Data and Insights for Broadband Strategy and Investments

Broadband investment decisions need data and insights on potential returns

We invest in broadband for the impacts and new opportunities it enables. Broadband is more than just internet access because its value comes from how broadband is used.

Question: What data and insights can be obtained to incentivize private investments in broadband and to make the case for public investments to bridge gaps in digital infrastructure?

Answer: We need data and insights on broadband market potential and the returns from investing in broadband. At SNG we call this the economic case for broadband – that broadband investment solutions need to be self-sustaining and not subsidized to be effective long term. Both private and public investors need data and insights to assess a broadband market and its potential to net a positive return on investment. For this, the right information is needed and SNG has developed a holistic approach to gathering the data and developing the intelligence needed to make sustainable broadband investment decisions.

Solely relying on broadband infrastructure maps, or data from service providers (e.g. Form 477 data) to identify which areas are unserved or underserved with broadband is not enough for those investing in broadband and digital infrastructure. To have granular, highly accurate data, SNG recommends also collecting broadband availability and service data directly from end-users because it matters whether individual businesses and households are actually getting the broadband they want and need.

SNG’s eSolutions Benchmarking (eSB) collects data directly from individual businesses, organizations, and households of how they are connected, using, and benefiting from their internet connection. This enables SNG to assess broadband market potential and develop a granular picture of gaps, barriers, and opportunities in broadband supply and demand for any market or geographic area.

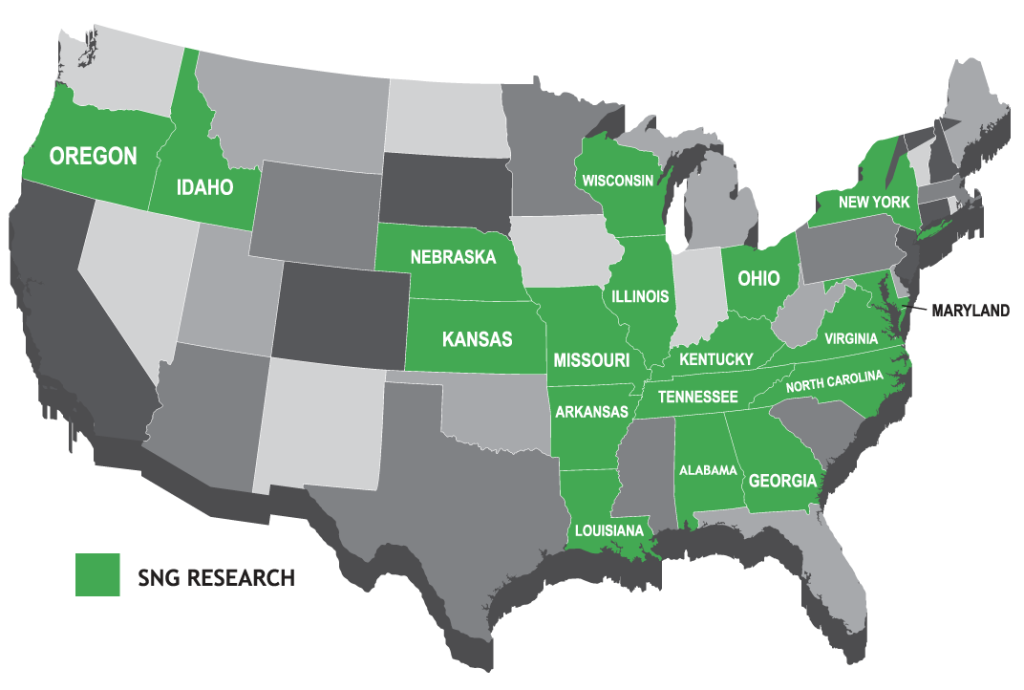

SNG has conducted eSB’s for communities and regions across North America and in Europe, as well as state-wide eSBs for ten(10) American States. To date SNG has amassed an industry-unique Digital Economy Database (DED) of more than 85,000 households, businesses, and organizations across North America. In addition to collecting data for your region, the DED provides the ability to benchmark your data against data collected from other regions for comparative analysis.

