Measuring Broadband’s Impacts and ROI

What Does Broadband Do and Don’t Make Me Think About It

by Doug Adams

It was one of those conversations you can only have at a conference, when you are exhausted after a long day, and your edit buttons are turned off. Michael Curri and I were dining with a community broadband consultant from Georgia who wanted to know, specifically, how to sell SNG’s services, designed to drive utilization and economic advancement, into her communities.

Now she wasn’t asking because she doesn’t get « it. » She understands the power of utilization and not just the power of availability. She gets what SNG does with regards to helping communities drive said utilization. What she didn’t get after a long day of sessions and networking… is how to make it simple for communities to understand. More specifically, mayors, governors, chambers of commerce, etc.

Now she wasn’t asking because she doesn’t get « it. » She understands the power of utilization and not just the power of availability. She gets what SNG does with regards to helping communities drive said utilization. What she didn’t get after a long day of sessions and networking… is how to make it simple for communities to understand. More specifically, mayors, governors, chambers of commerce, etc.

So I was reminded of a book I read when looking into building « usable » websites called « Don’t Make Me Think. » What does website usability have to do with this situation? Everything. After all, when designing a website – we often design it for ourselves… it makes sense to us, so it must make sense to everyone else.

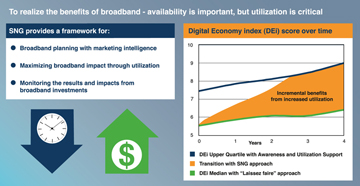

It is the same with broadband. The benefits of broadband and everything that come with it are typically at our core – it is second nature. We understand the benefits that this platform for innovation provides, both economic and social. But to make it tangible, understandable, usable to most people – including most people in government – let’s answer one question. It’s a business question. What is my ROI?

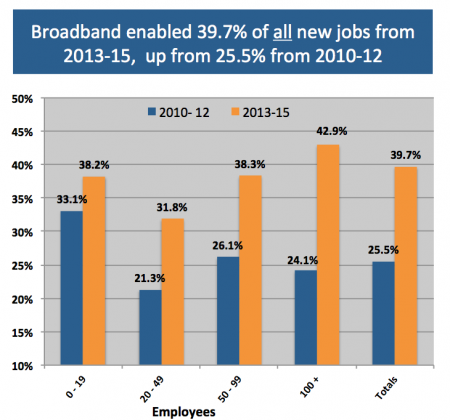

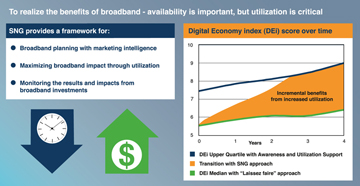

So how do we make broadband’s benefits tangible? We show a track record of results. By specifically looking at the initiatives we have with Virginia, we’re able to uncover that…

The economic benefits and return on investment from driving the implementation and utilization of e-solutions are clear and compelling. The impacts vary by sector, but to examine just one – Professional and Technical Services (i.e. engineers, architects, consultants) with less than 20 employees. Within this sector, SNG sees the economic development impact of utilization to be over 26 times return to GDP. And so, Mr. Mayor… for every dollar you spend with SNG’s programs to drive utilization, you receive $2.80 in tax revenues times return to taxes. Learn More>>

The economic benefits and return on investment from driving the implementation and utilization of e-solutions are clear and compelling. The impacts vary by sector, but to examine just one – Professional and Technical Services (i.e. engineers, architects, consultants) with less than 20 employees. Within this sector, SNG sees the economic development impact of utilization to be over 26 times return to GDP. And so, Mr. Mayor… for every dollar you spend with SNG’s programs to drive utilization, you receive $2.80 in tax revenues times return to taxes. Learn More>>

Even for one sector and a sizeable investment, the economic impact ratios are very compelling and well worth the investment. The actual numbers will vary, but the economic case for making such investments is clear.

So while there is not « one number, » there is definitely a significant ROI multiplier – drop me an email and we’d be happy to run some scenarios for your community/region.

Consider a New Model

Broadband Program Management… What’s the Best Way?

by Michael Curri

When administering a new program to deploy broadband and stimulate adoption, governments traditionally ramp-up their internal resources or hire consultants.

But there’s an alternative – a model that leverages existing local resources and links with local stakeholders who have a vested interest in the project outcome of economic development through broadband.

