Current Economic Impact of Broadband and Opportunities Revealed in e-Solutions Benchmarking and e-Strategy Reports from SNG

(October 28, 2010) e-NC and SNG announced today the findings of a comprehensive study of residents and businesses in the state of North Carolina. In all, 30,000 households and 70,000 businesses and organizations were surveyed to uncover utilization of broadband and e-solutions statewide, with 1,492 households and 6,266 businesses and organizations responding. The e-Solutions Benchmarking and accompanying e-Strategy report from SNG was funded by a grant to the e-North Carolina Authority by the National Telecommunications and Information Administration (NTIA) of the U.S. Department of Commerce.

(October 28, 2010) e-NC and SNG announced today the findings of a comprehensive study of residents and businesses in the state of North Carolina. In all, 30,000 households and 70,000 businesses and organizations were surveyed to uncover utilization of broadband and e-solutions statewide, with 1,492 households and 6,266 businesses and organizations responding. The e-Solutions Benchmarking and accompanying e-Strategy report from SNG was funded by a grant to the e-North Carolina Authority by the National Telecommunications and Information Administration (NTIA) of the U.S. Department of Commerce.

The e-North Carolina Authority (e-NC), and its predecessor the Rural Internet Access Authority, have worked to improve both the supply and demand side of the broadband issue since 2001. The SNG study, conducted between February and October 2010, revealed the potential of broadband for competitiveness and economic opportunity:

- Nearly one in five (18%) of new jobs were created as a direct result of Broadband Internet. Small businesses (less than 20 employees) are especially dependent on Broadband Internet as 28 percent of new jobs in that sector are attributed to using the Internet.

- More than half of all businesses (54%) said that they would not be in business if they did not have broadband while two in five (41%) would have to relocate if broadband was not available in their community;

- The number of households either currently running (31%) or planning to run a business from their home in the next twelve months (14%) is nearly half (45%) of North Carolina’s broadband

households;

- Even more broadband households are either now using (41%) or planning to use (24%) broadband to sell items online. That’s nearly two-thirds (65%) of broadband households using it to at least supplement their income;

- Most (85%) of home-based businesses said that broadband was essential to their business.

“We see in these findings how important broadband is to creating new jobs and improving quality of life in North Carolina,” said Michael Curri, president of SNG. “We now have the data that shows why it is so critical to promote broadband infrastructure along with adoption in North Carolina. e-NC has been and continues to be a leader in this field in making sure that North Carolina captures the benefits of broadband in the years ahead.”

The e-Strategy report revealed clear and direct paths to further leverage broadband and available resources to expand broadband’s reach. E-NC will be tackling the state’s challenges with strategies for:

- Better connectivity in un-served and under-served communities

- Mobile broadband to extend flexibility and reach

- Driving broadband adoption

- Supporting adoption of new and ground-breaking e-solutions

- Collaboration, utilizing stakeholders, community networks and anchor institutions

By employing e-strategies on multiple fronts, North Carolina will be poised to further leverage broadband for job development and economic growth.

“Findings show thirty-nine percent of households say they would likely relocate if broadband was not available, while 55 percent of organizations say broadband is essential for staying where they are,” says Jane Patterson, Executive Director of e-NC. “These numbers illustrate why it is important for all of us to continue to address the issue of broadband expansion in North Carolina. The e-NC Authority will continue to work with all providers to encourage greater broadband coverage across the state. We will also place a special focus on working with small businesses to show how they can increase their revenue potential through use of the Internet.”

About e-NC Authority

The e-NC Authority is the state initiative to link all North Carolinians – especially those in rural areas – to the Internet. The purpose of this organization is to use the Internet as a tool for helping people to improve their quality of life. Affordable Internet service will provide North Carolinians with increased access to commerce, health care, education and government services. Through the Internet, rural North Carolinians can utilize resources not located in their areas, contact friends and experts, grow their businesses and increase their personal knowledge – all while preserving the lifestyle that is an integral part of who they are. The e-NC Authority was preceded by the Rural Internet Access Authority, and was created on Aug. 2, 2000 by the N.C. General Assembly. The organization became fully functional in January 2001 and is governed by a commission appointed by the governor and the N.C. General Assembly. By legislative mandate, the e-NC Authority is housed and staffed by the N.C. Rural Economic Development Center. Visit www.e-nc.org.

