make better informed decision on how they can and need to move forward in a way that is pragmatic, clear, and cost-effective.

Why you should launch a “planning” program as well as a “mapping” one

In the rush to apply for mapping grants, states should not forget the opportunity to leverage up to $500,000 of federal stimulus funds for broadband planning. So, if you are about to submit to the NTIA a broadband mapping proposal for your state, we urge you to take the parallel step of launching a planning program too.

That planning program should aim to organize the most efficient way to help your state’s businesses and communities overcome the barriers to adopting BEST practices – hence reaping their benefits of their broadband effort.

Because it’s worth remembering that the real value of broadband is not only measured by availability, speed or price — though all of these are important enabling factors. Rather, that value is most directly tied to the benefits of broadband connectivity combined with e-Solutions – an e-Solution being “a way to do what we’ve already doing, only better thanks to the Internet”. Thanks to over 10 years of hands-on experience, we know that the winning equation for the country must be: “broadband connectivity + e-Solutions = self-sustaining stimulus.”

And we also know that the key to maximizing broadband and e-Solutions benefits is to develop a “combined understanding” of both barriers to adoption and use and BEST (broadband e-Solutions transformative) practices, and an ongoing involvement of teams and people on the ground, in our communities, businesses and organizations. Achieving that requires solid planning!

As noted above, up to $500,000 is available to each state mapping project to support such planning activities.

But to take advantage of this federal support for broadband planning, states need to submit a planning proposal and budget along with their mapping proposal. And they need to do so by NTIA’s August 14 deadline. Because if they don’t, the $500,000 available for planning effectively disappears for their state. So, don’t miss it. In our view, decision makers in every state should take advantage of this opportunity to set a course toward “self-sustaining stimulus.”

Do you need help?

For states concerned about how to come up with the 20% matching funds, we suggest careful consideration of ways to cover some, or all, of this amount through in-kind contributions. According to the NOFA, these can include “employee or volunteer services; equipment; supplies; indirect costs; computer hardware and software; use of facilities; [and] expenditures for existing programs presented as part of the [planning] project proposal.” Based on our experience, there’s a lot of value that can be derived from these forms of in-kind contribution.

Also, to help communities understand and plan the move up the BEST practices learning curve, we’ve developed tools such as e-Solutions Benchmarking (to establish a baseline and direction for planning investments in broadband infrastructure and sustainable adoption programs) and Evaluation and Adoption Analytics (to help evaluate the impacts of these investments and adjust plans and strategies based on clear and measurable evidence).

By Michael Curri – Broadband networks can create a “platform for productivity, competitiveness and innovation” in your community – delivering the infrastructure to capture economic and social opportunities, some known, some yet to be invented. Many communities fail during the broadband strategy, build-out and adoption phases as they lack focus and/or sufficient investment of time, energy, and resources.

Too often communities develop strategies based on following recipes from other regions. Instead of uncovering what the needed resources are, or how to leverage current efforts to best serve the specific and unique needs of the community, civic leaders race to “do what they did.”

There is no ‘one size fits all’ solution for successful broadband strategies that bring economic and civic benefits to a region and its citizens. Each community not only has different needs, but different strengths to best leverage the broadband platform. Strategic Networks Group (SNG) has for years been helping governments, at municipal, regional and national levels, to best understand where investment will make the biggest impact – and each and every time the best approach involves following the Broadband Lifecycle, or path to owning your digital future.

Continue Reading →

By Michael Curri

Much too often broadband initiatives that should be successful end up falling flat – for a myriad reasons. Perhaps they do not get off the ground because of a lack of vision, planning, or leadership. Many fail during the strategy and build-out process as they lack focus and/or sufficient investment of time, energy, and resources. Some initiatives may have been successful building the network but fail because they are simply taking a “we built it – you use it” approach and not driving applications and adoption. And even the most successful broadband projects, with ample utilization and economic and social impact can be perceived as a failure if the outcomes are not measured and reported.