The downsides for the traditional models are apparent. Ramping-up internal staff requires hiring and getting everyone up to speed on how to administer the program. And once the program ends, the staff you worked so hard to find and train will leave. Bad enough that you lose good people you’ve invested in, but staff may be looking for a job during their time with you, looking for a better deal to move on to a permanent position. If this happens, you’re left to restart – and you lose ‘history’ before projects have been completed before they take-on their new job.

For governments that use consulting support, the hiring process can be much shorter. But there is still the getting ‘up-to-speed’ time required – and it can be extensive when junior consultants are being used. Although the cost of hiring such ongoing consulting support can be high, there are opportunities to negotiate a better rate with the consulting firm as they are acquiring broadband program administration skills and experience that can be redeployed in other jurisdictions.

A third way – the way we would advocate – involves a model where government delegates certain elements of administration to stakeholders that are local to a local broadband project. Local economic development agencies are prime candidates as they:

- Are aligned with the economic development goals of broadband projects – this could have the ancillary benefit of transforming how economic development agencies approach economic development from traditional ‘smoke stack chasing’ to economic development through broadband

- Have existing local knowledge and relationships that can be leveraged – especially where they can identify and broker new partnerships that are mutually beneficial, increasing the sustainability of the broadband project

- Can be more cost-effective in overseeing projects as they are local and as they already have some administrative capacity – more regular and spot visits are possible because they’re local, plus purchases that don’t align with the needs of the community / region are more likely to be identified right away

This type of model enables the government focus on strategic and key administrative issues, while leveraging an existing network of resources that is aligned with the sustainability of the broadband projects they would administer. And when the government programming sunsets, those local economic development agencies remain as a support system to broadband projects as needed.

Post Conference Thoughts

After spending a few days in both Dallas and Washington DC over the past month, it is apparent that the biggest challenge facing broadband projects in every U.S. region is sustainability, and key to that of course is utilization.

As projects are finishing building their broadband infrastructure, now more than ever is the time for SNG to help meet the challenges of going from build to use.

Unfortunately, we have heard from way too many regions who tell us their adoption rates are low and the networks are not – and will not be – sustainable without major uptake.

Low adoption rates (i.e. 20%) cannot sustain the ongoing operations of a broadband network where the business case requires 40-50% uptake.

As your needs increase to drive uptake, please make sure you reach out to SNG as we have introduced some So they’re now beginning to focus on how to increase adoption rates and they’re realizing that they need to drive utilization with end-users – our focus and strength as we’ve again demonstrated with the new DEi Calculator.

SNG Announces Industry’s First and Only Hands-On, Comparative Database

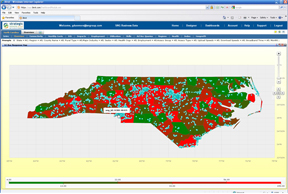

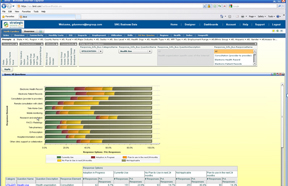

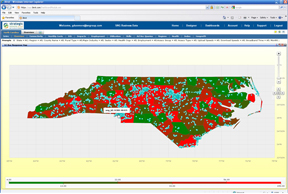

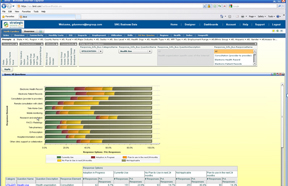

Digital Economy Intelligence Database from SNG enables SNG clients to compare regions and industries to uncover actionable information and insights. With this new solution from SNG, regional leaders can leverage the best practices from each region and industry across their territory.

Digital Economy Intelligence Database puts all the data from SNG’s in-depth analysis reports at your fingertips in a secure Web-based tool, allowing you to run your own queries and reports. Identify where, how, and by who broadband is being used to uncover gaps and opportunities to be addressed. Broadband utilization and its measurable impacts can quickly be assessed along multiple dimensions of geography, user characteristics, and Internet technologies to identify where broadband is being used to greater or lesser effect.

Digital Economy Intelligence Database puts all the data from SNG’s in-depth analysis reports at your fingertips in a secure Web-based tool, allowing you to run your own queries and reports. Identify where, how, and by who broadband is being used to uncover gaps and opportunities to be addressed. Broadband utilization and its measurable impacts can quickly be assessed along multiple dimensions of geography, user characteristics, and Internet technologies to identify where broadband is being used to greater or lesser effect.