DEi Expands to Score Industry Sectors

In June, we announced SNG’s popular new offering: the Digital Economy index (DEi). A composite score of how organizations use seventeen (17) Internet-enabled applications, or “e-solutions,” DEi is a unique assessment tool that can be used at any industry, sectoral, or geographic analysis of businesses and organizations to drive productivity and competitiveness.

DEI enables businesses and organizations to see where they stand relative to their peers. It can also produce customized scorecards at an individual organizational level showing where improvements can be made to be more productive and competitive in the 21st century knowledge economy.

DEI enables businesses and organizations to see where they stand relative to their peers. It can also produce customized scorecards at an individual organizational level showing where improvements can be made to be more productive and competitive in the 21st century knowledge economy.

As SNG’s DEi is a composite score of how organizations use Internet-enabled applications, or “e-solutions,” to drive productivity and competitiveness, DEi can also be shown strengths and weaknesses within industry sectors.

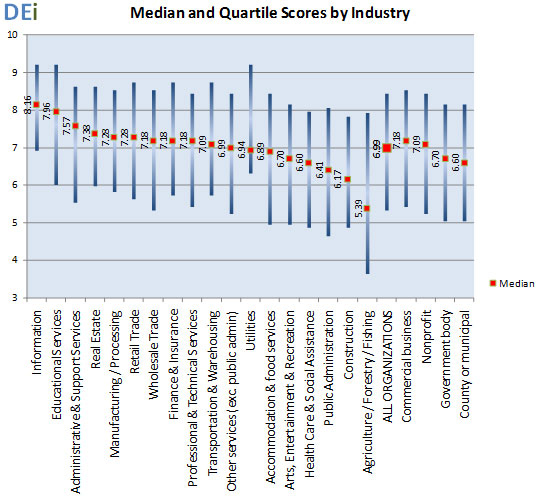

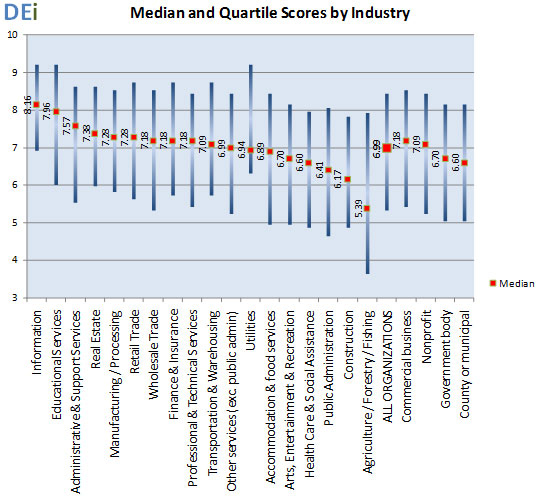

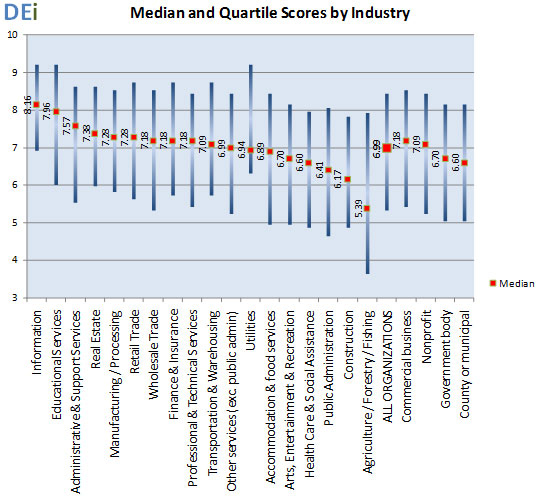

As we’ve just completed our latest work in North Carolina, let’s take a look at the DEi results by industry and sectors for North Carolina. The overall median DEi for all organizations surveyed in North Carolina is 6.99, with 50 percent of organizations falling between a DEi of 5.34 and 8.45. These scores compare utilization of e-solutions between industry sectors and we’ll explore what that means below.

Opportunities for increasing DEi, with resulting economic benefits, can be identified for potential action to increase the utilization of e-solutions by businesses and organizations.

For example, in North Carolina, the Construction industry (DEi = 6.17) and Information Services industry (DEi = 8.16) have among the lowest and highest median use of 17 types of Internet applications or processes. The average DEi for North Carolina was 6.99 (high is better).

