Assessing the State of Broadband in Oregon

“The Oregon Statewide Broadband Assessment and Best Practices Study will be a useful tool and reference for local communities and state policy makers in meeting the broadband challenge.”

– Christopher Tamarin, Oregon Broadband Office

The Need

The Oregon Broadband Office (OBO) within Business Oregon, an agency of the State of Oregon, needed to more clearly identify and validate the areas within the state that continue to be unserved and underserved with broadband services. There was urgency to develop this intelligence as input to legislative decisions on broadband investments in advance of the State legislative session starting in February 2020. Broadband Oregon sought broadband data collection, analysis, validation, and best practice research for the development of strategies and public investments in broadband infrastructure and broadband adoption and utilization.

One of the challenges for Business Oregon was relying solely on broadband data provided by the Federal Communications Commission (FCC) through the periodic form 477 self-reported by telecom providers. While the FCC broadband data reports at the census block level, it can be inaccurate on service coverage and ambiguous with service types within census blocks.

One of the challenges for Business Oregon was relying solely on broadband data provided by the Federal Communications Commission (FCC) through the periodic form 477 self-reported by telecom providers. While the FCC broadband data reports at the census block level, it can be inaccurate on service coverage and ambiguous with service types within census blocks.

Broadband Oregon therefore sought the best information available to identify the unserved and underserved areas in the state and estimate the cost to bridge broadband gaps. In today’s marketplace, unserved is considered to be service of less than 10 Mbps download and 1 Mbps upload (10/1 Mbps). Underserved is less than the current FCC recommendation of 25 Mbps download and 3 Mbps upload speed (25/3 Mbps).

Broadband Oregon also sought insights into best practices to solve broadband gaps and methods for funding broadband investments that do not rely solely on State financial resources. All of this research and analysis were required to be completed within a three-month period to meet the legislative deadlines.

What SNG provided

SNG was hired by the State of Oregon to conduct a statewide broadband study. SNG brought together a world class team of industry experts on broadband data analysis and mapping, broadband data collection, and broadband engineering and construction. The SNG team collected primary data and developed data from additional independent sources to supplement the latest FCC data, including fiber infrastructure and service data. SNG worked with Business Oregon to deploy our proven eSolutions Benchmarking (eSB) methodology and tools to collect data directly from households, businesses, and organizations across Oregon. Through the eSolutions Benchmarking data collection, SNG gathered connectivity and speed data, as well as other vital data on broadband utilization, from more than 3,600 households and 500 businesses in a compressed 4-week period.

SNG worked with our project team partners GeoTel Communications and the Internet-Is-Infrastructure to analyze the multiple data sources at the census block level to identify which Oregon census blocks were unserved, or underserved. Two additional categories were identified at the census block level:

SNG worked with our project team partners GeoTel Communications and the Internet-Is-Infrastructure to analyze the multiple data sources at the census block level to identify which Oregon census blocks were unserved, or underserved. Two additional categories were identified at the census block level:

- Basic Broadband between 25/3 Mbps and 100/100 Mbps

- Future Ready broadband above 100/100 Mbps

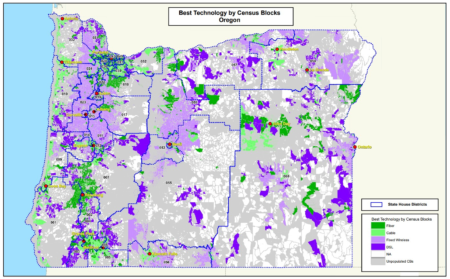

The SNG project team also identified the best terrestrial technologies available by census block among fiber, cable, fixed wireless, and DSL, The research goal was to assess fixed broadband services for Oregonians.

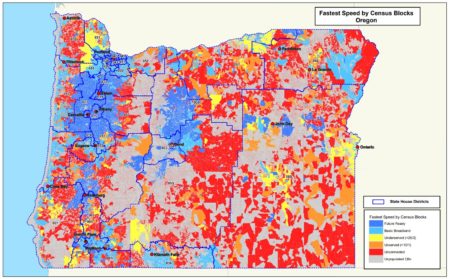

The census block level analysis enabled the creation of geographic “heat maps” of the four speed categories and of the four fixed internet technologies. Additional heat maps were created to show the presence of fiber infrastructure across the State. This same data was provided to Business Oregon as mapable data to include in the online, interactive Oregon broadband Map.

The results of the analysis were also aggregated to the state senate district level as well as at a county level to show local elected officials how broadband service in their senate districts and counties compare to their peers across the State. Detailed analysis of the new data was combined with the FCC data using the team’s insights and experience and this was documented in the final report.

Results and Outcomes

The Oregon Statewide Broadband Assessment and Best Practices Study prepared by SNG was submitted on February 18, 2020 to and unanimously accepted by the Joint Committee on Ways and Means Subcommittee on Transportation and Economic Development.

The analysis of multiple broadband data sources at the census block level revealed that 46 percent of populated census blocks are unserved or underserved and that these census blocks are in rural and sparsely populated areas representing about five (5) percent of Oregon’s population. This represents approximately 148,000 people and 60,000 households in rural Oregon.