The easier it is for our clients and their stakeholder groups to gain intelligence from their data, the more value that data has for them. This is why SNG has invested in the Digital Economy Intelligence Database and will continue to develop its capabilities. Our goal is to maximize the social benefits and economic growth that can be derived from broadband technologies and our mission is to arm our clients and stakeholders with the information and intelligence to take effective action towards this goal. The Digital Economy Intelligence Database is one more powerful step toward fulfilling this mission.

By using the Digital Economy Intelligence Database, users are now just a click of the mouse away from unlocking the keys to maximizing the business and social benefits of broadband:

By using the Digital Economy Intelligence Database, users are now just a click of the mouse away from unlocking the keys to maximizing the business and social benefits of broadband:

- Broadband’s Impacts on specific industries – who is using broadband most effectively and who is missing out on opportunities

- Specific e-solutions utilization among industries, regions, etc. and their economic impact.

- The differences between rural and urban areas within a region, or between regions – and how e-Solutions help each overcome challenges.

- The next level of mapping – a map of not only availability – but demand.

- The factors (other than availability) that drive utilization – and how to “bottle that” and bring it to areas where utilization is below average.

- The revenue driven and the cost savings resulting from broadband.

- How broadband impacts job creation.

- Barriers to using broadband and the needs to overcome them.

- How different sizes of organizations best utilize e-solutions.

« SNG’s latest business intelligence solution, its ‘Digital Economy Intelligence Database’ provides North Carolina the ability to see our broadband data and its economic impact in ways that were previously not easily available to us,” explains Jane Smith Patterson, Executive Director of e-NC “North Carolina now has access to Strategic Network Group’s world-class solution set to analyze broadband utilization and its impacts. The ability for our staff to customize how we see the data and compare it among regions and industries will prove critical for program planning and provide e-NC a strategic advantage to support NC communities regional economic development efforts both locally and globally.”

« SNG’s latest business intelligence solution, its ‘Digital Economy Intelligence Database’ provides North Carolina the ability to see our broadband data and its economic impact in ways that were previously not easily available to us,” explains Jane Smith Patterson, Executive Director of e-NC “North Carolina now has access to Strategic Network Group’s world-class solution set to analyze broadband utilization and its impacts. The ability for our staff to customize how we see the data and compare it among regions and industries will prove critical for program planning and provide e-NC a strategic advantage to support NC communities regional economic development efforts both locally and globally.”

“What’s really exciting about Digital Economy Intelligence Database is the ability to compare regions not just within your own territory but across the globe,” explains SNG president and CEO Michael Curri. “With results from studies across the globe, those who wish to share their study results can compare their region to other states, provinces, countries, etc. to better understand steps they can take can do to fully leverage the benefits of high speed Internet. Researchers recognize what we have built as a ‘normative database’ – for the laymen, it is simply the only way for one region to compare itself to another in the world of broadband utilization.”

SNG goes to the heart of a region’s broadband challenges and success by going straight to a region’s businesses, organizations, and households to collect information on how they use and benefit from the Internet. How are people and organizations using broadband? What are they not doing? What are their needs and barriers? How do they benefit and how do these benefits translate into tangible social and economic impacts? How does broadband utilization and its impacts change over time?

SNG goes to the heart of a region’s broadband challenges and success by going straight to a region’s businesses, organizations, and households to collect information on how they use and benefit from the Internet. How are people and organizations using broadband? What are they not doing? What are their needs and barriers? How do they benefit and how do these benefits translate into tangible social and economic impacts? How does broadband utilization and its impacts change over time?

All of this collected information, analyzed by SNG’s Broadband Economists and made available through the Digital Economy Intelligence Database enables stakeholders to develop programs and initiatives to drive innovation and economic development.

With our proven track record of showing regions how the use of Internet technologies will be most effective and deliver the most benefits, SNG’s Digital Economy Intelligence Database brings the ability to uncover the drivers of success and the needs of specific geographies more than ever before.