Some of the differences in the DEi score reflect unique characteristics of the structure of that industry. For example, the Construction industry has very high use of certain applications, such as supply chain management and document transfer, while having low use of tele-working.

One interesting example of using the DEi is a comparison of the Education industry (high DEi of 7.96) and Health and Human Services industry (low DEi of 6.60). Comparing these two industries highlights the extent to which the Education industry has pioneered such Internet uses as direct service delivery and remote counselling, while Health and Human Services lag significantly in these areas.

SNG’s proprietary DEi analysis is very useful in designing initiatives aimed at increasing the level and productivity of broadband adoption. For proponents of broadband as a critical tool for economic development, DEi shows where organizations and industries are leveraging broadband – and where they should be employing more e-solutions.

Back to Down Under

It took several weeks to sort out, but Australia’s hung parliament emerged with the Labor party still in power – and the National Broadband Network (NBN) very much alive and well. As a refresher, the proposed plan by the Labor party for a $43 billion National Broadband Network (NBN) will provide 100 megabits per second broadband access to approximately 93 percent of the Australian premises. Currently around 62 percent of households have broadband now but – for the most part – it is slow and expensive. In conjunction, the plan calls for a boost in broadband investment for businesses with hopes that it will directly support economic growth during the rollout.

It took several weeks to sort out, but Australia’s hung parliament emerged with the Labor party still in power – and the National Broadband Network (NBN) very much alive and well. As a refresher, the proposed plan by the Labor party for a $43 billion National Broadband Network (NBN) will provide 100 megabits per second broadband access to approximately 93 percent of the Australian premises. Currently around 62 percent of households have broadband now but – for the most part – it is slow and expensive. In conjunction, the plan calls for a boost in broadband investment for businesses with hopes that it will directly support economic growth during the rollout.

The influential Australian Industry Group lobby calls the NBN an “unprecedented opportunity” for business innovation and with the ubiquitous nature of the fibre roll-out – bringing with it unparalleled speed and reliability. The group cites the long term opportunities that broadband “everywhere” brings, creating an environment where Australian businesses are able to create services and business models that do not yet exist on a network which will give Australia the fastest internet access in the world.

Some of the NBN’s first cables are being laid in Willunga. This is trial site in Southern Australia; one of five across mainland Australia. The state of Tasmania is already offering fibre-based services as part of the NBN roll-out and hopes to complete its roll-out by 2015; at least 3 years ahead of the mainland.

The Australian roll-out target is expressed in terms of coverage: any premise in a street with fibre rolled down it must be connected within a few days of demand. Naturally, free connections are being offered as the roll-out takes place. Activation only occurs where a customer asks a retail service provider to provide service over the fibre.

Surprisingly, only 50 percent of households in Tasmania have taken the free connection compared with over 80 percent in the mainland trial sites. It is not clear what explains Tasmania’s experience. Perhaps communication is poor (i.e. low or no awareness campaign activity) and customers expect Telstra’s copper network to remain; Telstra is planning to migrate all its customers to the new network. Tasmania is passing legislation requiring customers to provide written notice if they wish to opt-out of a free connection (versus opt-in as now).

Worse, less than 1 in 10 customers connected in Tasmania have chosen to activate a broadband service over fiber. Perhaps, the offers made by several internet service providers are not attractive. A leading provider, iiNet, is providing exactly the same plans on fiber in terms of price and down load caps as it offers for ADSL2+ except that until June 2011 the down/up stream speeds will be increased from 25/2 (same as ADSL2+) to 100/8 Mb/s. Customers may prefer to stay with their current connection on ADSL2+ than become “guinea pigs” on the NBN network. That coupled with the “hassle” of changing providers, the question becomes whether the broadband status quo is unacceptable enough for people to spend the time and money to switch to the NBN? And do citizens understand the value of the opportunities afforded by the new fibre network?

The uptake challenges illustrate what we always say – Field of Dreams is a nice movie, but “build it and they will come” does not work in the real world. To ensure that individual businesses, organizations and households connect to the NBN, Australia’s leaders need to promote adoption of those e-solutions that are customized to their needs. To maximize the return on investment requires addressing local / regional drivers and barriers and with it appropriate awareness and adoption programs at a regional level. By following the Broadband Lifecycle, Australia will see major payoffs for their broadband investment in terms of productivity, competitiveness, and quality of life.

