Everyone thinks they have data… but what is it that makes a difference?

by Michael Curri

Every ten years, the US Government conducts a census to provide general demographics of regions and population overviews. But this is aggregated and basic information that is challenging to use as a sole source for decisions. And so additional research and data is required as strategies and policies are developed.

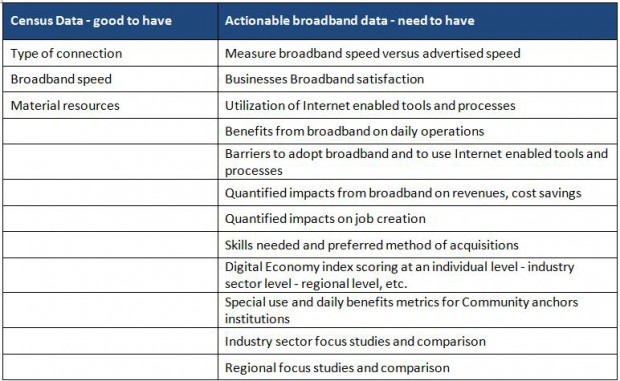

Unfortunately, in today’s broadband research world – most ‘data providers’ are simply giving you census data – basic information that is insufficient when trying to make broadband strategy decisions. Census data is only an inventory of the current situation and disregards demand.

Unfortunately, in today’s broadband research world – most ‘data providers’ are simply giving you census data – basic information that is insufficient when trying to make broadband strategy decisions. Census data is only an inventory of the current situation and disregards demand.

Demand versus Supply

Taking a step back and examining broadband data versus information needs through the lens of basic micro economic principles shows how ineffective, how blunt an instrument ‘macro/census’ data is. Whether a business has broadband, or how many computers (or smartphones) that business has does not explain how the business is using and benefiting from this technology. Furthermore, the data do not identify how to overcome barriers or drivers to increase productivity for an individual business or organization.

Measuring demand identifies market needs, reveals who cannot get enough, and can forecast where the benefits are. Broadband investors need this type of information to address market failures, such as bridging gaps in broadband availability, raising awareness and demonstrating value with groups that are under-utilizing Internet-enabled applications.

Supply versus demand is the difference between taking inventory and conducting strategic market research: the difference between passive and active data; the difference between standard broadband census data and the research insights: what SNG calls Digital Economy Metrics.

Actionable Data

More than a map, beyond speed or availability, actionable broadband research delves into the Internet-enabled applications (e-Solutions) that individuals and businesses are utilizing, the ones they are ignoring, and why. Actionable data shows efficiencies gained by some, economic benefits of others, and external factors that enable each. Utilization for economic and social advancement without overcoming adoption barriers is not achievable. SNG’s active data identifies these barriers which have a negative effect on improving utilization. SNG personalizes its findings, shows individuals and organizations where they are, where they could be, and the benefits associated with greater broadband utilization.

It is an active and transformative approach to data collection and analysis, using information to achieve meaningful economic benefits. It means being able to analyze broadband impacts at a micro-economic level, at an individual business level; to make better broadband investments using comprehensible and efficient tools, not just the fifty-thousand foot view of the situation.

While everyone claims they have broadband data – there is a big difference between passive data that is not actionable and the active, actionable data that only SNG provides that includes:

SNG actionable broadband data are the most reliable tool to develop local development initiatives as they enable policy makers to understand what the benefits of broadband are and how to get them. And also remember that data are just the start, it is the strategies built from information that will transform your community by fulfilling the promise of broadband’s applications.