Local case study on broadband utilization shows US business behind Norway: « The Trondheim Paper »

By Thibaud Châtel

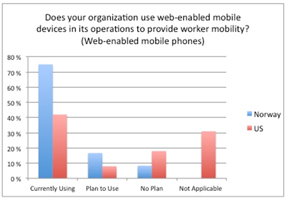

Last year the SNG team partnered with the Norwegian University of Science and Technology of Trondheim, a well-known European “Think Tank” for students. SNG provided support to a Master’s Degree student in Telematics, Steffen André Stople, in the form of an e-Solutions Benchmarking project. We studied the hospitality sector (hotels, bed & breakfast, camping facilities, etc.) of the Hardanger Fjord area, which include the second and third most populated cities of Norway – both extremely tourism dependent.

Last year the SNG team partnered with the Norwegian University of Science and Technology of Trondheim, a well-known European “Think Tank” for students. SNG provided support to a Master’s Degree student in Telematics, Steffen André Stople, in the form of an e-Solutions Benchmarking project. We studied the hospitality sector (hotels, bed & breakfast, camping facilities, etc.) of the Hardanger Fjord area, which include the second and third most populated cities of Norway – both extremely tourism dependent.

With an excellent response rate among the accommodation business of the area, comparisons were able to be drawn between Norway and the American tourism & hospitality sector by using SNG’s previously collected data.

As with much of Europe, Norway is ahead of the US in terms of broadband availability. And given connectivity, utilization should follow the same pattern (even though e-solutions drive utilization as much as availability, see below, next story).

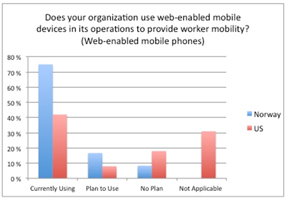

- 3 in 4 (75%) of Norwegian businesses are currently using web-enabled mobile phones to provide worker mobility, in contrast to 2 in 5 Americans.

- 100% of Norwegians businesses are using laptop computers versus 80% of Americans – making mobile e-solutions more adaptable for Norwegians.

- Wireless connection is used by twice the users in Norway than the US (29% versus 14%).

- Nearly 3 in 5 (58%) of Norwegian businesses are using Internet multimedia content or interactive tools while only 3 in 10 (31%) in the US. What’s worse is 35% of US businesses say video virtual tour, dynamic slide shows, live webcams and others are not applicable to their business.

- More than a third (35%) of Americans’ think that tele-working isn’t applicable in this sector as opposed to 0% of Norwegian businesses agreeing with this point of view.

While these results were well received in Norway, illustrating Scandinavians’ advance in the web-enabled 21st century – it is discouraging for those who believe in broadband’s powers and call the United States “home.” A significant portion of American organizations are not even considering the benefits of broadband and web-enabled solutions!

The “Trondheim paper” illustrates the way to follow, and most satisfied with this work, SNG will continue to support similar projects. Click here to download the full report.

Quick Bytes

News items from the broadband economists…

SNG’s own John DeRidder showed up on the news in Australia, commenting on the NBN initiative. John talks about how the speed may be a great feature, but price point and lack of e-solutions from the NBN are barriers they are going to have to overcome.

Click here to watch the clip on You Tube>>>

Click through to see the latest results from SNG, showing the direct results of how e-solutions increases utilization. Click here to see the chart>>>

Unanswered Questions, Unfulfilled Leadership

I was reading the other day about how firms in my homeland of Canada are filling the gaps left by the government’s decision to axe the long-form census. In this case, the newspaper (okay, not a real newspaper – the online version) described a firm that is collecting data about the workforce so that organizations can better understand how to attract and retain employees. This is a private sector firm collecting data to uncover what used to be provided by government agency Statistics Canada.

What is this story really about? Is it about the private sector is naturally filling a void created by a government cutting programs? Or is this a story about how leaders need insights… decisions need background information, and strategies need guidance? Just because it is a cliché does not mean it is not true… Knowledge is Power. The best decisions are made with better information. The best strategies are based on market intelligence. And investments are best leveraged when you know where they can have the most impact.

What is this story really about? Is it about the private sector is naturally filling a void created by a government cutting programs? Or is this a story about how leaders need insights… decisions need background information, and strategies need guidance? Just because it is a cliché does not mean it is not true… Knowledge is Power. The best decisions are made with better information. The best strategies are based on market intelligence. And investments are best leveraged when you know where they can have the most impact.

Governments poised to compete in the 21st century global economy realize that to thrive, they need to be able to leverage the resources they have, make the right decisions, and provide their businesses with an ability to innovate and capture markets. Good planning requires insights into opportunities within the context of available resources and tools to overcome barriers.

Regions with governments that are cutting back on information gathering will not have the data and insights they need to create winning strategies and develop programs that foster growth. Without naming names, we all know of regions that are depressed and struggling more than others. What do most have in common? Weak or nonexistent strategies. And behind that, a lack of insights needed to succeed. So who will fill the void?

I founded SNG 12 years ago to help communities and regions make better decisions about their broadband investments and show them how to better leverage the networks for economic and social development. This requires assessing needs, benchmarking gaps, and helping regions plan strategically to shorten the path to desired outcomes and impacts. In essence, SNG is translating broadband into opportunities and jobs through fact-based economic strategies.

If you don’t measure, you can’t manage … and you surely cannot develop successful strategies that will give the stakeholders in your communities and regions what they need to compete and lead in today’s knowledge economy. Without intelligence and insights on where you are now as compared to where you want to be, you are forced to be a follower. In the globally competitive marketplace, it’s the innovators that will benefit from a high wage economy and with it, high quality of life.

SNG maximizes limited resources by identifying key economic levers on which to pull and we do this on a case by case basis. SNG can help get you the information you need for your own creative strategies from a region-wide standpoint. In addition, our DEi Scorecard can give you insights all the way down to the individual organization level. For example, businesses can receive individual reports to let your entrepreneurs know how they stack up against local and global competition and what they need to do to be more competitive.

SNG: The Broadband Economists

If you’ve been to out website in the past few weeks, you’ve seen some drastic changes.

Let’s start with our new tagline, « The Broadband Economists. » What, you may ask, does this mean? At its heart, SNG is a group of broadband economists who develop strategies for most effectively leveraging broadband investments. But what exactly is a « broadband economist? » Well it is not a bean counter or an abstract thinker who cannot apply theory into practice. We are economists in the sense that we are looking to help make the most broad-reaching and transformational impacts that broadband can bring enable businesses, communities and regions. Our goals: economic development, social advancement, increased productivity and competiveness.

Our website, www.sngroup.com, also has a new look and is much easier to navigate. Enhancements include new insights for broadband initiatives in blogs, articles, newsletter archives, etc. We’ve provided tips and success stories to help successfully navigate and manage successful broadband initiatives through the Broadband Lifecycle

We’ve taken great pains to help everyone, from elected officials to business professionals to technology experts, better understand the keys to successful, transformative, and economically impactful initiatives. Visit our site on a regular basis for updates and broadband news as we’ll be monitoring the broadband industry – and its best practices – to help to ensure your success.

A Fresh Look at the Digital Divide

by Derek Murphy

A lot of funding is being invested in broadband infrastructure, which will bring high speed connectivity to many communities and regions around the world who previously did not have high speed access. As the number of communities without access to broadband declines, there will be room, both politically and financially, for other priorities. Within the context of the digital divide, what priorities need to be articulated and placed on the political and policy map?

A lot of funding is being invested in broadband infrastructure, which will bring high speed connectivity to many communities and regions around the world who previously did not have high speed access. As the number of communities without access to broadband declines, there will be room, both politically and financially, for other priorities. Within the context of the digital divide, what priorities need to be articulated and placed on the political and policy map?

For example, as planning and mapping efforts unfold across the United States, including our own SNG projects in North Carolina, Virginia, Louisiana, and Kentucky, more and more evidence is emerging of a shifting picture that is more complex than just “un-served” “under-served” and “served” as defined in the United States by the National Telecommunications and Information Administration. These relatively broad categories have played their role, but need to evolve if they are going to be useful for future planning efforts based on evidence that we have recently collected.

“39% of households would very likely relocate to another community if broadband was not available. Over 55% of organizations say that broadband is essential for remaining in their current location.” Recent SNG Technical Report for a designated State broadband authority.

Unserved communities: Recent SNG research shows that the vast majority of businesses and organizations (97 percent) have Internet connectivity. As a consequence, unserved communities are now primarily composed of residential areas, rather than whole communities that include business districts. In addition to the impacts on individual households, there are two significant dimensions to the digital divide faced by unserved communities. First, the higher the percentage of areas having broadband connectivity, the greater is the disadvantage experienced by the remaining unserved communities. e-Solutions Benchmarking data show a pronounced tendency of businesses and households to make decisions on where to locate based on the availability of high speed and reliable broadband. Second, a large percentage of economically active households use their home to generate income, either through teleworking or home based businesses. With economically active households making locational decisions with connectivity in mind, rural areas without broadband will lose economically active households, with major negative impacts on their long term sustainability.