As always, thank you for your continued support. If you have any questions or feedback, please don’t hesitate to get in touch!

In June, we announced SNG’s popular new offering: the Digital Economy index scorecards. A composite score of how businesses and organizations use seventeen (17) online practices, or “e-solutions,” the Digital Economy index (DEi) is a unique assessment tool that can be used at any industry, sectoral, or geographic analysis of businesses and organizations to drive productivity and competitiveness.

DEI enables businesses and organizations to see where they stand relative to their peers. SNG personalizes the value of online practices to individual businesses and organizations by producing customized scorecards that show where improvements can be made to be more productive and competitive an increasingly online economy.

DEI enables businesses and organizations to see where they stand relative to their peers. SNG personalizes the value of online practices to individual businesses and organizations by producing customized scorecards that show where improvements can be made to be more productive and competitive an increasingly online economy.

As SNG’s DEi is a composite score of how organizations use online practices to drive productivity and competitiveness, DEi can also be shown strengths and weaknesses within industry sectors.

As we’ve just completed our latest work in North Carolina, let’s take a look at the DEi results by industry and sectors for North Carolina. The overall median DEi for all organizations surveyed in North Carolina is 6.99, with 50 percent of organizations falling between a DEi of 5.34 and 8.45. These scores compare utilization of e-solutions between industry sectors and we’ll explore what that means below.

Opportunities for increasing DEi scores, with the accompanying economic benefits, can be identified and prioritized for action by businesses and organizations.

For example, in North Carolina, the Construction industry (DEi = 6.17) and Information Services industry (DEi = 8.16) have among the lowest and highest median use of 17 types of Internet applications or processes. The average DEi for North Carolina was 6.99 (high is better).

Some of the differences in the DEi score reflect unique characteristics of the structure of that industry. For example, the Construction industry has very high use of certain applications, such as supply chain management and document transfer, while having low use of tele-working.

One interesting example of using the DEi is a comparison of the Education industry (high DEi of 7.96) and Health and Human Services industry (low DEi of 6.60). Comparing these two industries highlights the extent to which the Education industry has pioneered such Internet uses as direct service delivery and remote counselling, while Health and Human Services lag significantly in these areas.

SNG’s proprietary DEi benchmarking capability is a critical tool for proponents of broadband and economic development because DEi shows where organizations and industries are leveraging broadband – and where they should be adopting online practices that will keep them competitive and relevant in a digital economy.

“The broadband lifecycle: e-strategy, pre-planning, and building capacity”

This month we continue our three-part series covering the steps of the broadband lifecycle as we focus on the strategy and the decision to invest, as well as the network build, or expansion.

By Michael Curri – Broadband networks can create a “platform for productivity, competitiveness and innovation” in your community – delivering the infrastructure to capture economic and social opportunities, some known, some yet to be invented. Many communities fail during the broadband strategy, build-out and adoption phases as they lack focus and/or sufficient investment of time, energy, and resources.

Too often communities develop strategies based on following recipes from other regions. Instead of uncovering what the needed resources are, or how to leverage current efforts to best serve the specific and unique needs of the community, civic leaders race to “do what they did.”

There is no ‘one size fits all’ solution for successful broadband strategies that bring economic and civic benefits to a region and its citizens. Each community not only has different needs, but different strengths to best leverage the broadband platform. Strategic Networks Group (SNG) has for years been helping governments, at municipal, regional and national levels, to best understand where investment will make the biggest impact – and each and every time the best approach involves following the broadband lifecycle.

Before your community can thrive with its own “platform,” you need to get over the common pitfalls along the broadband lifecycle. In case you missed it, last month we reviewed how initiatives can fall flat because of a lack of focus and/or sufficient investment of time, energy, and resources (demand analysis and pre-planning). SNG encourages all broadband project managers to design and run their broadband initiative with one eye on the Broadband Lifecycle. Click here to review steps one and two.

Step 3: e-Strategy & decision to invest

Often the toughest stage – this is where you and your partners in this journey need to ask yourself some tough questions, including – should we proceed? Obviously, you’ve started the journey, so you believe in the value and benefits that broadband can provide your community. But while you (and your colleagues) may be ready to proceed with building your region’s very own “platform for innovation” – will it be used, will it be sustainable? In short, have you addressed the key factors in the pathway to sustainable success?

Obviously, you’re not asking the “are we ready” question in a vacuum. A critical component of being “ready” is understanding the investment required – where the it will come from – and what the measurable benefits will be… will they outweigh the costs?

One way to do this is through SNG’s Community Broadband Readiness Self-Assessment, a process that SNG is taking communities through across the United States – most recently in Miami. The assessment tool provides a comprehensive understanding of the relative value of key factors that should be addressed as a pathway to sustainable success.

The Community Broadband Readiness Self-Assessment Tool is structured around six readiness categories:

The Community Broadband Readiness Self-Assessment Tool is structured around six readiness categories:

- Leadership

- Vision and Plan

- Organizational Stability

- Community Awareness

- Implementation Ability

- Market Profile

For example, the readiness assessment showed that Miami-Dade had a relatively high level of readiness to undertake a broadband initiative.

SNG can help guide you in this phase applying market analytics and our proprietary Community Broadband Readiness Self-Assessment Tool. By shaping your strategy to address not only broadband for un/under-served areas, but to include applications to drive innovation and efficiencies, we’re able to help establish a strategy to maximize broadband’s benefits. Recently SNG conducted readiness assessments for Miami Dade (FL), Lexington (KY), Akron (OH), Aberdeen (SD), providing an objective view of the current state of readiness for undertaking a broadband initiative

Step 4 – Build or expand network capacity

This step seems like the most straightforward – but don’t be fooled. While we know that building the network is can be the most difficult step, we all have or are a part of a technical team that specializes in building networks. But there are many implications – that without the right guidance and discipline – could be neglected.

Are your technical and business plans in place to ensure a smooth implementation? Do you have the right provider – and are your requirements well defined? SNG has helped regions in Ontario and partnered with organizations like IBM to ensure the build process runs smoothly, building to the current and future needs of businesses, organizations and households.

Next Month: Steps 5 (Awareness & adoption support) and 6 (Monitor impacts and outcomes).

While we’re on the topic of steps 3 and 4 and developing e-strategies for successful broadband initiatives and network builds, have you ever been asked by your constituents – how do I compare to my competition? What are other communities doing to better leverage broadband? What are the benefits of broadband should I be leveraging? In general, how am I doing?

While we’re on the topic of steps 3 and 4 and developing e-strategies for successful broadband initiatives and network builds, have you ever been asked by your constituents – how do I compare to my competition? What are other communities doing to better leverage broadband? What are the benefits of broadband should I be leveraging? In general, how am I doing?

SNG has recently announced our Digital Economy Index (DEi) – an assessment tool, an organization-specific “scorecard” that draws on information from eSolutions Benchmarking to assist small businesses and other organizations see where they stand. SNG’s DEi is a composite score of how organizations use Internet-enabled applications, or “e-solutions,” to drive productivity and competitiveness. By providing organizations’ with their DEi score, you are providing them insights into their utilization of e-solutions, how they compare to their peers, and where they can adjust to increase efficiencies, innovation, and profitability.

The Digital Economy Index helps organizations develop their own broadband adoption plan (and economic growth path). Which leads into the next step, awareness & adoption support (Step 5 of the Broadband Lifecycle, which we will discuss next month).

Broadband in a Down Economy

Across the globe the global downturn has had deep impacts. Many households are stretched thin, looking for ways to supplement lost income or to supplement declining or stagnant salaries. Recently SNG worked with the e-North Carolina Authority to conduct “eSolutions Benchmarking” across the state to understand how households are using broadband to tackle some of their challenges.

The study revealed the potential of broadband for competitiveness and economic opportunity:

- Nearly a third (31%) of the State’s broadband households operate a business from their home;

- The number of households either currently running (31%) or planning to run a business from their home in the next twelve months (14%) is nearly half (45%) of the State’s broadband households;

- Even more broadband households are either now using (41%) or planning to use (24%) broadband to sell items online. That’s nearly two-thirds (65%) of broadband households using it to at least supplement their income;

- Most (85%) of home-based businesses said that broadband was essential to their business. More than half (54%) said that they would not be in business if they did not have broadband while two in five (41%) would have to relocate if broadband was not available in their community.

For more information about these findings, please contact the e-North Carolina Authority who commissioned this work – see www.e-nc.org, or phone 1-866-627-8725.

