In the February 2019 edition of ISE Magazine, Michael Curri discusses the question: Does an investment in a locally owned fiber network pay off for our locality?

In the February 2019 edition of ISE Magazine, Michael Curri discusses the question: Does an investment in a locally owned fiber network pay off for our locality?

Using SNG’s analysis and experience with broadband initiatives across North America, Michael Curri examines the options and strategies localities can take to self-finance broadband and digital infrastructure. This is particularly important to address when managing telecom and internet costs for increasingly connected municipal and county operations, as well as smart community services. Furthermore, what options are there for localities when they have areas that are unserved or underserved?

Read article >> It May be Time to Make a BID

There two stages to a building digital infrastructure for a locality. The first stage is a core network for the municipality, county, etc. for their future telecommunications and internet needs. The second stage is Broadband Improvement Districts (BIDs) where property owners pay for their access to the network.

This model has worked for Ammon, Idaho, where:

- the municipality has saved 86% in their telecommunications and internet costs for ten times the bandwidth

- residential subscribers since 2018 pay $59 per month for Gigabit internet service.

For communities and regions that know they need broadband, understanding where and how to start is critical. SNG’s research shows that the drivers of this process are economic and community benefits. By assessing community benefits up-front you can build buy-in and develop a digital infrastructure strategy that is based on your needs and your circumstances.

SNG Research Brief – Household Broadband

SNG Research Brief – Household Broadband

Access to robust and competitive broadband is essential for any community to survive, let alone thrive. Unserved or underserved areas continue to exist in many localities, whether because of limited or no choices for service providers, outdated technology, etc. This research brief provides some insights and data points on the current state of access for households, with focus on rural communities and how they compare to urban areas.

From SNG’s research of over 19,000 households across the North America we are able to reveal some of the important findings that proponents of broadband need to know. These insights are from household data collected directly by SNG rather than statistics provided by service providers or other agencies.

Technologies used

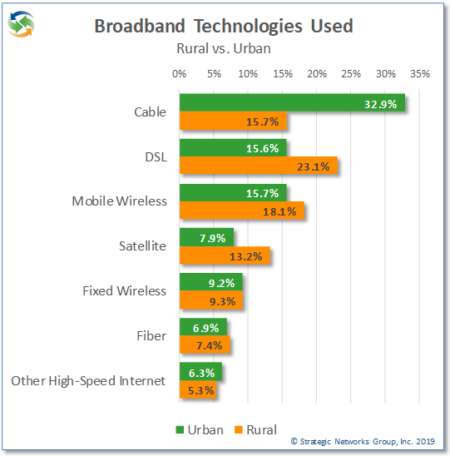

While fiber deployment and use are increasing, cable remains the dominant broadband technology overall with 23.6% of households, followed by DSL at 19.6%. However, the picture changes when you compare urban and rural areas.

While cable dominates urban markets, DSL is still the most used technology in rural areas – which suggests that this is due to the lack of other available options. Fiber use is low for both urban and rural households. For rural areas in particular, the lack of cable and fiber options drives up the use of mobile wireless and satellite as an alternative.

Broadband Service Priorities and Satisfaction

From a user perspective, technology is only relevant for its impact on connection speed, reliability, and price. Understandably, much emphasis is put on speed of connection, since this is how services are sold. However, when it comes to how households prioritize their selection of service, reliability is cited as highest priority with 88% of households compared to 77% who say speed is a high priority and 66% who say affordability is a high priority. These priorities are almost identical between rural and urban households.

So, if that is what households expect, then what is available and how do they feel about the connections they have?

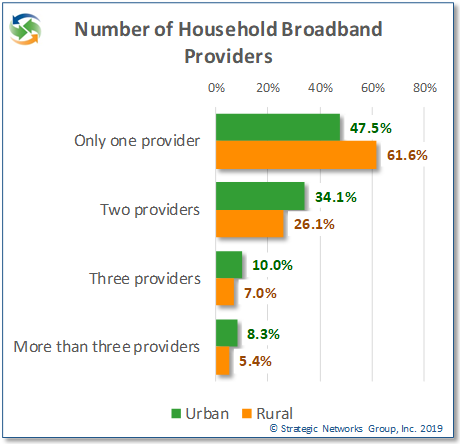

More than half (54%) of households have only one broadband provider available, clearly indicating a lack of choice for most households. For rural areas nearly 62% of households have only one broadband provider to choose from, with implications for competitive service price and quality.

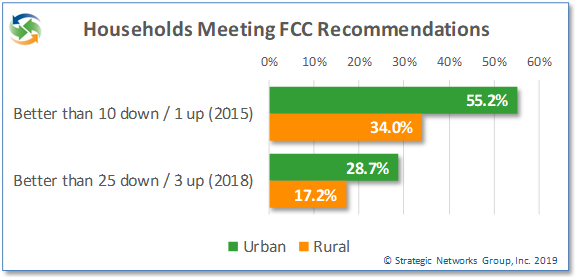

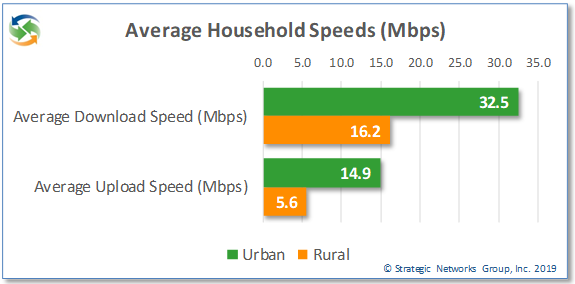

This is reflected in rural service speeds, price, and satisfaction. On average, rural households get approximately half the download speed as urban households and just over one third the upload speed. When it comes to meeting current FCC speed recommendations, 28.7% of urban households meet or exceed the recommended 25 Mbps download and 3 Mbps upload speed, while only 17.2% of rural households do so. Even looking at the old FCC recommendation of 10 Mbps down and 1 Mbps up, just over one third of rural households meet those speeds.

More than 61% of rural households get less than 10 Mbps download speed for an average cost of $70 per month. Overall, rural households pay a monthly cost of $4.38 per MB compared to $2.32 per MB for urban households, almost double the cost. Rural households have less choice and slower speeds and spend more for the same or poorer service.

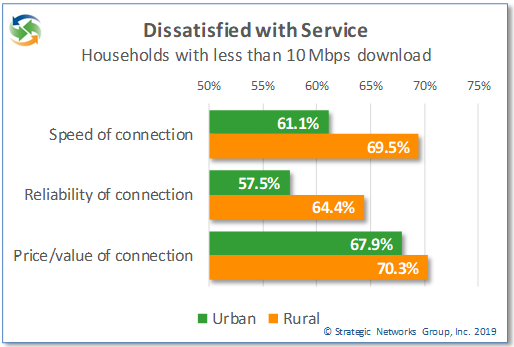

As a result, 70% of rural households subscribing to less than 10 Mbps download speeds are dissatisfied with the value of their service for the price they pay, and 69% are dissatisfied with the speed of service. In addition, 64% of households are dissatisfied with the reliability of their service. The satisfaction levels are only slightly better for urban households with less than 10 Mbps download, with 68% dissatisfied with value, 58% with speed, and 68% with reliability.

This is partly explained by the different mix of technologies deployed in rural areas. With a higher proportion of DSL and satellite connections used in rural areas the quality of speed and reliability is reflected in overall satisfaction levels, resulting in lower satisfaction with value for the price of the service. Fiber connections generate the highest satisfaction levels by far, followed by cable service. Very few households are fully satisfied with DSL or satellite services, and yet for some these are their only options for broadband connectivity.

34.7% of households say that their fiber connection is “worth every penny” for value satisfaction, compared to 7.6% for cable, 4.6% for DSL, and 2.0% for satellite. Another 48% say the value of fiber is “acceptable for what I pay”, versus 38% for cable, 27% for DSL, and 15% for satellite. Similar satisfaction levels by technology are shown for connection speed and reliability. More than any other technology, fiber is clearly a solution that meets household priorities and expectations.

The Implications for Households and Communities

Households without good broadband available to them may choose not to take any of the options forgoing the speed and reliability they need. Households in this situation will not use the internet to its fullest capacity, missing opportunities for them to fully benefit from what the internet can offer – such as new income opportunities, remote access to health care and education. This negatively impacts community well-being as inadequate broadband risks losing population and difficulty in attracting new residents and businesses. This is particularly challenging for smaller, rural communities where SNG research has shown that they are more likely to lack quality broadband and have the most to lose in terms of population decline, especially among youth.