Unserved pockets within served communities: SNG research has shown that these areas are primarily low density residential areas, usually rural and/or low income. Mapping efforts have been useful in identifying unserved communities but may be less effective at identifying the pervasive but smaller unserved areas within “served” communities. These low density areas provide a poor business case for infrastructure investments by current Internet Service Providers. Small areas are less likely to be the focus of infrastructure funding programs. As current efforts have their desired impact of reducing the number of unserved communities, it can be anticipated that a larger portion of unserved households will fall within this category of “unserved pockets within served communities.” Any strategy to address this aspect of the digital divide will necessarily be different from strategies used for unserved communities. The small scale and scattered nature of the target of population, together with the lack of institutional capacity, will require more imaginative approaches, either with incumbent ISPs or with small but agile wireless ISPs.

Uncompetitive Broadband: There already is significant recognition that much of the existing broadband infrastructure in North America consists of relatively low speed technologies. Fifty percent of the business respondents to a recent statewide SNG survey had upload speeds of less than 700kbps. Additionally, a significant portion of respondents indicated that they were unsatisfied with the speed and/or reliability of their broadband connection. This level of dissatisfaction can be expected to increase as reliance on Internet increases and the gaps between levels of service increases between highly served and poorly served areas.

While much of the current debate on “better broadband” focuses on improving speeds, the reliability issue should be considered as an equal or higher priority. Recent SNG surveys show that reliability and availability of redundancy are increasingly important to many businesses and organizations who state that the Internet is essential to their operations. For these organizations, availability of reliable service and redundancy will play an increasingly large role in their location decisions.

Over the few years, analysts and policy makers have used various terms to describe the need for “better broadband.” However, there remains the danger of using a simple threshold to determine whether a community or region has the desired level of Internet connectivity. A fundamentally stronger concept is that of “competitive broadband.” Competitive broadband recognizes that upgrades to infrastructure are required well into the future to maintain competitiveness globally and regionally. Without competitive infrastructure, businesses and people will quickly or slowly move to greener pastures.

Need for Mobile Broadband: while not the focus of this article, there needs to be acknowledgement of the growing role that mobile broadband plays. In SNG research, organizations and businesses state that mobile Internet is essential to their operations. The use of mobile devices and applications for “untethered access” is expected to continue to grow and become increasingly integrated into how organizations use the Internet. In planning and designing future broadband initiatives, care needs to be taken that the lack of mobile broadband doesn’t become the latest symptom of a digital divide.

As communities and regions absorb the impacts of recently announced broadband investments in infrastructure, planning and adoption, it will be important that we not remain stuck in the terminology and concepts that guided these investment programs. The very success of these investments will require us to evolve our analysis and planning.

As always, thank you for your continued support. If you have any questions or feedback, please don’t hesitate to get in touch!

Now she wasn’t asking because she doesn’t get « it. » She understands the power of utilization and not just the power of availability. She gets what SNG does with regards to helping communities drive said utilization. What she didn’t get after a long day of sessions and networking… is how to make it simple for communities to understand. More specifically, mayors, governors, chambers of commerce, etc.

Now she wasn’t asking because she doesn’t get « it. » She understands the power of utilization and not just the power of availability. She gets what SNG does with regards to helping communities drive said utilization. What she didn’t get after a long day of sessions and networking… is how to make it simple for communities to understand. More specifically, mayors, governors, chambers of commerce, etc. The economic benefits and return on investment from driving the implementation and utilization of e-solutions are clear and compelling. The impacts vary by sector, but to examine just one – Professional and Technical Services (i.e. engineers, architects, consultants) with less than 20 employees. Within this sector, SNG sees the economic development impact of utilization to be over 26 times return to GDP. And so, Mr. Mayor… for every dollar you spend with SNG’s programs to drive utilization, you receive $2.80 in tax revenues times return to taxes. Learn More>>

The economic benefits and return on investment from driving the implementation and utilization of e-solutions are clear and compelling. The impacts vary by sector, but to examine just one – Professional and Technical Services (i.e. engineers, architects, consultants) with less than 20 employees. Within this sector, SNG sees the economic development impact of utilization to be over 26 times return to GDP. And so, Mr. Mayor… for every dollar you spend with SNG’s programs to drive utilization, you receive $2.80 in tax revenues times return to taxes. Learn More>>

Digital Economy Intelligence Database puts all the data from SNG’s in-depth analysis reports at your fingertips in a secure Web-based tool, allowing you to run your own queries and reports. Identify where, how, and by who broadband is being used to uncover gaps and opportunities to be addressed. Broadband utilization and its measurable impacts can quickly be assessed along multiple dimensions of geography, user characteristics, and Internet technologies to identify where broadband is being used to greater or lesser effect.

Digital Economy Intelligence Database puts all the data from SNG’s in-depth analysis reports at your fingertips in a secure Web-based tool, allowing you to run your own queries and reports. Identify where, how, and by who broadband is being used to uncover gaps and opportunities to be addressed. Broadband utilization and its measurable impacts can quickly be assessed along multiple dimensions of geography, user characteristics, and Internet technologies to identify where broadband is being used to greater or lesser effect.  By using the Digital Economy Intelligence Database, users are now just a click of the mouse away from unlocking the keys to maximizing the business and social benefits of broadband:

By using the Digital Economy Intelligence Database, users are now just a click of the mouse away from unlocking the keys to maximizing the business and social benefits of broadband:

SNG goes to the heart of a region’s broadband challenges and success by going straight to a region’s businesses, organizations, and households to collect information on how they use and benefit from the Internet. How are people and organizations using broadband? What are they not doing? What are their needs and barriers? How do they benefit and how do these benefits translate into tangible social and economic impacts? How does broadband utilization and its impacts change over time?

SNG goes to the heart of a region’s broadband challenges and success by going straight to a region’s businesses, organizations, and households to collect information on how they use and benefit from the Internet. How are people and organizations using broadband? What are they not doing? What are their needs and barriers? How do they benefit and how do these benefits translate into tangible social and economic impacts? How does broadband utilization and its impacts change over time?  Last year the SNG team partnered with the Norwegian University of Science and Technology of Trondheim, a well-known European “Think Tank” for students. SNG provided support to a Master’s Degree student in Telematics, Steffen André Stople, in the form of an e-Solutions Benchmarking project. We studied the hospitality sector (hotels, bed & breakfast, camping facilities, etc.) of the Hardanger Fjord area, which include the second and third most populated cities of Norway – both extremely tourism dependent.

Last year the SNG team partnered with the Norwegian University of Science and Technology of Trondheim, a well-known European “Think Tank” for students. SNG provided support to a Master’s Degree student in Telematics, Steffen André Stople, in the form of an e-Solutions Benchmarking project. We studied the hospitality sector (hotels, bed & breakfast, camping facilities, etc.) of the Hardanger Fjord area, which include the second and third most populated cities of Norway – both extremely tourism dependent.

What is this story really about? Is it about the private sector is naturally filling a void created by a government cutting programs? Or is this a story about how leaders need insights… decisions need background information, and strategies need guidance? Just because it is a cliché does not mean it is not true… Knowledge is Power. The best decisions are made with better information. The best strategies are based on market intelligence. And investments are best leveraged when you know where they can have the most impact.

What is this story really about? Is it about the private sector is naturally filling a void created by a government cutting programs? Or is this a story about how leaders need insights… decisions need background information, and strategies need guidance? Just because it is a cliché does not mean it is not true… Knowledge is Power. The best decisions are made with better information. The best strategies are based on market intelligence. And investments are best leveraged when you know where they can have the most impact.

A lot of funding is being invested in broadband infrastructure, which will bring high speed connectivity to many communities and regions around the world who previously did not have high speed access. As the number of communities without access to broadband declines, there will be room, both politically and financially, for other priorities. Within the context of the digital divide, what priorities need to be articulated and placed on the political and policy map?

A lot of funding is being invested in broadband infrastructure, which will bring high speed connectivity to many communities and regions around the world who previously did not have high speed access. As the number of communities without access to broadband declines, there will be room, both politically and financially, for other priorities. Within the context of the digital divide, what priorities need to be articulated and placed on the political and policy map?