In good times and in bad, broadband is critical for community members to earn income (and extra income). But in bad times, research shows us that home-based businesses and sole proprietorships are more likely to sprout up. More than ever, it is critical for states and communities that want to remain competitive – and even thrive – to have broadband’s platform for innovation and competitiveness in place.

Want to know how your state is doing to facilitate competitiveness trhough broadband? Contact SNG today.

As we focus on how we can make our broadband initiatives successful and network builds sustainable, have you ever been asked by your constituents – how do we compare? What are other communities doing to fully leverage broadband? What are the benefits of broadband that my business should be leveraging? How can my household better access health, educational, and civic services? In general, how am I doing?

SNG has developed a Digital Economy Index (DEi) – which scores how businesses, organizations, and households use key online practices. The DEi enables benchmarking of seventeen (17) key online practices for businesses and organizations and thirty (30) key online practices for households.

To personalize the value of broadband and online practices to individual businesses (especially small businesses that often do not have information technology directors), SNG has developed a DEi Scorecard that draws on industry leading metrics from our Digital Economy Database to assist small businesses and other organizations see where they stand. SNG’s DEi is a composite score of how organizations use online practices, or “e-solutions,” to drive productivity and competitiveness. By providing organizations’ with their DEi score, you are providing them insights into their competitiveness and relevance in an online economy by showing them how they compare to their peers and where they can adjust to increase efficiencies, innovation, and profitability.

The Digital Economy Index helps organizations develop their own broadband adoption plan (and economic growth path). Which leads into the next step, awareness & adoption support (Step 5 of the Broadband Lifecycle, or path to owning your digital future).

While we’re on the topic of steps 3 and 4 and developing e-strategies for successful broadband initiatives and network builds, have you ever been asked by your constituents – how do I compare to my competition? What are other communities doing to better leverage broadband? What are the benefits of broadband should I be leveraging? In general, how am I doing?

(October 28, 2010) e-NC and SNG announced today the findings of a comprehensive study of residents and businesses in the state of North Carolina. In all, 30,000 households and 70,000 businesses and organizations were surveyed to uncover utilization of broadband and e-solutions statewide, with 1,492 households and 6,266 businesses and organizations responding. The e-Solutions Benchmarking and accompanying e-Strategy report from SNG was funded by a grant to the e-North Carolina Authority by the National Telecommunications and Information Administration (NTIA) of the U.S. Department of Commerce.

(October 28, 2010) e-NC and SNG announced today the findings of a comprehensive study of residents and businesses in the state of North Carolina. In all, 30,000 households and 70,000 businesses and organizations were surveyed to uncover utilization of broadband and e-solutions statewide, with 1,492 households and 6,266 businesses and organizations responding. The e-Solutions Benchmarking and accompanying e-Strategy report from SNG was funded by a grant to the e-North Carolina Authority by the National Telecommunications and Information Administration (NTIA) of the U.S. Department of Commerce. DEI enables businesses and organizations to see where they stand relative to their peers. It can also produce customized scorecards at an individual organizational level showing where improvements can be made to be more productive and competitive in the 21st century knowledge economy.

DEI enables businesses and organizations to see where they stand relative to their peers. It can also produce customized scorecards at an individual organizational level showing where improvements can be made to be more productive and competitive in the 21st century knowledge economy.

It took several weeks to sort out, but Australia’s hung parliament emerged with the Labor party still in power – and the National Broadband Network (NBN) very much alive and well. As a refresher, the proposed plan by the Labor party for a $43 billion National Broadband Network (NBN) will provide 100 megabits per second broadband access to approximately 93 percent of the Australian premises. Currently around 62 percent of households have broadband now but – for the most part – it is slow and expensive. In conjunction, the plan calls for a boost in broadband investment for businesses with hopes that it will directly support economic growth during the rollout.

It took several weeks to sort out, but Australia’s hung parliament emerged with the Labor party still in power – and the National Broadband Network (NBN) very much alive and well. As a refresher, the proposed plan by the Labor party for a $43 billion National Broadband Network (NBN) will provide 100 megabits per second broadband access to approximately 93 percent of the Australian premises. Currently around 62 percent of households have broadband now but – for the most part – it is slow and expensive. In conjunction, the plan calls for a boost in broadband investment for businesses with hopes that it will directly support economic growth during the rollout.