The analysis of multiple broadband data sources at the census block level revealed that 46 percent of populated census blocks are unserved or underserved and that these census blocks are in rural and sparsely populated areas representing about five (5) percent of Oregon’s population. This represents approximately 148,000 people and 60,000 households in rural Oregon.

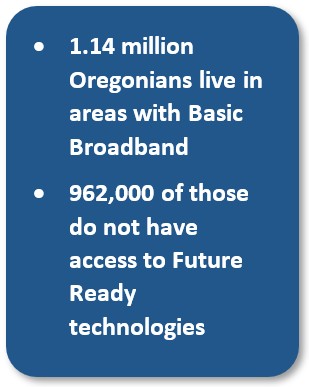

Of the other 95 percent of Oregonians considered served with broadband, 67.4 percent live in areas with Future Ready broadband (greater than 100/100 Mbps) and 27.6 percent have access to Basic Broadband (25/3 Mbps). While this is a good news story at a statewide level, there continue to be broadband issues to address across the state, including both rural and urban areas.

- SNG’s primary data collection revealed that there remain pockets within census blocks that do not have access to Basic Broadband or Future Ready broadband. These quality of broadband gaps are difficult to identify with the current FCC data reporting methods.

- Of the 27.6 percent of Oregonians (1.14 million people) with access to Basic Broadband, the majority of those areas have access to cable or DSL technologies that do not offer Future Ready broadband speeds of 100/100 Mbps, nor rank highly in reliability by Oregon households and businesses.

SNG’s research also found that:

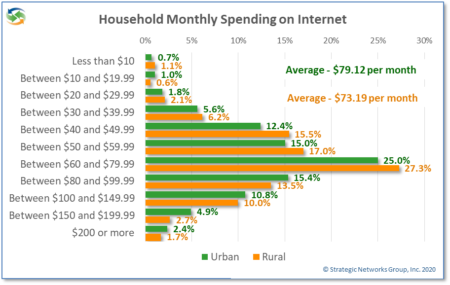

28 percent of households report that their internet connection speed is not fast enough, with 38 percent reporting occasional or frequent problems.

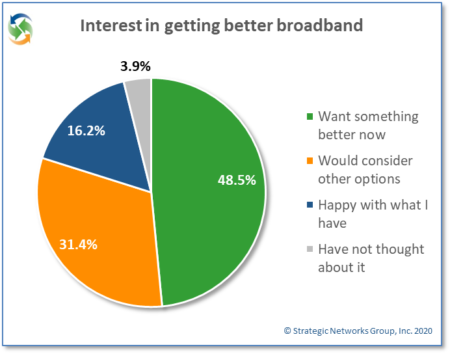

28 percent of households report that their internet connection speed is not fast enough, with 38 percent reporting occasional or frequent problems.- 49 percent of Oregon household would definitely or very likely relocate in order to get a better level of broadband service. This likelihood increases with younger age groups and higher incomes, putting broadband-deficient communities at risk.

- Three quarters of households and businesses across Oregon are very likely to change service providers to get better broadband services, another strong indication of dissatisfaction with current services in many areas.

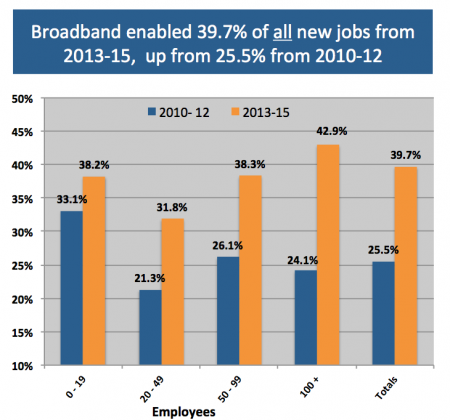

- Only 14 percent of businesses reported new jobs. Of those new jobs, 70 percent were attributed to using the internet. Although the number of businesses reporting may not be representative of Oregon overall, the job impact data suggests that broadband is critical for future new job growth.

The cost estimate of $1.32 billion prepared by our project partner Atlantic Engineering Group to provision fiber to all households in these unserved and underserved areas, represents an average cost per home passed of $23,101. This high cost for bringing fiber to the home (FTTH) into unserved and underserved areas strongly indicates that:

- a mix of technologies will be required to provide better broadband connectivity to unserved and underserved areas, which are primarily rural. A detailed cost estimate will require a more analysis at a local level to determine where FTTH may be cost effective versus using fixed wireless with fiber backhaul.

- the private sector cannot be expected to address unserved and underserved areas alone because of the high costs and that the community benefits of broadband are largely off-balance sheet to them. The rural-urban digital divide in Oregon is not likely to decrease unless public investments are made in digital infrastructure and growing the demand for broadband through digital transformation. This will require State policies, strategies, and programs in Oregon that will better enable public-private partnerships and private investment.

Findings and results are detailed in the Oregon Statewide Broadband Assessment and Best Practices Study Report.

What the Oregon Broadband Office said

Experience of working with SNG: “Strategic Networks Group is excellent to work with; very responsive and supportive”

Chris Tamarin, Oregon Broadband Office

Feedback on the Oregon Statewide Broadband Assessment and Best Practices Study Report: