Why Video is Not a Killer App

More than 3,300 interested in broadband flocked to Munich earlier this month to review the latest trends and best practices in our industry. We were thrilled to be able to participate and share our insights on broadband, its meaningful use, and how to maximize its benefits.

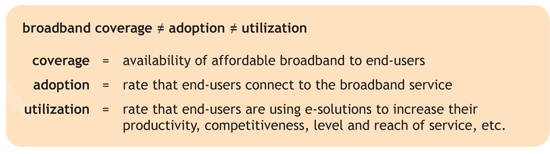

Chris Holden, the organization’s president, set a tone for the conference that aligned with SNG’s own mantra – the importance of meaningful use. Holden explained that the biggest challenge facing the FTTH (fiber) market is adoption and use… driving meaningful use. Holden explained that there seems to be an understanding gap when getting  people to switch.

people to switch.

The current hope is that video becomes the killer app that will drive more people to make the switch to fiber and therefore reap the untold benefits of faster Internet. Maybe. I may be a little less optimistic than the rest that video is a silver bullet. As a broadband evangelist, I realize the message must change to get the masses to “convert.” How does video matter to businesses operations and competitiveness? The fact is that there are lots of audiences for whom video does not currently matter. The real question is how can you make it relevant to them and personalize the context? For example, for health care providers and their patients, broadband video would become relevant with the availability of telemedicine.

There are no shortcuts, no killer apps, or silver bullets. It’s still Marketing 101 – tangible benefits are the only thing that moves move the needle.

In Kentucky, the process of outreach is underway. Led by the Office of Broadband Outreach in Frankfort, KY, SNG and their partners have deployed broadband utilization surveys statewide directly to over 120,000 residential and organizations email addresses. As in Illinois the survey is open to the public and available on the host agency websites.

Where in some instances, survey participation is seen in “pockets” of activity, surveys have been received from every corner and county in Kentucky. This is particularly important in the more mountainous Appalachian areas of South and Eastern Kentucky where, historically, broadband capacity and availability has been lacking.

Kentucky sees a high rate of interest from radio and print media which has provided a nice little push encouraging survey completion.

The Nunavut Broadband Development Corporation (NBDC) in Canada’s Arctic recently engaged SNG to measure the impacts-to-date of broadband investments and to forecast broadband needs and investment levels required to meet those needs.

The Nunavut Broadband Development Corporation (NBDC) in Canada’s Arctic recently engaged SNG to measure the impacts-to-date of broadband investments and to forecast broadband needs and investment levels required to meet those needs.

NBDC is a not-for-profit, federally registered corporation with a membership representing community, private sector and citizen interests. This project is made possible with funding support from CanNor.

SNG Selected by Two North American Regions to Drive Broadband’s Benefits

Greetings and Happy New Year from each and every one of us at SNG in our offices across the globe, from North America, to Europe, to Australia. Already we’ve hit the ground running in what’s sure to be a big year from Broadband with stimulus hitting its stride, from America to Australia. We look forward to providing you with our latest findings in the coming months.

First, we wanted to provide you with what we hope to be something to get you inspired as we share about our two latest projects. Is your region taking a serious step towards driving a 21st century economy, or are you just building networks? If the answer is the former, you’d fit in nicely with our two latest clients. And we’d love to lend our expertise.

Illinois and SNG Announce Partnership

Partnership for a Connected Illinois Announces Partnership with Strategic Networks Group to Drive Meaningful Broadband Use, Innovation, and Economic Development

SNG and the Illinois Institute of Rural Affairs Engaged to help Maximize Broadband’s Potential

SPRINGFIELD, Illinois, January 4, 2012 – The Partnership for a Connected Illinois , also known through its Broadband Illinois website, today announced further efforts to utilize broadband for driving better learning tools for school children, growing the Sta  te’s job base, driving innovation and increasing economic prosperity, and improving health care.

te’s job base, driving innovation and increasing economic prosperity, and improving health care.

PCI will work in a partnership with Strategic Networks Group (SNG) and the Illinois Institute of Rural Affairs in order to maximize the benefit of public and private-sector investments in broadband deployment and use. These investments have the potential to be a transformative investment for Illinois’ 21st century competitiveness.

The PCI initiative includes a state broadband strategy, informed by statewide research to measure broadband’s utilization and identify gaps. The result will be a statewide broadband plan preparing Illinois to be a leader in job creation and economic growth, education, medical innovation and quality of life. Another output of the research will be reports to individual organizations to help them understand how they can become more competitive through broadband.

“By developing a statewide broadband strategy for better broadband, we’re creating a future that includes economic opportunities, increased availability of educational tools, and higher-quality health care for Illinois residents,” said Drew Clark, executive director of PCI. “Better broadband means better lives. Our mission is to make high-speed broadband internet available to residents throughout Illinois.”

In developing a statewide broadband plan, the Partnership for a Connected Illinois is conducting statewide research on behalf of the State of Illinois in order to develop strategies that will position Illinois to be a leader in job creation and economic growth, education, medical innovation and quality of life.

Illinois turned to SNG due to their proven track record with maximizing broadband investment in more than 10 states, and in other regions throughout the world. The solutions that SNG brings to bear will help Illinois ensure that its broadband investment has deep, meaningful, and lasting impacts.

Partnering with SNG in support of this initiative is the Illinois Institute for Rural Affairs of Western Illinois University, which will help provide a statewide approach to accelerate the understanding and meaningful use of broadband for global competitiveness, job creation, and socio-economic impacts.

“Forward-looking governments understand the direct benefits that broadband and e-solutions bring, including increasing competitiveness, productivity, and revenues,” explains Michael Curri, president of SNG. “We’re delighted that Illinois is embracing the process of turning broadband’s potential into a strategy to create jobs, retain and attract businesses, and improve the overall quality of life of its citizens.”

About Partnership for a Connected Illinois (PCI)

PCI, also known for its Broadband Illinois website, is a non-profit entity working on behalf of the State of Illinois. PCI collects data about broadband availability and works with local providers and communities to make high-speed broadband available throughout the state. PCI is also working to improve the adoption and enhance the impact of broadband in Illinois. Learn more about PCI at broadbandillinois.org.

About Strategic Networks Group

SNG is a group of broadband economists who develop strategies for most effectively leveraging broadband investments. SNG looks to help make the most broad-reaching and transformational impacts that broadband can bring enable businesses, communities and regions by delivering the data and analysis decision makers need to maximize broadband’s potential. SNG’s goals: economic development, social advancement, increased productivity and competiveness. Learn more about SNG online at www.sngroup.com and discover how broadband market analytics can accelerate regional economic development.

About the Illinois Institute for Rural Affairs

IIRA is a unit of Western Illinois University and has served the people of rural Illinois since 1989. Its mission is “to improve the quality of life for rural residents by partnering with public and private agencies on local development and enhancement efforts.” The IIRA’s 40-member staff delivers on its mission through its research and outreach efforts.

Click to see this announcement on PCI’s website.

SNG Hard at Work in Canada’s Arctic

The Nunavut Broadband Development Corporation (NBDC) in Canada’s Arctic recently engaged SNG to measure the impacts-to-date of broadband investments and to forecast broadband needs and investment levels required to meet those needs.

The Nunavut Broadband Development Corporation (NBDC) in Canada’s Arctic recently engaged SNG to measure the impacts-to-date of broadband investments and to forecast broadband needs and investment levels required to meet those needs.

NBDC is a not-for-profit, federally registered corporation with a membership representing community, private sector and citizen interests. This project is made possible with funding support from CanNor.

Over the next few months, SNG will conduct an assessment of the socioeconomic impact of broadband in Nunavut, which will:

- Establish and implement a framework to provide an assessment of the socioeconomic impact of broadband in Nunavut for to the Nunavut Broadband Development Corporation

- Measure the benefits of broadband in monetary and qualitative terms as they relate to regional businesses, residential customers, communities, and nongovernmental organizations

- Show both the economic and social impacts of broadband

- Forecast future demand for Broadband in Nunavut

- Present three investment scenarios for broadband in Nunavut, including the socioeconomic costs and benefits of each scenario

We’re excited to help this area of Canada harness the power of broadband. Stay tuned in 2012 for our findings and how broadband can impact even the most sparsely populated regions.

Fibre to the Home Council Europe

Attending the Fibre to the Home Conference in Munich February 15th and 16th? If so, make sure to stop by to say “Hi” to Michael Curri and take in his presentation at 14:30 on the 15th, Socio-economic Benefits of FTTH Networks.

Attending the Fibre to the Home Conference in Munich February 15th and 16th? If so, make sure to stop by to say “Hi” to Michael Curri and take in his presentation at 14:30 on the 15th, Socio-economic Benefits of FTTH Networks.

Learn More About the Conference>>

Partnership for a Connected Illinois Announces Partnership with Strategic Networks Group to Drive Meaningful Broadband Use, Innovation, and Economic Development

SNG and the Illinois Institute of Rural Affairs Engaged to help Maximize Broadband’s Potential

SPRINGFIELD, Illinois, January 4, 2012 – The Partnership for a Connected Illinois , also known through its Broadband Illinois website, today announced further efforts to utilize broadband for driving better learning tools for school children, growing the Sta  te’s job base, driving innovation and increasing economic prosperity, and improving health care.

te’s job base, driving innovation and increasing economic prosperity, and improving health care.

PCI will work in a partnership with Strategic Networks Group (SNG) and the Illinois Institute of Rural Affairs in order to maximize the benefit of public and private-sector investments in broadband deployment and use. These investments have the potential to be a transformative investment for Illinois’ 21st century competitiveness.

Its the end of the year – and that means “Best Of” list. We’ve had some great research findings and article submissions this past year – in this year-end edition of Bandwidth, we’re sharing our favorites…

Broadband and Revenue Growth Increasing Internet utilization dramatically increases corporate revenues and job creation

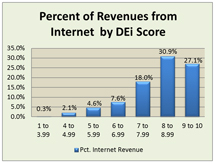

An SNG study of nearly 600 businesses revealed a direct correlation between revenue growth and the adoption and use of e-solutions. Higher levels of utilization generate higher revenues and greater benefits for businesses. The most significant impacts on a firm’s bottom line are more sophisticated e-solutions such as teleworking, selling goods or services online, etc. – which means that firms that are not ‘fully online’ are missing out on significant potential revenue. In some cases they could grow by up to 30%.

An SNG study of nearly 600 businesses revealed a direct correlation between revenue growth and the adoption and use of e-solutions. Higher levels of utilization generate higher revenues and greater benefits for businesses. The most significant impacts on a firm’s bottom line are more sophisticated e-solutions such as teleworking, selling goods or services online, etc. – which means that firms that are not ‘fully online’ are missing out on significant potential revenue. In some cases they could grow by up to 30%.

By measuring over 17 activities classified as “e-solutions,” or Internet enabled applications, SNG has developed a Digital Economy index (DEi) which measures the utilization of broadband as a platform for innovation. DEi scores range from 1 to 10 (10 being highest), with higher scores reflecting the greater the number, scope and sophistication of the Internet activities deployed in an organization.

Businesses with a high DEi, meaning higher levels of adopting and using e-solutions, experience larger percentage increases of revenues (between 27 and 31%).

Read More on the SNG Blog>>

New Dimensions in the Digital Divide

The digital divide has long been commonly understood to mean unequal access to the Internet and its accompanying resources and services. Earlier this year, we showed how when connectivity expands to more households, as we look at how people use and benefit from the Internet, another dimension to the digital divide emerges. SNG’s research (below) shows:

- Computer and Internet skill levels affect broadband utilization, but more interestingly:

- The lower your income, the lower your utilization.

- The older you are, the lower your utilzation.

Click on chart for a larger version.

Click on chart for a larger version.

SNG’s proprietary Digital Economy index (DEi) was used to develop this chart. Measuring how households use thirty distinct Internet activities yields a DEi score. The higher the DEi, the more Internet activities a household engages – 10 being a household at 100% utlization. As utilization is impacted by income and age – the lower a household income or the older the household, the lower its Internet utilization. The differences (or divide) is most pronounced for those over 55 and those making less than $30,000. So the digital divide is actually expanding as younger, higher income households best leverage e-solutions. Read the full article >>

Broadband and Job Creation

The Internet Innovation Alliance (IIA) released its 10 ways broadband contributes to job creation and serves as a connector of job seekers, employers and employees. Sources for the research include the American Library Association, the Federal Communications Commission, and SNG. Click here for the top 10 list.

The Internet Innovation Alliance (IIA) released its 10 ways broadband contributes to job creation and serves as a connector of job seekers, employers and employees. Sources for the research include the American Library Association, the Federal Communications Commission, and SNG. Click here for the top 10 list.

Our two contributions show the multiplier effect broadband investment has, as well as how many NEW jobs in North Carolina were created as a direct a result of broadband.

Broadband and Small Business

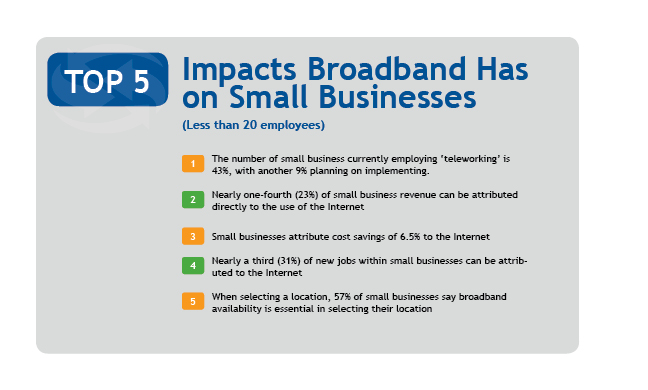

Using SNG’s Digital Economy Analytics Platform (DEAP), containing data from regions across the U.S. and the globe, SNG revealed the top 5 impacts broadband has on small business:

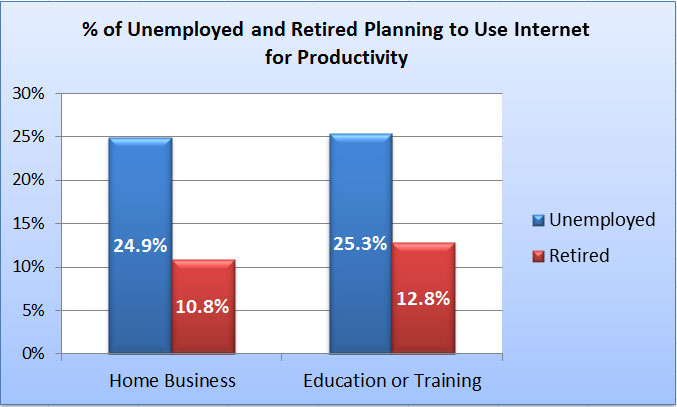

Broadband and the Unemployed

One out of four unemployed individuals are using the Internet to start a home business. While another 25% are relying on the Internet for education and training to help them get their next job. Even the retired are using the Internet for both of these purposes.

n= 229 unemployed, 868 retired

n= 229 unemployed, 868 retired

Visit SNG’s research library for more findings >>

Our Favorite Bandwidth Articles of 2011

In case you mised it, each month SNG provides insights and research into the world of broadband. In case you missed them, here are a few articles we thing you should take a minute to review…

Change is Hard… and So is Utilization

Are you focusing on simply providing broadband and waiting for people to adopt… and ultimately utilize e-solutions (the tried and failed build it and they will come mentality) or are you driving utilization? Focus on driving sophisticated use of broadband and you’ll see your region’s economy reap the benefits. Read Article>>

Making the Most of Your Broadband Investment

Broadband is critical infrastructure, a means to an end – not the finish line. Neither broadband coverage alone nor adoption is sufficient to achieve your goals and outcomes. Only broadband utilization leads to desired economic and social benefits. Read Article>>

What Steve Jobs Taught Us About Driving Broadband Utilization

Broadband has the ability to radically change our entire world in orders of magnitude more than it already has. But we need to get past the utilitarian view of broadband – looking at what it enables and instead what it empowers. At the advent of broadband, Apple’s campaign challenged us to push the world forward. Is what we’re doing enough to drive the complete transformative power of broadband… or do we need to Think Different? Read More>>

Creating an Action Plan for Broadband Utilization

Broadband availability alone is not enough to realize its social and economic benefits. An understanding of how to effectively use of broadband for commerce, citizen services and the positioning of rural counties as attractive areas for 21st century business and living will play a critical factor in their long-term success of your broadband investment and your ability to impact the lives of the citizens and businesses already located in the regions. Read More>>

The State of the Divide in 2011

More than a decade into our broadband revolution, the knowledge economy, and e-everything, it’s a bit discouraging to find that, even today, geography can still dictate individual or organizational potential for success. Read More>>

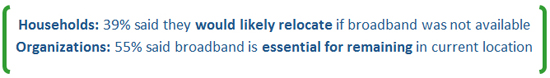

Uncovering the Value of Rural Broadband

SNG’s research shows that broadband strongly influences locational decisions by both businesses and households about whether to stay or where to move. Our research also shows that consumers consider the speed and reliability of their broadband in making these decisions. Read More>>

Don’t Let Your Region be a “No Place”

Without compelling reasons, applications, and e-solutions for your constituents to utilize your broadband network – the hopes you have for its transformational power are sure to come up short. Read More>>

SNG Announces Industry’s First and Only Hands-On, Comparative Database

Digital Economy Analytics Platform from SNG enables SNG clients to compare regions and industries to uncover actionable information and insights. With this new solution from SNG, regional leaders can leverage the best practices from each region and industry across their territory. Read More>>

By John de Ridder

The popularity of Netflix illustrates how market and technology shifts are posing headaches for carriers. Canada has recently tried to address bandwidth pricing but expect more developments.

In 2007, Netflix started streaming its movie and television catalogue to subscribers in the USA and now has over 23 million customers in place. The same unlimited movie download offering was expanded to Canada in 2010 at a cost of $7.99 a month. By August 2011, the service had signed up 10% of Canada’s broadband households; where signing up the same percentage (albeit more homes) took six years in the United States.

The success of the Netflix offerings is starting to create headaches for carriers and ISPs as they do not get revenue contribution from over-the-top applications like Netflix and yet have to invest to carry the extra traffic. The headaches remain after the Canadian Radio-television and Telecommunications Commission’s (CRTC’s) recent decisions.

Bandwidth Headaches

Digitization of broadband networks (both fixed and mobile) is causing tectonic shifts in business models. Traditionally, carriage and content went together: not any more. Entertainment was the ‘killer app’ that spurred the building of cable networks. The builders assumed they would be the providers of the content. But the impetus for delivering content over broadband is now coming from non-traditional sources that do not build the networks they rely on.

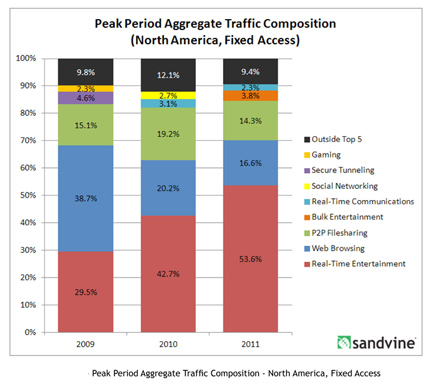

Not only have the builders of networks been deprived of the revenues that they expected out of video, but also have to augment their networks to keep-up with the growth in video traffic; for which they earn very little. Over half the current downstream traffic on fixed networks in North America is accounted for by real time entertainment.

“Intelligent broadband network solutions” provider Sandvine reports that Netflix accounted for 32.7 percent of all North American peak fixed access downstream content in the Fall of 2011. That puts Netflix way beyond the other three top Internet protocols or services by daily volume—approaching double HTTP (17.48 percent), almost three times YouTube (11.32), and nearly four times BitTorrent.

Some carriers’ knee-jerk reaction to the first manifestation of this kind of traffic was to block file-sharing networks like BitTorrent. This was discriminatory and not compatible with net neutrality.

The obvious neutral solution is to charge per GB irrespective of the content or its source. Volume based charging goes against the grain for those accustomed to unlimited downloads on broadband. And it is bad news for Netflix at about 2GB per hour (double with high definition) and average usage around 40GB per month. Twenty Organization for Economic Cooperation and Development (OECD) countries have no data caps at all among their broadband offers. But things are changing. Most Netflix customers are in the USA and in May 2011, AT&T slapped 150Gb and 250GB data caps on its DSL and U-Verse customers. This remedy has been over-turned in Canada.

Canada

In 2000 the CRTC permitted cable carriers to introduce usage caps and/or usage-based billing (UBB) charges for their wholesale services if UBB was also applied for their retail customers. Later, this option was extended to telephone companies offering broadband access.

On 25 January 2011 (Decision 2011-44), the Commission set the UBB rates at retail minus 15 percent. But the concession was not enough for many independent ISPs which together account for just 6 percent of the residential retail market. They hoped the CRTC would set a 50% discount. The January decision ignited consumer backlash and created a wave of public scorn that hit Ottawa ahead of the May federal election, quickly turning into a hot-button issue for a minority Conservative government and opposition parties alike. Also Netflix Inc. expressed serious concerns about its future in Canada – “[usage-based billing] is something we’re definitely worried about,” (Reed Hastings, chief executive of Netflix). On February 3, 2011, the federal Cabinet advised the CRTC that if it did not review the decision and come back with a new one, it would be reversed.

What does this mean going forward for bandwidth pricing?

The revised model that the CRTC finally produced on November 15, 2011 offers two options. First, for companies that proposed a usage-based model, their tariffs have to be based on the approved capacity model, effective February 1, 2012. For companies that proposed a flat rate model, their tariffs were approved effective immediately.

The capacity model requires ISPs to choose what bandwidth of pipe it wants in order to carry traffic between aggregation points (e.g. street cabinets) and the handover point. This is similar to the wholesale model proposed for the new broadband network in Australia. If ISPs do not order enough capacity, their traffic will become congested without affecting other ISPs.

This should appease Netflix and others but where is the incentive for ISPs to buy bigger pipes to accommodate traffic for which they get little or nothing? The bandwidth headache will remain until get to linear pricing on volumes. Data caps are just the first step towards that.

Sources:

CRTC Telecom Regulatory Policy CRTC 2011-703 [15 Nov 2011] http://www.crtc.gc.ca/eng/com100/2011/r111115.htm

Financial Post , 1 October 2011 http://www.nationalpost.com/news/Netflix+face+Canadian+regulations/5487301/story.html

Financial Post, 16 November 2011 http://www.financialpost.com/news/CRTC+ruling+hits+smaller+ISPs/5716827/story.html

OECD Communications Outlook, 2011

Sandvine, Global Internet Phenomena Report, Fall 2011 http://www.sandvine.com/news/global_broadband_trends.asp

Competition and Broadband in the EU

by Joanna Taylor

In Europe there is a healthy competitive market for the telecommunication services, including broadband services, to end users. What is the basis for this competition? The fundamental attributes are explored briefly below. Could they be transferred to the western side of the Atlantic? There seems to be no reason why not!

Economists and lawyers generally agree, to the extent that they agree upon anything, that healthy competition is a “good thing.” Competition drives down prices and encourages innovation while its opposite state, a monopoly creates an environment where innovation is limited and there is no market pressure driving down prices. In essence, an open, competitive market provides a higher degree of public good than a monopolistic, closed market focused on exploiting its market dominance to maintain high prices or restrict investment.

Economists and lawyers generally agree, to the extent that they agree upon anything, that healthy competition is a “good thing.” Competition drives down prices and encourages innovation while its opposite state, a monopoly creates an environment where innovation is limited and there is no market pressure driving down prices. In essence, an open, competitive market provides a higher degree of public good than a monopolistic, closed market focused on exploiting its market dominance to maintain high prices or restrict investment.

Economists and lawyers often refer to “natural monopolies,” as those that result from a set of circumstances where only one supplier is likely to enter the marketplace. It is argued that these conditions are present in the telecommunications access market. For example, when the final section of a wired (fixed line or last mile) service closest to a house or business premises is dedicated to the individual customer, and most customers only have the opportunity to purchase service from a select provider, there is very limited opportunity for a second provider to invest profitably in a duplicate access network. This is equally true in the broadband and mobile/wireless contexts and on both side of the Atlantic ocean.

Typically the incumbent, or first operator, will have created a largely universal copper network, and indeed has sometimes had an obligation to do so. In comparison, a new market entrant in its start-up phase would typically not be able to afford to re-create such a network in its entirety and will need the capability to link to the other network to provide the services they are marketing to potential customers. Typically, the service package includes the customer’s ability for their customer’s calls to connect with their competitor’s customers. However, if a new entrant’s network is unable to deliver calls made by its customers to people or organizations that procure services from another provider the new entrant will fail. In contrast, the profit maximising position for a monopoly network operator would be to refuse to deliver calls that originate from another network, or charge extortionate amounts to do so.

If market entry is to be encouraged, some form of regulation is required to force provider interconnection and control its prices.

In Europe, these twin concepts of the benefits of competition and the natural monopoly of the access market have long been recognized as appropriate solutions to sustainable competition and new market entry. Two recent public consultations on the regulatory regime have focussed on how to increase effective operation without any perceived need to discuss if the fundamentals require changing.

The European regulation that supports this service level competition is based on European competition law. The key difference is, however, that the regulation restricts behaviours in advance, ex-ante rather than ex-post, to prevent potential exploitation by operators of monopoly or quasi monopoly positions. As noted above, exploitative monopolistic behaviours may take the form of excessive pricing or market foreclosure, and the rules operate to counter both.

In brief, the system is as follows:

- The regulator has an obligation to review the telecommunication markets every few years and assess if any operator has significant market power (SMP), broadly equivalent to 40% market share, that would enable it to act anti-competitively,

- If an operator is found to have SMP, it can be required to offer wholesale services to other operators that enable them to compete on the retail market,

- These wholesale services should typically be offered on a non discriminatory basis to all other operators, and the retail arm of the operator with SMP should consume those same services when delivering services to its end customers, and

- The prices for the wholesale services should be cost orientated, and there should be sufficient margin between the wholesale and retail prices to cover the costs of retailing.

Over time the number of SMP markets has tended to fall, as competition has developed and entrants have built their own networks. A market entrant will initially invest in a core network, and as its customer base grows, it builds its network out towards the edge of the network, concentrating on the areas of highest customer density and value as this is where the opportunities are greatest . Former TV Cable operators may compete with the ex-incumbent in urban areas but SMP may remain with one, or both operators. The degree of competition in the access network remains limited outside city centres.

This European regulatory standards body is not without its critics, and its implementation, which varies somewhat country by country, could be improved but there is no doubt that the new regulatory standards have created an explosion of service level competition. Not only have consumers and businesses seen significant benefit, but also significant price reductions have been seen in the retail fixed and mobile markets.. Broadband services have got faster without price increases. In the European Union there are over 250 million internet users, with 95% of the population having fixed broadband access available to them, and virtually every European owns a mobile phone .

The regime has not restricted investment in infrastructure, as the roll out of fibre networks into high-density areas demonstrates. A proposal from Germany to exclude fibre networks from the rules was firmly rejected by the European Court of Justice in 2009.

The target for basic broadband for the 100% of the European Community by 2013 and 30mbits by 2020 is being made within this framework, and any development that uses pubic funds for network development is captured.

What would North America look like if this model were adopted? There is interconnection and the FCC requires some services to be offered on a wholesale level, but the whole process is shrouded in complexity. A general obligation for local access providers to provide wholesale services and to consume them themselves in a transparent and non-discriminatory manner might be just the catalyst the market needs!

How easy would a move to this model be? Well, that depends on the hearts and minds of those involved. The European model does not prevent operators being successful or prevent those who are inefficient from failing. The most successful are those that understand the logic of the competitive model and embrace it, whether as incumbent or entrant. Perhaps now is the time that this approach should be considered?

Quick Bytes

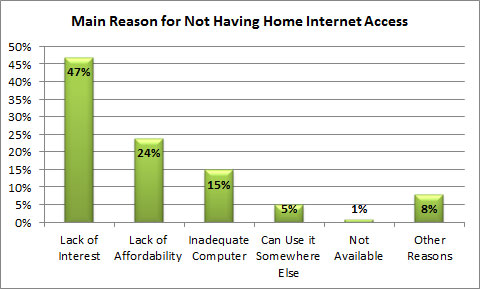

The U.S. Department of Commerce recently released a report entitled “Exploring the Digital Nation – Computer and Internet Use at Home – a long report with several important findings. But our favorite happens to be results showing why the 32% of American homes without home Internet access don’t subscribe to a service.

So there are more than 34 million households in the U.S. without Internet access… and while we’ve been quick to blame the digital divide, the price, that does not seem to be the main challenge. Even if we combine the numbers for Affordability (24%) and Inadequate Computer (15%), it still comes in below the number one reason: Lack of Interest. So while affordable, pervasive availability is critical – it is just as important (if not moreso as the study suggests) to show the “So What” of broadband… WHY should people adopt and then utilize broadband and its e-solutions?So while the digital divide is real and significant – perhaps as broadband evangelists, we should focus just as much effort on the the “understanding” divide.

So there are more than 34 million households in the U.S. without Internet access… and while we’ve been quick to blame the digital divide, the price, that does not seem to be the main challenge. Even if we combine the numbers for Affordability (24%) and Inadequate Computer (15%), it still comes in below the number one reason: Lack of Interest. So while affordable, pervasive availability is critical – it is just as important (if not moreso as the study suggests) to show the “So What” of broadband… WHY should people adopt and then utilize broadband and its e-solutions?So while the digital divide is real and significant – perhaps as broadband evangelists, we should focus just as much effort on the the “understanding” divide.

The Move to Internet Enabled Jobs

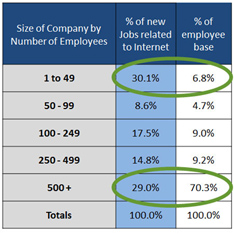

There is job creation and loss in any economy – the question is whether more jobs are being created than lost. And whether the jobs lost can be overcome with new jobs created. SNG research in two US States reveal that up to 30% of the new jobs being created for small businesses (1-49 employees) and large firms (over 500 employees) are directly related to the Internet.

Our research also shows that small businesses create ten times (10x) more jobs related to the Internet as compared to large firms based on total employment. This is significant because if you’re looking to help create jobs in your region, it’s small businesses that are your biggest lever for local economic development.

Our research also shows that small businesses create ten times (10x) more jobs related to the Internet as compared to large firms based on total employment. This is significant because if you’re looking to help create jobs in your region, it’s small businesses that are your biggest lever for local economic development.

Also, given how much of new job creation is related to the Internet – broadband is becoming increasingly important for local economic development. Which means that without high quality, reliable and affordable bandwidth, it becomes increasingly challenging for firms of any size to stay competitive in an economy where more and more business activity and collaboration is online.

Joanna Taylor

In Europe there is a healthy competitive market for the telecommunication services, including broadband services, to end users. What is the basis for this competition? The fundamental attributes are explored briefly below. Could they be transferred to the western side of the Atlantic? There seems to be no reason why not!

Economists and lawyers generally agree, to the extent that they agree upon anything, that healthy competition is a “good thing.” Competition drives down prices and encourages innovation while its opposite state, a monopoly creates an environment where innovation is limited and there is no market pressure driving down prices. In essence, an open, competitive market provides a higher degree of public good than a monopolistic, closed market focused on exploiting its market dominance to maintain high prices or restrict investment.

Economists and lawyers generally agree, to the extent that they agree upon anything, that healthy competition is a “good thing.” Competition drives down prices and encourages innovation while its opposite state, a monopoly creates an environment where innovation is limited and there is no market pressure driving down prices. In essence, an open, competitive market provides a higher degree of public good than a monopolistic, closed market focused on exploiting its market dominance to maintain high prices or restrict investment.

Economists and lawyers often refer to “natural monopolies,” as those that result from a set of circumstances where only one supplier is likely to enter the marketplace. It is argued that these conditions are present in the telecommunications access market. For example, when the final section of a wired (fixed line or last mile) service closest to a house or business premises is dedicated to the individual customer, and most customers only have the opportunity to purchase service from a select provider, there is very limited opportunity for a second provider to invest profitably in a duplicate access network. This is equally true in the broadband and mobile/wireless contexts and on both side of the Atlantic ocean.

Typically the incumbent, or first operator, will have created a largely universal copper network, and indeed has sometimes had an obligation to do so. In comparison, a new market entrant in its start-up phase would typically not be able to afford to re-create such a network in its entirety and will need the capability to link to the other network to provide the services they are marketing to potential customers. Typically, the service package includes the customer’s ability for their customer’s calls to connect with their competitor’s customers. However, if a new entrant’s network is unable to deliver calls made by its customers to people or organizations that procure services from another provider the new entrant will fail. In contrast, the profit maximising position for a monopoly network operator would be to refuse to deliver calls that originate from another network, or charge extortionate amounts to do so.

If market entry is to be encouraged, some form of regulation is required to force provider interconnection and control its prices.

In Europe, these twin concepts of the benefits of competition and the natural monopoly of the access market have long been recognized as appropriate solutions to sustainable competition and new market entry. Two recent public consultations on the regulatory regime have focussed on how to increase effective operation without any perceived need to discuss if the fundamentals require changing.

The European regulation that supports this service level competition is based on European competition law. The key difference is, however, that the regulation restricts behaviours in advance, ex-ante rather than ex-post, to prevent potential exploitation by operators of monopoly or quasi monopoly positions. As noted above, exploitative monopolistic behaviours may take the form of excessive pricing or market foreclosure, and the rules operate to counter both.

In brief, the system is as follows:

- The regulator has an obligation to review the telecommunication markets every few years and assess if any operator has significant market power (SMP), broadly equivalent to 40% market share, that would enable it to act anti-competitively,

- If an operator is found to have SMP, it can be required to offer wholesale services to other operators that enable them to compete on the retail market,

- These wholesale services should typically be offered on a non discriminatory basis to all other operators, and the retail arm of the operator with SMP should consume those same services when delivering services to its end customers, and

- The prices for the wholesale services should be cost orientated, and there should be sufficient margin between the wholesale and retail prices to cover the costs of retailing.

Over time the number of SMP markets has tended to fall, as competition has developed and entrants have built their own networks. A market entrant will initially invest in a core network, and as its customer base grows, it builds its network out towards the edge of the network, concentrating on the areas of highest customer density and value as this is where the opportunities are greatest . Former TV Cable operators may compete with the ex-incumbent in urban areas but SMP may remain with one, or both operators. The degree of competition in the access network remains limited outside city centres.

This European regulatory standards body is not without its critics, and its implementation, which varies somewhat country by country, could be improved but there is no doubt that the new regulatory standards have created an explosion of service level competition. Not only have consumers and businesses seen significant benefit, but also significant price reductions have been seen in the retail fixed and mobile markets.. Broadband services have got faster without price increases. In the European Union there are over 250 million internet users, with 95% of the population having fixed broadband access available to them, and virtually every European owns a mobile phone .

The regime has not restricted investment in infrastructure, as the roll out of fibre networks into high-density areas demonstrates. A proposal from Germany to exclude fibre networks from the rules was firmly rejected by the European Court of Justice in 2009.

The target for basic broadband for the 100% of the European Community by 2013 and 30mbits by 2020 is being made within this framework, and any development that uses pubic funds for network development is captured.

What would North America look like if this model were adopted? There is interconnection and the FCC requires some services to be offered on a wholesale level, but the whole process is shrouded in complexity. A general obligation for local access providers to provide wholesale services and to consume them themselves in a transparent and non-discriminatory manner might be just the catalyst the market needs!

How easy would a move to this model be? Well, that depends on the hearts and minds of those involved. The European model does not prevent operators being successful or prevent those who are inefficient from failing. The most successful are those that understand the logic of the competitive model and embrace it, whether as incumbent or entrant. Perhaps now is the time that this approach should be considered?

by John de Ridder

The popularity of Netflix illustrates how market and technology shifts are posing headaches for carriers. Canada has recently tried to address bandwidth pricing but expect more developments.

In 2007, Netflix started streaming its movie and television catalogue to subscribers in the USA and now has over 23 million customers in place. The same unlimited movie download offering was expanded to Canada in 2010 at a cost of $7.99 a month. By August 2011, the service had signed up 10% of Canada’s broadband households; where signing up the same percentage (albeit more homes) took six years in the United States.

The success of the Netflix offerings is starting to create headaches for carriers and ISPs as they do not get revenue contribution from over-the-top applications like Netflix and yet have to invest to carry the extra traffic. The headaches remain after the Canadian Radio-television and Telecommunications Commission’s (CRTC’s) recent decisions.

Bandwidth Headaches

Digitisation of broadband networks (both fixed and mobile) is causing tectonic shifts in business models. Traditionally, carriage and content went together: not any more. Entertainment was the ‘killer app’ that spurred the building of cable networks. The builders assumed they would be the providers of the content. But the impetus for delivering content over broadband is now coming from non-traditional sources that do not build the networks they rely on.

Not only have the builders of networks been deprived of the revenues that they expected out of video, but also have to augment their networks to keep-up with the growth in video traffic; for which they earn very little. Over half the current downstream traffic on fixed networks in North America is accounted for by real time entertainment.

“Intelligent broadband network solutions” provider Sandvine reports that Netflix accounted for 32.7 percent of all North American peak fixed access downstream content in the Fall of 2011. That puts Netflix way beyond the other three top Internet protocols or services by daily volume—approaching double HTTP (17.48 percent), almost three times YouTube (11.32), and nearly four times BitTorrent.

Some carriers’ knee-jerk reaction to the first manifestation of this kind of traffic was to block file-sharing networks like BitTorrent. This was discriminatory and not compatible with net neutrality.

The obvious neutral solution is to charge per GB irrespective of the content or its source. Volume based charging goes against the grain for those accustomed to unlimited downloads on broadband. And it is bad news for Netflix at about 2GB per hour (double with high definition) and average usage around 40GB per month. Twenty Organization for Economic Cooperation and Development (OECD) countries have no data caps at all among their broadband offers. But things are changing. Most Netflix customers are in the USA and in May 2011, AT&T slapped 150Gb and 250GB data caps on its DSL and U-Verse customers. This remedy has been over-turned in Canada.

Canada

In 2000 the CRTC permitted cable carriers to introduce usage caps and/or usage-based billing (UBB) charges for their wholesale services if UBB was also applied for their retail customers. Later, this option was extended to telephone companies offering broadband access.

On 25 January 2011 (Decision 2011-44), the Commission set the UBB rates at retail minus 15 percent. But the concession was not enough for many independent ISPs which together account for just 6 percent of the residential retail market. They hoped the CRTC would set a 50% discount. The January decision ignited consumer backlash and created a wave of public scorn that hit Ottawa ahead of the May federal election, quickly turning into a hot-button issue for a minority Conservative government and opposition parties alike. Also Netflix Inc. expressed serious concerns about its future in Canada – “[usage-based billing] is something we’re definitely worried about,” (Reed Hastings, chief executive of Netflix). On February 3, 2011, the federal Cabinet advised the CRTC that if it did not review the decision and come back with a new one, it would be reversed.

What does this mean going forward for bandwidth pricing?

The revised model that the CRTC finally produced on November 15, 2011 offers two options. First, for companies that proposed a usage-based model, their tariffs have to be based on the approved capacity model, effective February 1, 2012. For companies that proposed a flat rate model, their tariffs were approved effective immediately.

The capacity model requires ISPs to choose what bandwidth of pipe it wants in order to carry traffic between aggregation points (e.g. street cabinets) and the handover point. This is similar to the wholesale model proposed for the new broadband network in Australia. If ISPs do not order enough capacity, their traffic will become congested without affecting other ISPs.

This should appease Netflix and others but where is the incentive for ISPs to buy bigger pipes to accommodate traffic for which they get little or nothing? The bandwidth headache will remain until get to linear pricing on volumes. Data caps are just the first step towards that.

Sources:

CRTC Telecom Regulatory Policy CRTC 2011-703 [15 Nov 2011] http://www.crtc.gc.ca/eng/com100/2011/r111115.htm

Financial Post , 1 October 2011 http://www.nationalpost.com/news/Netflix+face+Canadian+regulations/5487301/story.html

Financial Post, 16 November 2011 http://www.financialpost.com/news/CRTC+ruling+hits+smaller+ISPs/5716827/story.html

OECD Communications Outlook, 2011

Sandvine, Global Internet Phenomena Report, Fall 2011 http://www.sandvine.com/news/global_broadband_trends.asp