Conducting an eSolutions Benchmarking provides the data points and insights clients need to:

- Optimize investments in broadband and digital infrastructure based on user-driven demand research (instead of assumed pro-forma subscription rates)

- Identify broadband needs, gaps, barriers, and opportunities – for targeting user groups, funding, and necessary technical support

- Quantify potential economic and community returns on investment based on cost-benefit analysis of demand drivers

- Provide communities, counties, regions, port authorities, tribes, etc. data for local planning and evidence-based decision-making

- Provide a baseline of data for measuring progress and evaluating economic and community returns from investments in digital infrastructure and transformation

With eSolutions Benchmarking, we help our clients make evidence-based decisions, build buy-in, and build an action plan focused on outcomes that engages the community and providers to:

- Address gaps in the meaningful use of the internet (i.e. utilization) and uncover community benefits that can self-finance digital infrastructure without raising taxes, nor taking on unsustainable debt

- Grow demand for broadband and drive network sustainability by driving demand for smart community services and online business applications

- Identify opportunities to implement smart community services that pay for themselves and enhance local quality of life

“Michael Curri and SNG give quantifiable reasons to deploy broadband. Their research provides hard data that is specific to a community, region, or state, not opinions, feelings, assumptions, or conjecture. Finally, we have access to facts that enable informed decisions so we can confidently define a path forward and acquire favorable financing.”

Joseph Franell

CEO – Eastern Oregon Telecom

Chair – Oregon Broadband

Advisory Council

SNG takes a holistic approach to assess both current and future demand at a granular level, coupled with examination of current and potential supply-side solutions. We believe this is the basis for communities and regions to address the economic and social challenges from investing in broadband, smart community technologies, and necessary digital infrastructure for their future.

Digital infrastructure is much more than connecting to the internet, it is about digital transformation of how people live, how we do business, and how communities thrive.

Does your community need better broadband? Is your region’s infrastructure meeting the needs of local institutions, businesses, and households? How can you maximize the community benefits and economic impacts from your broadband investments? SNG helps you uncover all of this.

More than a dozen states have used eSolutions Benchmarking and SNG’s accompanying recommendations to formulate statewide broadband plans.

SNG’s eSolutions Benchmarking (eSB) Reveals:

- Current state of broadband market segments (market analytics and market potential)

- Economic impacts already achieved from investing in broadband

- Potential economic benefits to be realized from increasing adoption and utilization

- Gaps and opportunities by sectors and locations

- Future broadband needs

- Need for awareness and adoption programs

eSolutions Benchmarking – data collection and analysis

Using world-leading, one-of-a-kind online tools that collect over 120 indicators on broadband utilization, impacts, needs, barriers, equipment, readiness, skills, and more, SNG’s methodology is entirely personalized to your needs. We work in full collaboration with our client and local stakeholders to ensure that the data collection process brings back as many insights as possible.

SNG can help determine the current state of broadband utilization within a defined geography and/or sector. Information on eSolutions usage is collected directly from businesses, institutions and organizations through customized and proven online solutions. Through analysis of the data collected, we provide intelligence on the level of eSolutions utilization, the benefits and outcomes for government and business organizations and households based on their usage, the drivers and barriers for eSolutions, and insights into best practices. Comparative results are also summarized using SNG’s exclusive Digital Economy index (DEi).

Each and every eSolutions Benchmarking initiative includes a full report, an eStrategy go-forward report, and access to your data. Here are some examples of our work that have been publicly released.

eSolutions Benchmarking will build a unique repository of primary data about broadband usage across your region to develop effective strategic broadband initiatives and eSolutions adoption plans. Areas of special interest can be identified and studied in detail (e.g. tourism, manufacturing or telemedicine). SNG’s growing database allows each region to assess its performance against other regions.

Get your free consultation on benchmarking broadband in your region!

"*" indicates required fields