See how a rural county got the support and funding to build the digital infrastructure they need to thrive – Custer County Broadband Impact and Market Assessment.

Find out more about SNG Solutions for Local Economic Development.

Is quality broadband important to households?

Is quality broadband important to households?

Hopefully, the obvious answer to most people is yes. But just how important is it? And what does it mean for regions and communities that may not have quality broadband, or enough of it?

We can debate how and why it may be important, and even measure that, as SNG has done over many years. But there is one measure that sums it all up and the results are significant. Assuming you could never get broadband service, how likely is it that you would leave to relocate to a community that offers broadband? We have asked thousands of households that question and the results are both expected and surprising.

Insight #1 – Younger people are more likely to relocate for broadband than older people

Forty percent of people in the 18 to 34-year age bracket would definitely relocate, with another 20 percent very likely to relocate. Fewer than 7 percent would not consider relocating for broadband. The likelihood of relocating diminishes for older cohorts, but more than one third of people 65 years and over would definitely or very likely relocate.

Certainly, the availability of quality broadband is only one factor in making a decision on where to live … or not live, but when almost two thirds of people in the prime of their working life … and often with young children … may relocate to another community to get better broadband, that can have huge impacts on communities that are lagging.

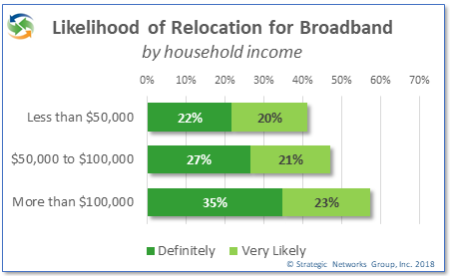

Insight #2 – Higher income households are more likely to relocate than lower income households

58 percent of households with incomes over $100,000 would definitely or very likely relocate for broadband. Lower income households are less likely to relocate which may not be surprising, but even 42 percent of households with income below $50,000 would definitely or very likely relocate. Even more supposing is that these statistics change very little even for very low-income households below $20,000.

High-income households do have more options to choose to relocate than their low-income neighbors, but this is exactly the cohort that communities can least afford to lose. Not only is there risk to losing the younger workforce, but also the high-income earners (and local spenders).

Insight #3 – Long-standing residents are more likely to relocate than newer residents

Perhaps the most surprising finding from SNG’s research is that households that have been in their location for more than 5 years have a higher likelihood of relocating compared to newer residents. Fifty-one percent of long-standing residents would definitely or very likely relocate for broadband, compared to 36 percent of newer residents. It is a fallacy to assume that because people are well-established in the community they are less likely to relocate.

Long-standing residents may cross all age groups and income levels, but they also represent the established base of the community with longer and deeper social connections. The risk of losing such residents can have tangible effects on the social fabric of the community.

In summary, it is less necessary to know how and why people use broadband than to know how they feel about the importance of broadband in their lives. The willingness to relocate for better broadband and its potential impacts should be something that all community leaders recognize and pay attention to. Find out how households in your community, region, or state feel about broadband – how they are using it, and what they need – by doing your own Broadband Market Demand Assessment.

There is a choice … attract and retain youth, high-income earners, and long-standing residents … or risk losing them to neighboring communities.

How can funding agencies get ten times more broadband coverage per tax dollar invested?

– invest in planning and technical assistance

56% of rural businesses and 49% of rural households would likely relocate to get the broadband they need. Thousands of communities risk economic and social decline without broadband. What role can funding agencies play?

No funding agency can make the investment to bridge all the gaps in broadband and digital infrastructure, even with matching dollars or public-private partnerships. The best roles for public funding agencies are to help localities plan effectively so that they can support their own investments and partnerships, or fill digital infrastructure funding gaps where needed by making an economic case for investing. By helping localities pivot to approaching broadband as digital infrastructure investments that pay for themselves over time, funding agencies can better leverage their efforts and funding budgets.

By helping localities pivot to approaching broadband as digital infrastructure investments that pay for themselves over time, funding agencies can better leverage their efforts and funding budgets.

The up-front broadband demand aggregation, planning, and design is a fraction of the cost of network implementation. By funding the up-front planning and technical assistance, a locality can uncover existing budgets that when reallocated can finance digital infrastructure investments. These up-front efforts can be one-tenth, or less, of a total digital infrastructure project cost.

The result – the funding agency help more locally driven projects get off the ground toward success on their own, allowing scarce public funds to be spent more effectively and to help with infrastructure costs for those small communities that cannot do it on their own.

Read more at Invest in Digital Infrastructure, not Just Broadband Networks

There are still far too many communities without broadband and funding agencies do not have enough money to fund all of the necessary digital infrastructure and last mile connectivity to individual premises. It is time to start looking at different ways to deploy broadband into unserved and underserved areas.

How can funding agencies get ten times more broadband coverage per tax dollar invested?

Localities without broadband will lose residents, businesses, and their tax base. How many communities exist today without roads, electricity, or water and sewer systems? However, areas remain unserved or underserved because there is not enough of a return (profit) for broadband service providers to justify the investment. Whether private, public, or private-public partnerships fund broadband, investments will need to be made and financed for such localities to survive, let alone thrive. A pivot in approach is needed to approach broadband as digital infrastructure.

Current Investment Challenges with Broadband Planning and Investment

- Unserved and underserved areas exist because there is not enough of a business case (profit) for private sector providers to invest

- Many of the unserved or underserved localities have limited resources (financial and staffing) and expertise to develop comprehensive broadband plans that are economically sustainable

- Inertia and gridlock that leads to accepting the status quo after spending time and money on traditional feasibility studies that are fundamentally flawed in trying to make a private sector business case for broadband where none exists.

Broadband Funding Program Challenges

When broadband funding is available, how can funding agencies determine whether:

- Community leaders are staffed and prepared to develop and launch a sustainable solution? In other words, are they committed and ready?

- The project is comprehensive and sustainable

- Potential project risks can be identified to avoid pitfalls, or unsustainable networks that do not resolve the lack of broadband access

- Public funds invested will generate the greatest local economic impacts and community benefits

Digital Infrastructure

Broadband, like roads, is essential infrastructure. Retaining businesses, jobs, and population are all benefits that broadband enables for a locality, but are off-balance sheet to private sector providers. That is why broadband needs to be approached as digital infrastructure – it has become an essential service. Governments invest in infrastructure because there are public benefits that private sector entities cannot monetize – these are externalities, or what we at SNG also call community benefits.

Economic and community development agencies know they must address broadband gaps if their localities are to remain viable. For example, despite fiscal constraints and resistance to public investment in broadband by vested interests, States are allocating $10million, $20million or $100 million to broadband, which are significant legislative wins. However, if the cost to expand broadband to unserved areas is $1.3 to $1.7 billion (as was with the State of Tennessee), it will take at least a decade if reliant upon state funding at those levels – and no community can afford to wait five to ten years for broadband. Anyone that can leave, will have left for better education, healthcare, public safety, economic opportunities, and overall quality of life. Businesses and high value individuals will be very difficult to retain, let alone attract. Struggling localities will continue an accelerating downward spiral.

In the absence of funding private sector investment, municipalities have tried to establish a municipal or utility-based ISP, taking on a bad business case while directly competing with incumbents. Often these projects are locked into the traditional mindset of building a municipal retail ISP as “The” solution. Some have been successful, most have struggled. In many States municipalities are prohibited or severely restricted in taking this retail ISP services approach.

Another approach is funding projects using private service providers to deploy to unserved areas, typically with matching funding. Preference is given to those projects that offer the greatest matching funding to State dollars. This may be straightforward and may ‘check the box’ for broadband service, but choosing one provider to build-out to an area is essentially using public funds to subsidize one provider among many. While it may be compelling for practical reasons, this approach assumes that private providers can and will execute quickly with deployments, as well as provide competitive levels of service to address local broadband demand – current and future. However, subsidizing one service provider in a market tilts the playing field and inhibits healthy competition. Furthermore, problems can arise when profit-driven service providers interests do not align with a locality’s interests and needs – such as deploying smart community services.

Without other options, localities will continue to see under-investment in digital infrastructure even when community benefits outweigh private sector returns on investment.

Investing in Digital Infrastructure Planning

A more recent strategy is investing in digital infrastructure planning which enables funding agencies to leverage ten times what they are currently receiving from their broadband investments. The ten-fold (10x) difference is funding a network build (e.g. $1M for Ammon, Idaho) versus investing in planning to self-finance digital infrastructure (e.g. $100K). Funding agencies can get greater leverage from their broadband investment dollars by helping communities take the right action to invest in their own digital infrastructure than they do by investing directly in that infrastructure themselves.

The challenge with developing a Digital Infrastructure Strategy for Communities and Regions is that they need help in understanding how this model can work and they need technical assistance to take initial steps. The starting point is assessing potential municipal cost reductions, subscriber savings, local economic growth, and smart community service benefits. When these community benefits outweigh digital infrastructure costs, it is possible to self-finance. For example, when telecom and internet costs can be reduced by 86% (see economic case of Ammon, Idaho) those municipal cost reductions are existing budgets that can be reallocated to finance the digital infrastructure investment.

Funding agencies can play a critical role in broadband funding and policies. They can invest in communities rather than a network build. Broadband and digital infrastructure are not ends in themselves, but means to enable good-paying local jobs, grow local economic opportunities, and enhance local quality of life.

What can funding agencies do? A pragmatic, evidence-based approach is needed to make important decisions on broadband funding awards, while minimizing additional work for localities. Furthermore, with uncertainty on the level of broadband funding that will be available, an arms-length, objective process to assess and rank potential projects is needed to:

- Prioritize where funding should be invested for projects that are essentially ‘ready to go’ because they can be self-financed based on economic feasibility and community returns on investment (retaining and growing local business and jobs, access to health and educational services, etc.). These projects would get help with planning, getting started, and implementing a digital infrastructure approach – which is a more efficient use of State dollars when planning costs one-tenth as compared to directly investing in infrastructure.

- More efficient use of public dollars by investing in planning and demand aggregation enables areas to self-finance their digital infrastructure allows the remaining available public dollars to be allocated to areas that have the greatest need, but who may not have the means to address their needs themselves.

- Determine how funding be more efficiently and effectively spent (infrastructure, technical support, demand aggregation, etc.) based on each area’s identified needs, thereby maximizing community benefits per State dollar invested.

A funding agency’s role is most valuable in helping achieve economic and community development goals, while ensuring communities are ready and have the means to implement sustainable digital infrastructure plans.

Maximizing community benefits per broadband dollar invested

How can funding agencies determine where, when, and how to invest to address digital infrastructure needs of communities?

The first step is for communities to answer the question: Do the community benefits from a digital infrastructure investment outweigh the costs for the community/region?

Based on SNG’s long track record and unique experience in working with funding agencies in this way, we recommend the following:

- Assess Economic Feasibility of broadband infrastructure and whether potential community benefits outweigh costs over longer term (e.g. 15-20 years)

- Create a process for communities to self-opt in by providing a standardized input form localities can complete and provide the necessary information

- Those communities that have provided their information will receive an assessment of economic feasibility for their community or region – an arms-length assessment to support their broadband planning. Additionally the localities will have a geographically based phased plan based on estimated demand — to ensure their broadband planning is demand driven.

Outcome from Assessing Economic Feasibility: The funding agency will have an assessment of potential returns from broadband investment for each community / region, which can be ranked in terms of cost-benefit ratios and project sustainability. Additionally, identified municipal cost reductions can be used as matching funds for grant applications. See example of job and business impacts assessed for Custer County, Colorado.

- For communities that have participated in the economic feasibility assessment and their proposed projects prove to be sustainable, invite local leadership (council, broadband committees, etc.) to take the Community Readiness for a Digital Future

- Leadership teams from each community / region take 10-15 minutes to complete an online survey with objective metrics to assess whether or not they are doing the right things needed to get their project across the finish line. It also uncovers different perspectives between stakeholders – is there alignment, or are there gaps in their perspectives and/or approach? Time, money, and political capital can be saved by uncovering and addressing previously unseen gaps.

Outcome from Assessing Readiness: The funding agency receives a readiness summary of communities and regions who may require broadband funding. This enables the State to have a clear picture of which projects are ‘ready to go’ and which projects may require more preparation and technical support, which can be accompanied with broadband funding.

- Based on Economic Feasibility and Readiness findings, prepare a summative ranked list on impacts (increases in GDP, business and job growth, etc.) from State broadband investment dollars with details incorporated on the Readiness of each project – and if needed, how they can be helped to become ready and develop sustainable projects. This is critical input to the success of any broadband planning process at a community and regional level.