Much too often broadband initiatives that should be successful end up falling flat – for a myriad reasons. Perhaps they do not get off the ground because of a lack of vision, planning, or leadership. Many fail during the strategy and build-out process as they lack focus and/or sufficient investment of time, energy, and resources. Some initiatives may have been successful building the network but fail because they are simply taking a “we built it – you use it” approach and not driving applications and adoption. And even the most successful broadband projects, with ample utilization and economic and social impact can be perceived as a failure if the outcomes are not measured and reported.

It is for all of these reasons that SNG encourages its customers (and all broadband project managers for that matter!) to design and run their broadband initiative with “one eye on the Broadband Lifecycle.” In this issue of Bandwidth, and the next two, we will be taking a look at 2 of the 6 steps of the Broadband Lifecycle. In this issue: step 1 (identifying gaps, needs, and demand) and step 2 (pre-planning and assessment).

Continue Reading →

By Doug Adams

Now that you have funding, how can you make sure that your project lives up to the promise that got it funded in the  first place? Hundreds of broadband projects are being funded in 2010 – be it from Stimulus or some other funding source – but how many will truly become a community asset that drives economic and social benefits?

first place? Hundreds of broadband projects are being funded in 2010 – be it from Stimulus or some other funding source – but how many will truly become a community asset that drives economic and social benefits?

Key to making sure your project will have a return on investment with quantifiable outcomes starts with these four guidelines:

- Don’t focus on engineering: it’s all about awareness and adoption;

- Use data to drive decisions before, during, and after the project;

- Create a “platform for innovation”: investing in broadband is NOT just about the financials;

- Frame the benefits, measure them, and promote.

Continue Reading →

With more and more funding for broadband – for example, the US’s $100 billion through the American Jobs Plan, or Canada’s Universal Broadband Fund – unserved and underserved localities should be encouraged by these positive and significant steps. However, there are a number of uncertainties:

With more and more funding for broadband – for example, the US’s $100 billion through the American Jobs Plan, or Canada’s Universal Broadband Fund – unserved and underserved localities should be encouraged by these positive and significant steps. However, there are a number of uncertainties: In parallel to developing their own broadband investment solutions, localities should apply for broadband funding once the application process is available. If their application is funded, great – then use public funds to support and expand a healthy competitive broadband marketplace that connects all local premises with digital infrastructure that can provide needed redundancy by being available to multiple providers.

In parallel to developing their own broadband investment solutions, localities should apply for broadband funding once the application process is available. If their application is funded, great – then use public funds to support and expand a healthy competitive broadband marketplace that connects all local premises with digital infrastructure that can provide needed redundancy by being available to multiple providers.

As a local leader or elected official, you may need to decide whether or not you need a survey, or a study for your broadband initiative. If the value isn’t clear, or if it doesn’t get you closer to your goal, why spend time and money on a ‘survey’ or another ‘study’? Don’t do it just because another community has.

As a local leader or elected official, you may need to decide whether or not you need a survey, or a study for your broadband initiative. If the value isn’t clear, or if it doesn’t get you closer to your goal, why spend time and money on a ‘survey’ or another ‘study’? Don’t do it just because another community has. Regardless of which option communities choose, elected officials would want to be in the best position to negotiate and to decide the best path forward for their community by understanding the broadband investment options, the

Regardless of which option communities choose, elected officials would want to be in the best position to negotiate and to decide the best path forward for their community by understanding the broadband investment options, the  We know that providers already have their expected take rates and will use their spreadsheets in developing their own business case. However from SNG’s extensive research, the majority of the community benefits from broadband are off-balance sheet to providers – which means providers under-value their return on investment as compared to community returns on investment (i.e. community benefits). We call this

We know that providers already have their expected take rates and will use their spreadsheets in developing their own business case. However from SNG’s extensive research, the majority of the community benefits from broadband are off-balance sheet to providers – which means providers under-value their return on investment as compared to community returns on investment (i.e. community benefits). We call this