An implicit outcome of the steps described above is that communities will reveal their level of interest and commitment to act through their participation. While funding agencies can assist communities, it is essential that the local leaders are willing and able to take action. Funding agencies will know:

- Which communities have the greatest need for assistance

- What type of assistance they need

- How motivated they are to take action on their own behalf

- How ready they are to take action

- What next steps will be most effective for communities ready for assistance

Every community has different characteristics and faces different challenges. Those with the most need may not provide the greatest impact at a State level, but the benefits and impacts at a local level can be a matter of survival for a community or region. With relatively small investments the state can assist such communities to own their digital future and, collectively, the impact on the State can generate significant economic impacts without impractical and limited investments in the broadband networks themselves.

States and localities know that they need to address their unserved and underserved areas, but with little or no available budgets and huge potential broadband costs to pay for ‘last mile’ they are challenged and rightly do not want to take on an unfunded mandate. What options do elected officials have to ensure their residents and businesses have the broadband they need? Also, can this be done quickly as those who need broadband the most are often the last to get it.

Business Case vs. Economic Case for Broadband

We already know that digital infrastructure investments can more than pay for themselves – see economic case of Ammon, Idaho. Making an economic case for investing work requires looking beyond the private sector business case to add municipal cost reductions, subscriber savings, economic growth, and smart community service benefits. Quantifying these economic and community benefits, SNG’s research shows that they can outweigh the costs of digital infrastructure. Additionally, what may not be financially feasible with a private sector expected return rate over 3-5 years may be possible when financing at infrastructure rates over a term of 15-20 years. Taken together, investing in digital infrastructure can become economically feasible – which enables communities and regions to address broadband gaps in ways they could not before.

The same analysis can be applied at a State or regional level to find out which unserved areas would require financing, rather than grants. No State nor regional development agency has enough funds to cover last mile costs required to ensure universal broadband access – for example, in Tennessee it was estimated to cost $1.3-1.7 billion to build fiber to achieve the FCC’s broadband definition of 25/3 Mbps. Without such funding, States have turned to private sector providers to incentivize broadband investments with matching funding. While this approach can get service to some unserved and underserved areas, there is still significant capital investment needed and funding one provider risks unbalancing the market and limiting competition.

On the other hand, just like road infrastructure and airports, public investments in infrastructure lower capital investment barriers for the private sector – enabling the private sector to reach new customers, provide enhanced services, and compete on a more level playing field.

Helping Localities Take Ownership of their Digital Future

A less costly and more far reaching alternative is for communities and regions to see how they can take their digital future into their own hands. This starts with understanding whether a digital infrastructure approach can be self-financed by assessing economic feasibility to see whether cost reductions outweigh a ‘build your own’ network approach. If the answer is yes, localities can themselves invest in digital infrastructure sustainably.

SNG’s research shows that municipal cost reductions alone pay for local investments in digital infrastructure by 1.3 times over 15 years – or put in terms of payback period, the network pays for itself in 15-20 years just in municipal cost reductions. There are additional community benefits of economic growth, subscriber savings, and smart community services that need to be added to the calculus when weighing community benefits against investment costs.

In summary, investments in local planning are a fraction of the potential capital investment required for last mile and offer a much greater return for every tax dollar invested. By providing technical assistance and funding for planning to uncover where digital infrastructure can be self-financed, funding agencies can get broadband coverage to many more unserved and underserved areas. Furthermore, helping localities own the process of digital infrastructure and transformation enables them to own their digital future as compared to simply funding last mile connectivity.

Watch this Broadband Agendas webinar from ICF to learn the difference between the business case and the economic case for broadband, and how  communities turn it to their advantage.

communities turn it to their advantage.

Watch the webinar

When cities and counties decide to invest in broadband networks, they face the same business-case challenge as private-sector carriers. The city or county has usually arrived at this point precisely because the private sector does not see enough of a business case for investment, so how is government going to do what business cannot? Government’s advantage as a network builder is not anti-competitive behavior: it is that government and the community gain economic benefits from the network that a private-sector company cannot tap.

Speakers:

Michael Curri – Founder and President, Strategic Networks Group – starting at minute 36 of the webinar

Paul Leedham – Chief Innovation Officer/Director of IT, City of Hudson

Ysni Semsedini – CEO of Festival Hydro Inc and Rhyzome Networks

Jim Stifler – Chief Economic Officer, City of Hudson

Webinar conducted March 1, 2018

How can communities take control of their broadband future?

Many communities continue to struggle with inadequate broadband for their community. Residents and businesses cannot get the quality broadband they need, or any broadband at all. Municipalities are impeded or prohibited in providing new services and the local economy and overall community vitality suffers. Commercial ISPs are unwilling or unable to improve local broadband and yet resist attempts by communities or regions to take control of their broadband future.

Standing still is not an option. The status quo will not change unless communities take the initiative. However, the most common approach to solving the problem is for municipalities to build and operate their own municipal broadband network. Credit to those that do this, but in many cases this becomes a continual struggle to avoid operating losses and recover the investment, while operating in the face of strong resistance and competition.

Standing still is not an option. The status quo will not change unless communities take the initiative. However, the most common approach to solving the problem is for municipalities to build and operate their own municipal broadband network. Credit to those that do this, but in many cases this becomes a continual struggle to avoid operating losses and recover the investment, while operating in the face of strong resistance and competition.

Here is the root problem. Commercial ISPs do not invest in network expansion or upgrades because there is not enough of a business case to do so for your area. They do not see the payback they need from that investment and they have already captured the most lucrative part of your market. This model of replicating the traditional ISP model and competing in the free market, albeit with more robust broadband, is really an ‘old school’ approach and one that will always be a struggle. You need to ask yourself …

“Can we really build and operate a profitable, competitive network when the incumbent providers, who already have networks and customers, don’t see the business case to invest any further?”

Fortunately, there is a better way available to any locality serious about owning its broadband future. It starts by recognizing and embracing broadband as the essential infrastructure of the 21st century. This approach is now possible because of maturing technologies that allow you to build open access virtualized networks that not only provide the digital infrastructure your community needs, but also is a platform that opens a marketplace for internet service providers. You put local users in control rather of their future than having them held hostage to whatever is available, and you can do this without becoming an internet service provider yourself.

Let’s go out on a limb and say that there is no municipal leader who wakes up one day and says, “What I really want to do is to become an ISP”. This is only a means to achieve your true goal, which is to ensure that everyone in your community can get affordable, quality broadband if they want it. It is about providing internet access, but it is also much more than that. It is about everything you can do with digital infrastructure and smart community services that will make your community a desirable place to live and do business.

It is time for a new approach … to change the paradigm based on a broader vision. To find out more read the full article “How can municipalities take control of their broadband future?”

Report Leverages Survey Results to Uncover the Gaps and Challenges in Broadband Cities are Experiencing, and What They’re Doing About Them

Superior, Colorado – Today in conjunction with its underwriters (Corning, Fujitsu, Henkels & McCoy Group, and Power & Tel); Strategic Networks Group (SNG) released its extensive report on city activity regarding the current state of broadband service, smart city applications in use, and investments being made in its “Aspirational Cities” report available online at sngroup.com/cities. The report is a follow-up to last year’s comprehensive state-level research on broadband research. The cities research report can be found at https://sngroup.com/broadband-sustainable-development/.

“Our research examines, at the city level, the drivers for investment, financing used and needed, perceived current state as well as which broadband activities are being undertaken,” explains Michael Curri, SNG’s president and founder. “The study’s findings can help cities that have already taken steps toward broadband challenges as well as those cities considering upgrading their broadband.”

More than one hundred American cities participated with some highlights of the findings including:

- Most participating cities do not have a broadband office and thus, may not have dedicated personnel that can focus on driving economic development, community vitality, and other strategic initiatives through broadband.

- Nearly two-thirds of cities surveyed do not have any of these three key items in place to advance broadband’s benefits in their communities – funding to support broadband, a city broadband office, or broadband adoption and training programs.

- Lack of city funding has been the one overwhelming element preventing cities from moving forward with broadband network investments. More than half of the cities surveyed also say a lack of external funding has prevented them from moving forward, suggesting they’re waiting for external solutions that may never come.

- Only half of cities consider their broadband speeds excellent or very good.

“It’s apparent from our cross-selection of cities across the nation that leadership, investment, and strategies need to be put in place at the municipal level to ensure the competitiveness and effectiveness of today’s American cities,” said Michael Curri, SNG’s president and founder.

Key contributors to this initiative were:

- Doug Adams, Strategic Networks Group

- Michael Curri, Strategic Networks Group

- Lori Sherwood, Vantage Point Solutions

- Gary Dunmore, Strategic Networks Group